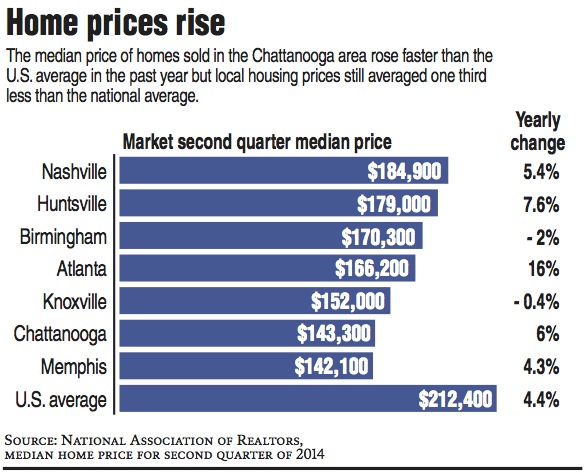

Chattanooga home prices continued to outpace both inflation and workers' income in the past year, but the median price of local houses sold so far this year is still one third less than the U.S. average.

The National Association of Realtors said Tuesday that the typical Chattanooga home sold during the second quarter for $143,300, or 6 percent more than the median price of a year ago. Nationwide, median home prices rose only 4.4 percent but the average price of $212,400 remained above any markets in the Mid-South.

Although Chattanooga home prices rose, housing sales by Chattanooga Realtors in the first half of 2014 were still down 4.5 percent from a year ago. The sales slump was typical of many markets that saw a brief dip in the past year after two years of rising sales and prices.

Dr. Lawrence Yun, chief economist for the National Association of Realtors, told local Realtors and home builders Tuesday that the decline is only in interruption in a multi-year sales upturn.

"It looks like this slowdown is coming to an end and we expect that as jobs and the economy continue to improve we will see increases again in home sales," Yun told a luncheon gathering at the Chattanoogan organized by the Greater Chattanooga Association of Realtors.

Home prices outpaced the 2.1 percent increase in inflation and the 2-3 percent gain in wages for most workers, Yun said.

Home buyers also will likely face higher interest rates over the next couple of years as the Federal Reserve begins to tighten its monetary policies by ending its bond purchase program at the end of 2014. Yun predicts that mortgage rates, which now average about 4.1 percent, will rise to about 6.15 percent by 2016 as inflation and the economy heat up and the Federal Reserve ends much of its stimulative monetary policy. Although mortgage rates were below 4 percent last year, Yun said home buyers should look to the future, not the past, in evaluating purchase options.

"The proper reference point is not with the past, but with the future and that indicates that buying now is more attractive than waiting for the future when rates and prices will likely be higher," Yun said.

For 2015, the National Association of Realtors' forecast is for the consumer price index to rise to a 3.5 percent inflation rate, while the economy grows at an annual average of 2.7 percent.

"We expect a multi-year housing recovery, but not as strong as in the past," Yun said.

Vicki Trapp, president of the Chattanooga Realtors' group, said local home sales have shown stronger gains this summer. June sales by local Realtors were up 11.2 percent from a year ago.

"The housing market is doing quite well in Chattanooga," she said. "The inventory is as great as what we would like, but we are doing better than most markets in the supply of homes available for buyers, at least in most areas."

Yun said Chattanooga's housing market "is very, very steady" and wasn't hit as hard as many markets like Atlanta and Nashville during the recession. But those markets have bounced back more in the years since the downturn ended.

Chattanooga is yet to regain all of the jobs it lost during the recession, which is keeping home prices here below the U.S. average, Yun said.

Contact Dave Flessner at dflessner@timesfreepress.com or at 757-6340.