Rachael Pickett retired from BellSouth seven years ago, but during tax season the Cleveland, Tenn., retiree still has a full-time job.

As one of the coordinators for the Volunteer Income Tax Assistance program, Pickett is among 60 local volunteers who help thousands of area low-income and elderly taxpayers fill out their tax returns at no cost. Last year, 8,431 individuals and families got help from VITA volunteers in the Chattanooga area and collectively they received $11.1 million in refunds.

What you should bring

Persons seeking tax help from VITA should bring a photo ID, social security cards for everyone listed on the tax return, W2 and other tax forms for income, interest, dividends and other financial transactions, and a 1095-A form if you purchased insurance through the Marketplace under the Affordable Care Act.Where to get help* Bradley Baptist Association, 2707 North Ocoee St. in Cleveland, Tenn. - Mondays, Tuesday and Fridays from 4:30 to 8 p.m. and from 10 am. to 2 p.m. Saturday. Appointment only at 476-5493 (English), 488-5470 (Spanish)* Cleveland Community Center, 1334 South Church St., SE, Cleveland, Tenn. - Tuesday and Thursdays from 11 a.m. to 5 p.m. and Saturdays from 10 a.m. to 2 p.m. *Kmart in the Bradley Square Mall, 200 Paul Huff Highway in Cleveland, Tenn. - Saturdays from 10 a.m. to 2 p.m. * Lee University Walker Business Building in Cleveland, Tenn. - Tuesday and Thursdays from 6 to 8 p.m.* Samaritan Center at Southern Adventist University in Ooltewah - Thursdays from 8 a.m. to 7 p.m., Fridays from 10 a.m. to 3 p.m. and Sundays from 9 a.m. to 5 p.m.* Brainerd Recreation Center, 1010 N. Moore Road - Tuesdays and Thursdays form 4:30 to 8 p.m., Saturdays form 10 a.m. to 2 p.m.* Signal Mountain United Methodist church, 3419 Taft Highway - call for appointment at 290-1394* Northside Neighborhood House, 211 Minor Street - call 267-2217 for appointment* Second Missionary Baptist Church, 2919 E. Third St. - Monday through Friday from 11 a.m. to 4 p.m.* Highland (Old 21st Century School), 104 North Tuxedo Ave. - Tuesdays and Thursdays 10 a.m. to 8 p.m., Wednesdays from 10 a.m. to 6 p.m., and Saturdays from 10 a.m. to 2 p.m.* Northgate Mall, 252 Northgate Dr., Mondays from 1 p.m. to 6 p.m., Wednesdays from noon to 4 p.m., and Saturdays from 10 a.m. to 2 p.m.* Soddy Daisy Senior Center, 190 Depot St., in Soddy Daisy - Tuesdays 9 a.m. to 4 p.m. by appointments, 332-1702* Urban League office, 730 M.L. King Blvd., - Tuesdays and Thursday from 9 a.m. to 2 p.m.

VITA provides help to those making up to $53,000 a year, but the average income of a family served last year was only $21,000. Many qualified for earned income tax refunds, helping to swell many refunds to more than $2,000, IRS tax consultant Joseph Kotsis said.

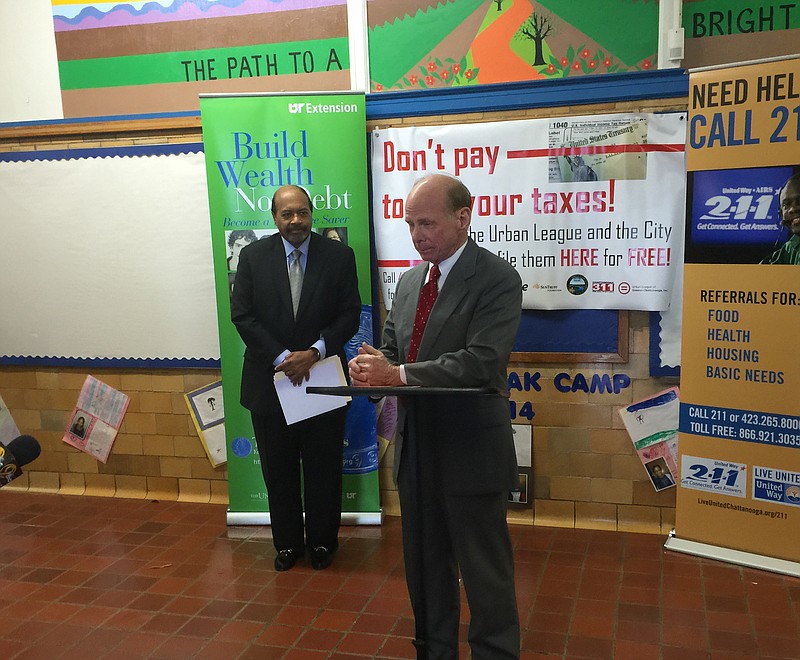

"This helps create wealth in our community," Chattanooga Mayor Andy Berke said Friday during the kickoff to this year's VITA program at the Highland Center in Brainerd. "By taking people who need assistance and making sure they get their returns done properly, this provides dollars that are used to pay mortgages, to make rental payments, and to spend in in local stores. This is particularly important here as we see on Brainerd Road where predatory lending is all too prevalent and takes wealth out of our community."

Pickett opened the first VITA site last week in Cleveland, but the real rush is expected to begin today as most taxpayers got their tax forms in the mail or at work in the past week or two.

"This is the kind of work I love to do and it's great to help people out so they can save money," she said. "But it is getting a lot more complicated and tougher and I hope people will be a bit more patient this year."

They may need to be. The Affordable Care Act has added extra tax filing requirements, especially for those who have purchased health insurance through the individual marketplace exchanges created under the Affordable Care Act, or so-called ObamaCare.

This is the first year tax filers have to declare whether or not they had health insurance last year through their employers, government program or individual policies. For those who did not have insurance, a $95 penalty (or 1 percent of income if greater) will be levied against the individual.

The IRS is not requiring individuals to submit proof of health insurance, however. But VITA volunteers, who began training for the tax assistance last October, have had to learn some of the details of the ObamaCare filing requirements.

The VITA program is helped by many retirees, volunteer workers and accounting students from Lee University and Southern Adventist University. But UTC is not including the program in its accounting course this year and several long-time volunteers have left the program. As a result, there are only about one-thrid as many VITA volunteers in the Chattanooga area this year as what there were last.

"We work hard to help those that need this service and we'll manage again this year, although it may take a bit longer in some instances," Kotsis said. "We know this is a tremendous help to a lot of people."

Since the Urban League and its partners began coordinating the VITA program in 2006, more than 39,100 tax returns have been processed in the Chattanooga area, saving local consumers more than $500,000 a year in tax preparation fees. Each client served by the VITA program saves, on average, approximately $165 in filing and processing fees they would have spent with a paid preparer, Urban League President Warren Logan said.

Contact Dave Flessner at dflessner@timesfree press.com or 423-757-6340.