Dixie Group officials are hoping for a better rest of the year following a tough first quarter for the high-end carpet company.

In the first quarter, Dixie reported a loss of $4.7 million from continuing operations and a nearly 7 percent dip in sales from a year ago.

Dixie sales totaled $89.2 million, down from $95.8 million last year.

As a result of the quarterly downturn, which comes on the heels of a tough 2015 for Dixie Group, company officials announced Wednesday cost-cutting measures, including cutting the year's capital spending plan in half, consolidating some West Coast facilities and vacating around 70 jobs, out of its 1,400-employee workforce.

Shares of Dixie stock fell by nearly 12.8 percent, or 60 cents per share, to $4.10 per share, in trading on the Nasdaq Exchange.

Jon Faulkner, the chief financial officer for Dixie, said Wednesday "if you look through the quarter at what really happened, we had low sales."

"The industry was off, but we were off a little bit more, especially in the commercial area," he said.

Dixie Group produces high-end soft surface flooring and doesn't benefit as much from new multi-family home construction as other carpet makers. Dixie doesn't benefit as much from single-family home remodels either, said Faulkner.

Faulkner also chalked part of Dixie's first quarter results to the fact the floor covering industry as a whole has not rebounded as well as the construction industry - and even within the floor covering industry, hard surface sales are currently outpacing soft surfaces such as carpet.

"We've definitely lost some [market] share between soft surface and hard surface," Faulkner said. "I think that loss has been greater at the lower end than the higher end."

Dan Frierson, chairman and CEO of Dixie, said the company's first quarter results are typically the toughest.

But "this year our sales were substantially weaker as compared to the same period in 2015," he said.

Frierson said Dixie is also still facing down the costs and hurdles of restructuring which largely took place last year, with the acquisition of West Coast facilities such as Los Angeles-based Atlas Mills.

Frierson said Dixie production levels were low in the winter quarter thanks to low sales volume and low productivity from product development, as well as sub-par production quality of new products, which resulted in waste.

Part of cutting capital costs and reducing expenses in 2016 meant vacating a rented facility in California and consolidating two West Coast facilties into one. Some vacated jobs have been those lost and simply not refilled.

Dixie is down 33 employees since the beginning of the year and 72 since last year's peak.

Faulkner said there are positives going forward, though.

Dixie's most expensive, highest-quality products are also currently its most in-demand, he said.

Also, "we believe we're coming out of restructuring," and "a lot of the costs of the restructuring are going to be behind us by mid-year."

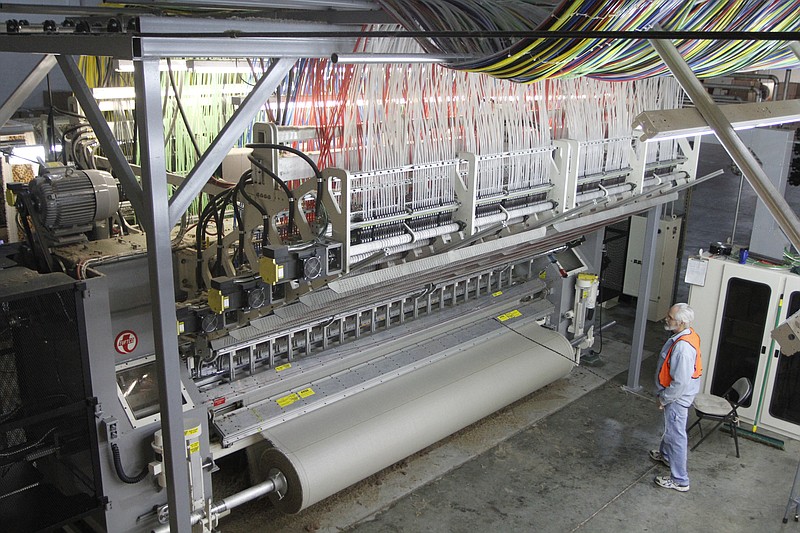

Workers were harder to find, and tougher to train, than originally thought going into the restructuring, said Faulkner. But Dixie's workforce now is able to do more with fewer people thanks to training and new equipment, he said.

Healthcare costs have come down, following the retooling and rolling out of a new company policy and plan. Faulkner said some provisions of the Affordable Healthcare Act "caused a lot of the increases we were seeing."

Faulkner said going into the rest of 2016, company officials are focused on increasing profitability and getting earnings back up.

Contact staff writer Alex Green at agreen@timesfreepress.com or 423-757-6480.