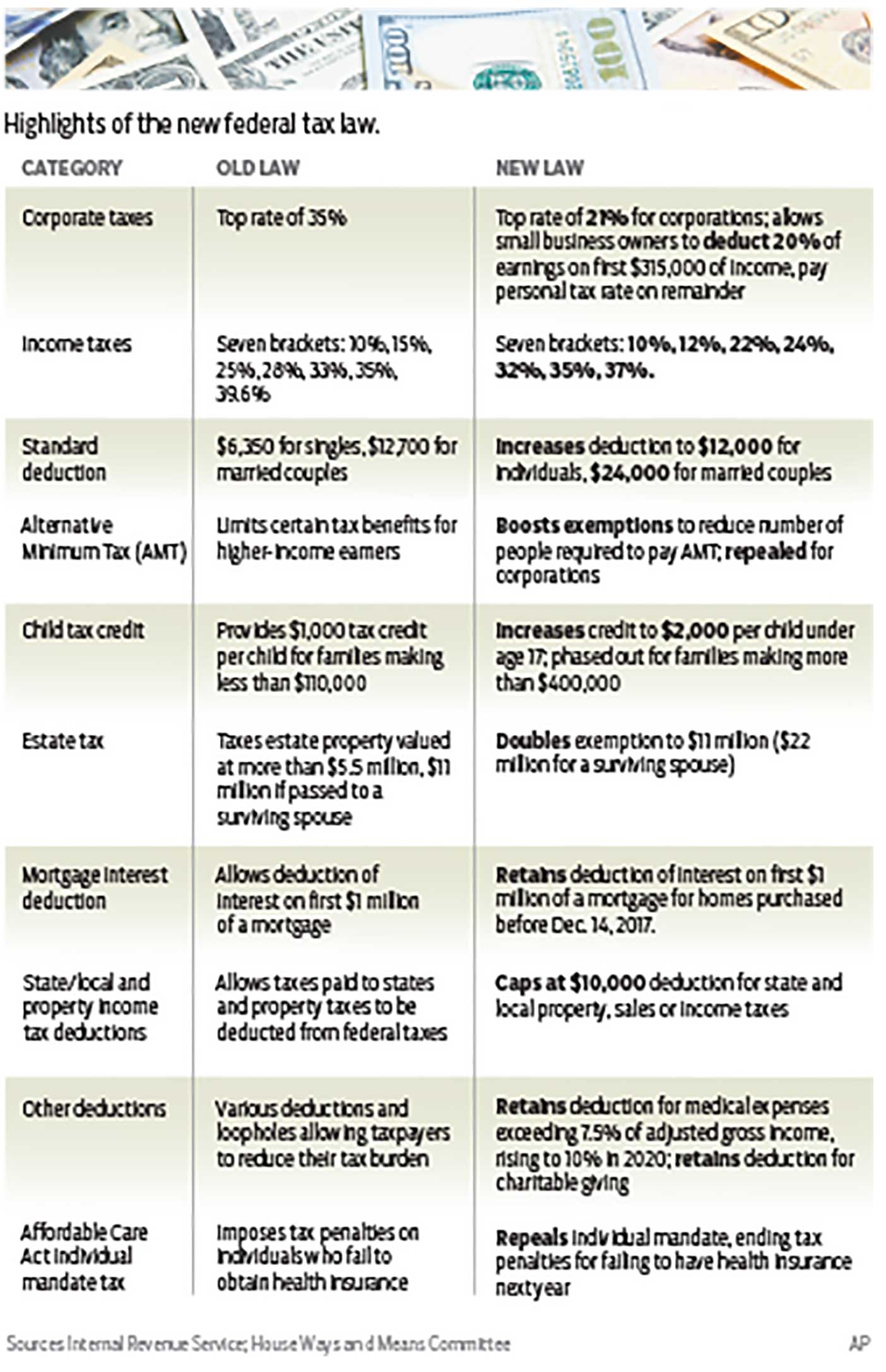

Most individual taxpayers, although not all, should benefit this year from the new tax law, which cuts income tax rates, nearly doubles the standard deduction and eliminates personal exemptions.

Most individual taxpayers, although not all, should benefit this year from the new tax law, which cuts income tax rates, nearly doubles the standard deduction and eliminates personal exemptions.

Workers should start seeing the changes in their paychecks in February once the Internal Revenue Service finalizes withholding tables.

"For most individuals there's not a lot of planning and changes you can do," said Tom McCormick, a tax accountant partner with LBMC in Chattanooga.

The new law doubles the standard deduction, although the personal exemption is going away, which could disproportionally affect larger families.

With a higher standard deduction, a growing majority of Americans are expected to simply take the standard deduction and not itemize their tax returns. That will simplify returns for many taxpayers, although it could discourage some people from giving as much to charity or buying real estate. Those who take the standard deduction don't itemize items such as mortgage interest payments or many charitable contributions.

Even for those who do itemize, the new law limits the deduction on mortgage interest to the first $750,000 of the loan (for homes purchased after mid-December 2017), and interest on home equity lines of credit can no longer be deducted.

Current mortgage-holders aren't affected, however, and Congress backed away from tax reform proposal to phase out mortgage deductions.

"There will be some impact from the tax change, but it obviously could have been much worse for us; and overall I still think we'll have another good year in 2018 even with these changes," said Greater Chattanooga Realtors President Geoff Ramsey.

Taxpayers can deduct no more than $10,000 in state and local taxes, but the new law expands the deduction for medical expenses. The Act also repeals the Obamacare tax on those without health insurance in 2019.

Travis Shears, senior manager of tax services for LBMC in Chattanooga, cautioned individuals from making dramatic changes in response to the individual tax changes.

"As far as planning goes on the individual side, drastic measures might be a little premature because a lot of these changes are scheduled to sunset in 2025, and unless another law comes around, it will revert to the way it was before," Shears said.