At Pinnacle Bank, creating a great place to work is vital not only for employee happiness but also for the company's financial results.

The Nashville-based bank, which has been recognized by Fortune magazine as one of the best places to work, has grown into the second biggest bank in Tennessee in less than two decades by acquiring other banks and recruiting veteran, top bankers from other companies.

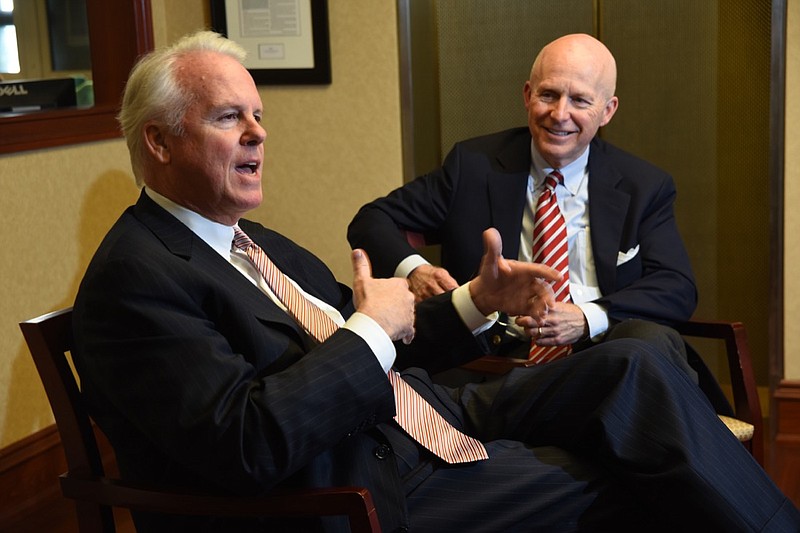

"Creating a great work environment and recruiting great bankers to Pinnacle really is the most important thing to us," said Terry Turner, CEO of Pinnacle Financial Partners. "The key is to hire happy, successful people and give them the support and freedom to do their job to serve our clients."

Turner said most hires are not made from those sending in resumes or filling out employment applications seeking a job. Instead, top-performing bankers elsewhere are targeted for Pinnacle. Bankers at Pinnacle, many of whom previously worked at other banks, try to convince their bank colleagues to come to Pinnacle.

Since acquiring the former CapitalMark Bank in Chattanooga in 2015, Pinnacle has more than doubled the number of bank lending officers in Chattanooga and the bank's loan portfolio. The number of financial advisors has grown from 21 at the time of the 2015 merger to 46 today and Pinnacle expects to add another this month.

"We've had a tremendous amount of success bringing experienced, well-respected bankers in the market to Pinnacle," said Craig Holly, former AmSouth Bank president who started CapitalMark in 2007 and now heads the Chattanooga market for Pinnacle. "They've brought a significant book of business to us and that has been a big driver of our success."

In 2015 when Pinnacle bought CapitalMark, the bank had about $600 million in loans in Chattanooga by CapitalMark.

"We have $1.3 billion today (in Chattanooga loans) so we've seen very dramatic growth," Turner said during a Chattanooga visit last week.

The average banker hired at Pinnacle has been in the banking business for 26 years. Company surveys indicate associates at Pinnacle say the best part of working for the bank is the lack of micromanagement.

"By relying upon experienced, highly talented bankers, we don't have to micro manage them and therefore they are free to take care of clients and get that done better than at most other banks," Turner said.

As a commercial-oriented merchant bank, Pinnacle sees relationships and banking advice as key to helping clients and having the right bankers to build those relationships is key.

"Access to capital is still critical for business and having a banking relationship is key for the success of many businesses," Turner said.

Pinnacle pays, on average, more to most of its financial advisors. But Turner said the revenue generated by its lenders and bankers is well above the industry average.

"Our work environment compares with none other in our industry and we've just been able to attract very experienced, highly talented bankers," Holly said. "We allow them to come here and do what they like to do and want to do and that is to take care of their clients. Embedded in that is an ease of business for our clients. We allow our talented bankers to take care of their clients. The good ones want to work in that kind of environment."

Pinnacle began in Nashville in October 2000 and four years ago acquired the former CapitalMark Bank in Chattanooga, which was launched in 2007. Pinnacle later acquired Magna Bank in Memphis and in 2017 completed a $2 billion purchase of the Bank of North Carolina, expanding into seven new markets in the Carolinas and Virginia.

Pinnacle's stock has not kept pace with its growth over the past couple of years, given investor concerns about the low-interest environment and growing loan portfolios at what many fear may be the end of a long economic upturn. Shares of Pinnacle stock have risen more than 20 percent so far this year but remain about 18 percent below a year go.

But Turner said Pinnacle should do well over time with its strategy to operate in the 15 biggest markets in the area from Memphis to Atlanta to Charleston, South Carolina to Washington D.C.

"We're in 10 of those markets already and we think these are markets where we can do very well," Turner said.

Despite the bank's relative youth, Pinnacle has grown to the the fourth biggest bank in deposit size in metropolitan Chattanooga and ranks No. 3 among business clients with $1 million to $500 million in sales, according to Greenwich Associates. Surveys of businesses by Greenwich ranked Pinnacle No. 1 in client satisfaction in Chattanooga.

Turner said he uses the Chattanooga growth "where our growth is moving on a 45-degree slope" to help convince other bankers to join Pinnacle or investor to invest in the company's stock.

"We can make larger loans than we could before," Holly said of the growth under Pinnacle."We have more products and services from a treasury management perspective that we offer now. We've expanded our trust operations. It's just allowed us to do a lot more."

Contact Dave Flessner at dflessner@timesfreepress.com or at 757-6340.