The number of Chattanoogans going broke or losing their properties to foreclosure fell in the first half of 2011 as the local economy showed signs of recovering from the worst downturn since World War II, according to figures released Tuesday.

"We are seeing some improvement in the overall market, and Chattanooga seems to be doing better than much of the country," said Mark Vitner, managing director and senior economist for Wells Fargo Bank. "But the backlog of foreclosed properties is still humongous, and some of this improvement may be because some banks are still reluctant to foreclose in the current market."

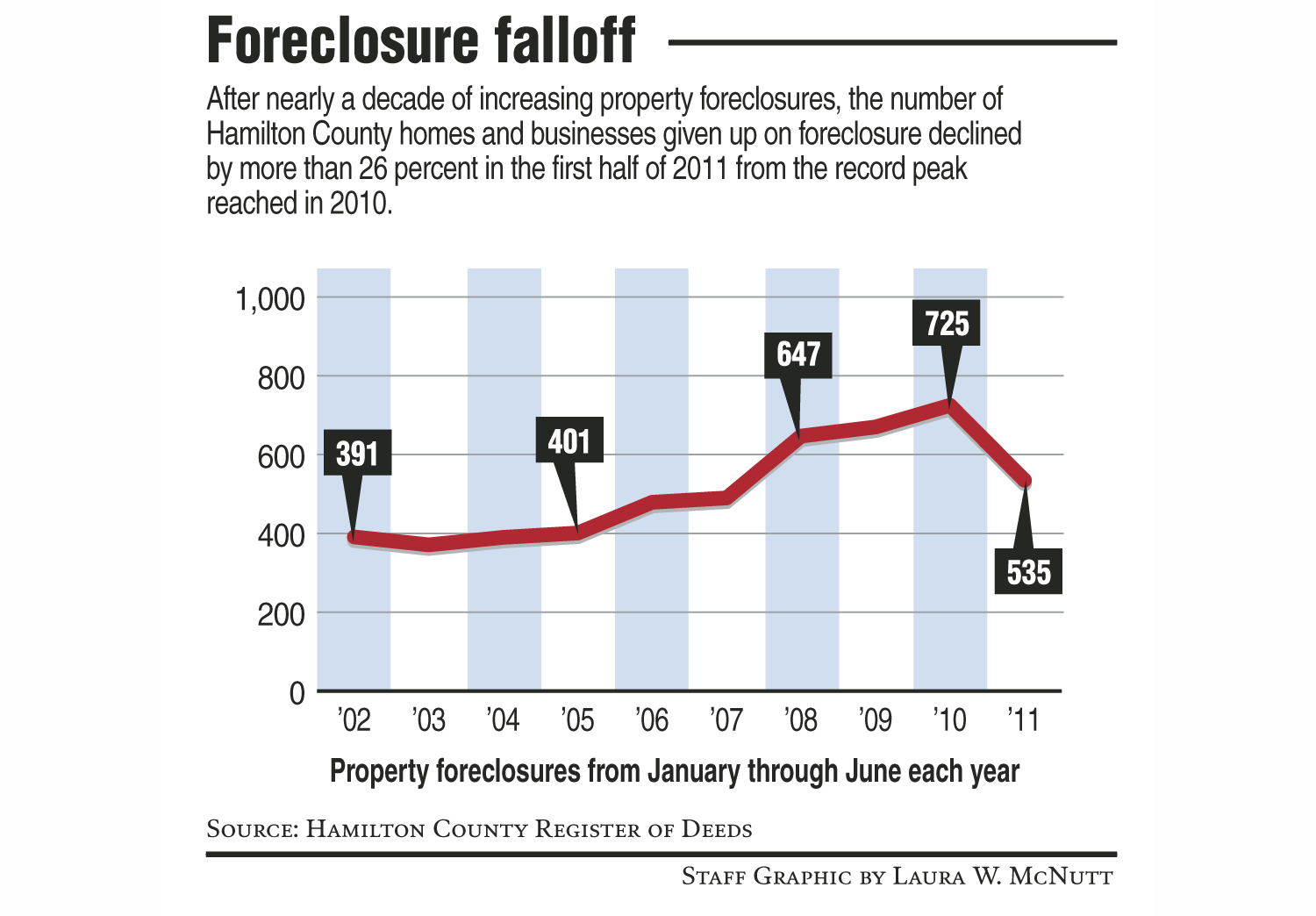

In the first six months of the year, the number of property foreclosures in Hamilton County plunged by more than 26 percent from the record high reached in 2010, according to records with the Hamilton County register of deeds.

With fewer foreclosures, Chattanooga bankruptcy filings also declined for the second consecutive year during the first half of 2011. Bankruptcies often are filed to stave off threatened foreclosures by lenders.

"The filings are down, but there are still a tremendous number of people hurting, and many of those without jobs or in lower-paying jobs are not being able to file for the type of protection and workout plan we could negotiate in the past," said Eron Epstein, a bankruptcy attorney who has handled consumer bankruptcies in Chattanooga for more than two decades. "We're still staying very busy."

Two years after the official end of the economic downturn, nearly one-fourth of the home sales by Chattanooga Realtors during May were foreclosed properties. To avoid foreclosures, others are being sold in so-called short sales - the lender sells a property for less than what's owed on a mortgage and takes a loss, Realtors said.

In the wake of the mortgage meltdown in 2008 and falling property values in many markets, lenders have tightened credit standards for making new loans. That's helping to cut the number of new delinquent loans, but it also is making it harder to clear out some foreclosed properties, bankers and Realtors said.

"It's much more difficult to get financing today than in the past, especially for many distressed properties," said Brandi Pearl Thompson, a real estate agent who specializes in foreclosed properties for the Aaron Shipley Remax real estate group. "But on the other hand, banks seem to be taking longer to foreclose on many properties."

In several parts of the country, federal regulators and plaintiff attorneys have questioned the paperwork trail on some home foreclosures, leading in some cases to court proceedings. As a result, lenders in some instances have called temporary moratoriums on more foreclosures.

Vitner said the supply of unsold foreclosed properties is likely to depress home prices and sales in most markets for at least another year until sales catch up with the volume of unsold properties.

In May, nearly one of every four homes sold in Chattanooga was in foreclosure and others were sold in short sales. Such sales tend to depress the overall price of homes, which declined in Chattanooga by 4.3 percent from May 2010 to May 2011, according to the Greater Chattanooga Association of Realtors. The average home in Chattanooga now sells for about $124,900.

"There are still some problem areas, but overall our loan delinquencies are declining and Chattanooga is doing better - certainly better than many parts of the state," said W. Keith Sanford, city president for First Tennessee Bank, one of Chattanooga's largest lenders.

The improving economy cut consumer bankruptcies nationwide by 8 percent in the first six months of 2011 compared with the same time year ago, the American Bankruptcy Institute reported Tuesday.

"The drop in bankruptcies for the first half of the year shows the continued efforts of consumers to reduce their household debt, and the overall pullback in consumer credit," said Samuel J. Gerdano, executive director for the American Bankruptcy Institute.