For the second year in a row, three health insurers offering individual health plans under the Affordable Care Act in Tennessee are planning to cut their premiums next year as the competition among insurers grows with the return of the nation's biggest health insurer into the Tennessee health exchange market.

Cigna, Oscar Health and Celtic /Ambetter are all proposing to lower premiums on their individual plans in 2021 and UnitedHealthcare, which is America's biggest health insurer by revenue, is returning to the Tennessee market in Chattanooga, Nashville, Memphis and other west Tennessee cities.

But the state's biggest health insurer, BlueCross BlueShield of Tennessee, plans to boost its increase in premiums next year for individuals by nearly 10% after making only a modest 1.4% boost in its premium rates in 2020.

BlueCross, which is the only health insurer that plans to participate in the health exchange market for individuals in all 95 of Tennessee's counties, is planning to boost its premiums next year for individuals by 9.8% and will raise it rates for small employer groups by 2.8%.

Dalya Qualls, director of corporate communications at BlueCross, said the rate increases reflect the costs of health care, which is projected to rise by 1.8% for the treatment of the coronavirus and by even more from increased claims and higher drug costs.

"We set our premium rates for the upcoming year to cover what we expect to pay out for our members medical care needs, along with our operating expenses – which we work hard to limit on behalf of our members," Qualls said. "So far this year, we've seen higher claims costs than expected - and we anticipate that trend will continue into 2021. We also factored in increases in the rates we pay for specific drugs and services, along with expected changes in the mix of drugs and services our members may need next year."

Although up from the current year, the increases by BlueCross next year are still only a fraction of the 62% premium increases the state approved for BlueCross in 2017 and the 36% hike adopted in 2016 after initial losses forced costly premium increases and several insurers, including UnitedHealthcare, exited the individual health exchange market altogether in Tennessee.

But in its hometown of Chattanooga, BlueCross will face competition on the health exchange next year from three other health insurers - Cigna, United Healthcare and Celtic/Ambetter which each plan to offer individual coverage options under the Affordable Care Act (ACA).

The Tennessee Department of Commerce and Insurance announced Tuesday it has approved rates for six health insurance carriers offering individual plans through the so-called Obamacare program, in 2021, in different parts of the state, pending final approval by federal regulators.

Last year, 221,553 Tennesseans bought individual health plans through Tennessee's exchange market under the Affordable Care Act and enrollment stood at 200,445 at the end of the open enrollment period.

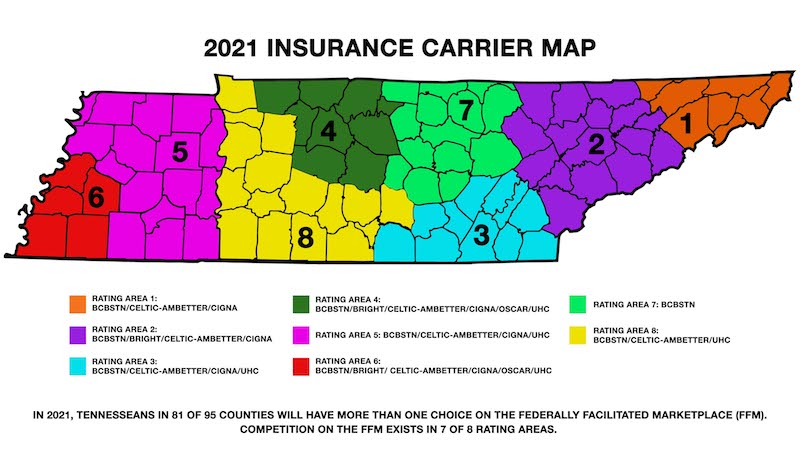

Residents in 14 Tennessee counties will have only BlueCross as a carrier option, but Tennessee Insurance Commissioner Hodgen Mainda said "hard-working and resilient families in 81 of the state's 95 counties will have more than one choice of health insurance carriers" in the Federally Facilitated Marketplace. The rate cuts approved by the Department of Commerce and Insurance represent only the third time in the history of Obamacare that such reductions were sought and approved.

"Increased competition and lower prices perfectly align with Gov. (Bill) Lee's vision to help support Tennessee consumers," Mainda said.

Backers of the Affordable Care Act, often called "ObamaCare," said the increased number of insurers offering plans next year and rate reductions by some in competitive markets proves that the program is working six years after Americans first began enrolling for individual coverage under the health exchange marketplace. Despite President Trump's efforts to end Obamacare and an ongoing legal challenge to the law's constitutionality, more than 3% of all Tennesseans are insured through the individual exchange market and the law sets standards for nearly all other persons insured through other private and government plans.

But the number of individuals enrolled in individual Obamacare plans this year was still down nearly 20% from the peak four years ago before the individual mandate to buy insurance was removed and initial premiums were much lower.

"The fact that we got another major new entrant into our market (UnitedHealthcare) despite continued efforts to destabilize the program over the past four years proves that the Affordable Care Act has been remarkably resilient," said Gordon Bonnyman, an attorney for the Tennessee Justice Center. "But the big threat now is that no matter how the market is performing or the demand of both consumers or the willingness of insurers to participate, we have this huge looming threat over the program which is the states' challenge to its constitutionality of the law."

Tennessee, Georgia and Alabama have joined in an 18-state legal challenge to the constitutionality of Obamacare after Congress removed the tax penalty for not buying health insurance. Critics of the Affordable Care Act note that in the 38 states where the federal government administers health exchanges, including Tennessee, premiums more than doubled from 2013 to 2017. Last year, nearly 82% of U.S. counties, primarily in rural areas, had only one or two insurers selling coverage under the Obamacare exchanges.

Enrollment in Tennessee's exchange

Enrollment in the individual coverage options offered under the Affordable Care Act peaked in 2016:2014: 151,352 people (limited coverage for the entire year)2015: 231,4402016: 267,8672017: 234,1252018: 228,6462019: 221,553Source: Healthinsurance.org

"Congress meant for the individual mandate to be the centerpiece of Obamacare," Texas Attorney General Paxton said in his argument for the court to strike down the law now that the mandate has been removed. "Without the constitutional justification for the centerpiece, the law must go down."

"Obamacare is a failed social experiment," Paxton said. "The sooner it is invalidated, the better, so each state can decide what type of health care system it wants and how best to provide for those with preexisting conditions, which is federalism that the Founders intended."

The U.S. Supreme Court has scheduled oral arguments on the challenge to Obamacare on Nov. 10, just a week after the presidential election day.

In the meantime barring any court ruling overturning the law, persons may sign up for the individual coverage plans for 2021 through the health care exchanges from Nov. 1 through Dec. 15 at www.healthcare.gov.

Six health insurers are planning individual coverage through the health exchange marketplace in Tennessee in 2021. The carriers, areas of coverage, and rate changes sought for next year include:

* BlueCross BlueShield of Tennessee. Statewide coverage. Proposed 2021 rate request seeking an average increase of 9.8%.

* Bright Health. Continuing coverage in Knoxville, Memphis and Nashville areas. Proposed 2021 rate request seeking an average increase of 3.01%.

* Celtic/Ambetter Insurance. Proposed coverage expansion into Jackson and Tri-Cities areas with continuing coverage in Nashville, Knoxville, Chattanooga and Memphis areas as well as cities in West Middle Tennessee such as Columbia, Dickson and Lawrenceburg. Proposed 2021 rate request seeks an average decrease of 2.5%.

* Cigna. Continuing coverage in Chattanooga, Jackson, Knoxville, Nashville, Memphis and Tri-Cities. Proposed 2021 rate request seeking a premium decrease of 6.1%.

* Oscar Health. Continuing coverage in Nashville and Memphis. Proposed 2020 request seeking an average increase of 9.9%.

* UnitedHealthcare. After dropping its individual coverage plans in 2017 after hefty early losses in the program, UnitedHealthcare will resume coverage in 2021 in the Chattanooga, Jackson, Memphis and Nashville areas as well as cities in West Middle Tennessee such as Columbia, Dickson and Lawrenceburg.

Insurers have until Sept 23 to sign final agreements with Centers for Medicare and Medicaid Services (CMS) to participate in the 2021 marketplace.Mainda said consumers should contact licensed insurance agents or company representatives in considering 2021 plan coverage.

"We urge consumers to carefully review plans when shopping on the exchange during Open Enrollment," said Rachel Jrade-Rice, an assistant commissioner for the state insurance department. "While it may be tempting to enroll in a plan with the lowest premium, consumers should also take into account other potential costs such as co-pays and deductibles. Ask questions and contact the carriers about their plans.

Contact Dave Flessner at dflessner@timesfreepress.com or at 423-757-6340.