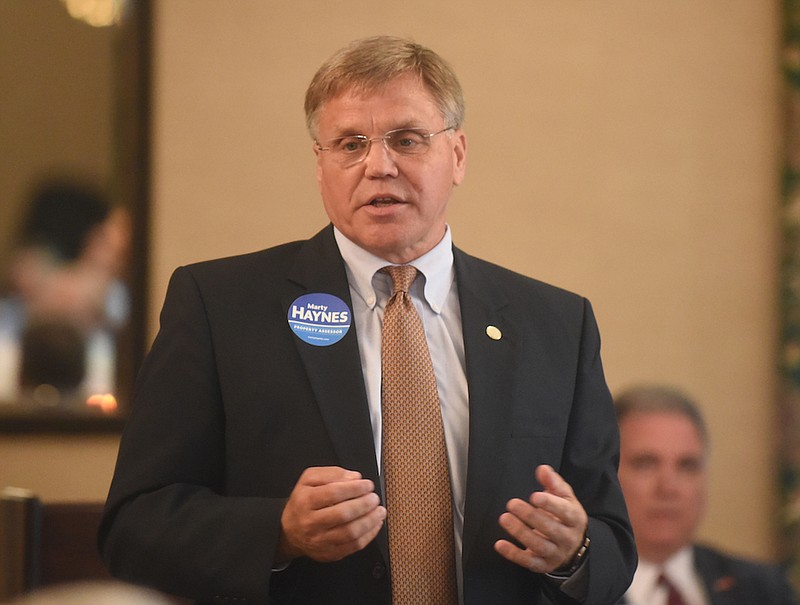

The reappraisal of more than 130,000 Hamilton County properties this year has generated plenty of calls to the county office that prepared the new tax assessments, but Hamilton County Assessor Marty Haynes said most home owners and other property owners are accepting the new valuations once they are told about the overall gains of more than 25% in most property values over the past four years.

"Most citizens indicate they are fine with their property value increasing, but they have said they do not want to pay more in property taxes," Haynes said. "When appraisers in my office have discussed the 2021 property values with the public, most understand real estate values have increased over the last four years."

Ultimately, the Hamilton County Commission will set the new property tax rate and determine what property taxes the public will pay when a new fiscal budget is adopted in the next couple of months. The reappraisal, which is required under state law, determines the value of the property but not the tax rate the county uses to levy its property taxes.

If you go

Hamilton County Assessor Marty Haynes and his staff will meet with property owners who have concerns about their property reappraisals at 6:45 p.m. Friday evening at the East Brainerd Church of Christ at 7745 E. Brainerd Road. Homeowners are encouraged to bring their new assessments to discuss with county appraisers. Persons with questions about their property assessments also may call 423-209-7990 or visit the website at www.HamiltonTN.gov/Assessor.

Nonetheless, one area of Chattanooga where many property owners have had concerns about higher property appraisals is in the East Brainerd neighborhoods where tornadoes a year ago damaged many properties.

"I have had a lot of calls from residents who are still rebuilding from the tornadoes and their assessments still went up," Hamilton County Commissioner Sabrina Smedley said. "There are a lot of questions so I asked our assessor to come out and meet with the community to explain their reappraisals."

The Friday evening public meeting, which begins at 6:45 p.m. at the East Brainerd Church of God on East Brainerd Road, will give homeowners a chance to talk directly with county appraisers about their new assessed values and how they can challenge the appraisals, if they choose to do so.

Haynes said about 10% of those receiving the new appraisals have called his office to talk with appraisers about the value assigned to each property and most have accepted the valuations after discussing the process with his staff. Those who disagree with the county's property valuations and are unable to informally convince the county to adjust their assessments will be able to formally appeal their property appraisals, starting later this spring.

For her part, Smedley said she hopes that the county commission agrees to roll back the property tax increase to offset the impacts of the higher assessments on property values.

"I don't think that coming out of a pandemic like this is a good time to try to raise taxes," she said.

- Compiled by Dave Flessner who may be reached at dflessner@timesfreepress.com or at 423-757-6340