Each of the past two U.S. presidents has proposed selling some or all of the Tennessee Valley Authority to help pay down the federal debt, arguing that government ownership of America's biggest public utility was no longer necessary or beneficial.

Congress never adopted the suggestions from either the Democratic Obama administration to sell all of TVA or the recommendation from the Republican Trump White House to split up TVA and sell its transmission assets.

But with a new president taking office last month and potentially pushing again to revamp the Tennessee Valley Authority, the TVA board commissioned an outside consulting firm last November to analyze TVA's structure and status for the future.

The new study released Thursday by Lazard, one of the world's leading financial advisory and asset management firms which previously analyzed TVA in 2014, reaffirms the value of TVA's government ownership.

The study said TVA has paid down its debt by more than $6 billion over the past six years, addressing previous concerns by the Office of Management and Budget (OMB) about TVA potentially adding to the federal debt. TVA also has lowered wholesale power rates, which has helped reduce power expenses for the nearly 10 million persons served by TVA and its local power companies.

TVA has lowered its annual operating costs by more than $800 million in the past six years to help limit its need for rate increases, Lazard said.

George Bilicic, vice chairman of Lazard, said TVA has outperformed both the long-range goals it established in 2014 and has beat the results for most of its utility peers.

"TVA has executed extremely well across its missions," Bilicic told the TVA board. "The TVA business model of public power is a reasonable approach to support TVA's mission and is working extremely well."

Bilicic called TVA's management "outstanding" since its last 2014 study and he said TVA "is best in class" among electric utilities. TVA has developed plans to address both the shortfall in its pension plan and the potential liability of its coal ash residues which were highlighted as concerns by the OMB in the past. TVA is projecting it won't raise electric rates over the next decade.

Despite recent criticism of some local power companies that TVA won't provide unbundled access to its transmission lines to allow municipalities and power coops to shop around for cheaper wholesale power, Lazard said the TVA fence that limits such sales in and out of TVA's service territory benefits the entire region.

"TVA is exempt from the Federal Power Act and Federal Energy Regulatory Commission authority to order utilities to provide transmission service; this exemption limits both TVA's exposure to competition and loss of customers in TVA's service area, which in turn facilitates TVA's ability to spread out fixed costs over a wider customer base," the Lazard report.

TVA President Jeff Lyash credited much of TVA's success to the 2005 reforms adopted to the TVA board, which replaced the previous three-member full-time board with a 9-member part-time board of outside directors who hire a full-time CEO. Lyash said TVA combines the efficiency of private enterprise, offered through its outside directors, with the advantages of government ownership and mission.

"Unlike investor-owned utilities that focus on shareholder returns, our mission is to serve all of the people of the Valley," Lyash said.

TVA officials said the mission focus of TVA was reflected last year when the federal utility, in response to the pandemic has provided more than $225 million in assistance, credits and loans to community agencies and local power companies.

"This has been an unprecedented success in helping meet the needs of people during this pandemic," said Jeannette M. Mills, executive vice president and chief external relations officer.

Contact Dave Flessner at dflessner@timesfreepress.com or at 423-757-6340.

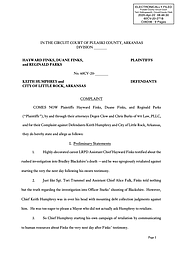

TVA changes 2014 to 2020

* Wholesale rates decreased by 0.29 cents per kilowatt-hour, reaching 6.69 cents per kilowatt-hour in 2020. Retail rates increased by 0.05 cents per kilowatt-hour, reaching 9.14 cents per kilowatt-hour in 2020.* Total financial obligations fell by $6.1 billion since FY 2013, achieving the 2023 strategic financial obligations goal of $21.8 billion three years ahead of schedule.* Electricity sales fell by 0.7% and operating revenue fell by 1.4%. This decrease can be partially attributed to TVA's $1.4 billion fuel cost reduction over the period* Operating and maintenance expenses decreased by 2.5% and fuel and purchases decreased by 36%* Net income increased by 19% to $1.4 billion in 2020-higher net income provided TVA with additional cash for deleveraging and capital expendituresSource: Lazard