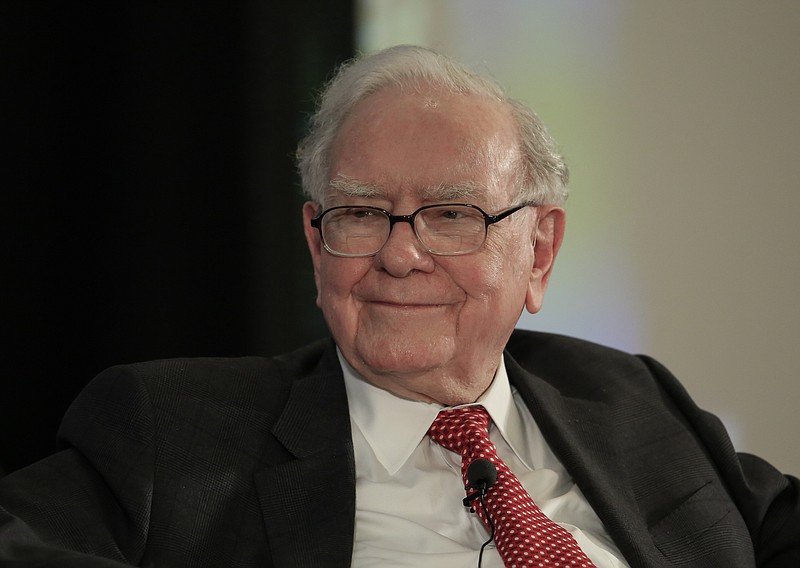

In his annual letter to shareholders released over the weekend, one of the world's richest men praised the East Tennessee entrepreneurs behind two of his major business acquisitions.

Warren Buffett, chairman of Berkshire Hathaway, said Clayton Homes which Berkshire acquired for $1.7 billion in 2003 and Pilot Travel Center which Buffett's investment group plans to buy an 80% share of by 2023, are both generating annual pre-tax earnings of more than $1 billion.

"Each company was started by a young man who had graduated from the University of Tennessee and stayed put in Knoxville," Buffett said in saluting the entrepreneurs behind the multi-billion-dollar Knoxville companies. "Neither had a meaningful amount of capital nor wealthy parents. Jim Clayton, after several other business ventures, founded Clayton Homes on a shoestring in 1956, and "Big Jim" Haslam started what became Pilot Travel Centers in 1958 by purchasing a service station for $6,000."

In 2020, Clayton Homes revenues jumped 17.1% to $8.6 billion and pre-tax earnings rose 13.9% to $1.25 billion "driven by increases in units sold and revenue per home sold," Berkshire Hathaway said in its annual report.

In 2018, Buffett's Berkshire Hathaway paid $2.76 billion for an initial 38.6% stake in Pilot Travel Centers, according to insurance filings. The Haslam family plans to maintain a 10% ownership share in Pilot, the nation's biggest chain of truck stops in the country. Berkshire Hathaway did not break down results for Pilot in its financial filings released Saturday.

The Knoxville businesses are among the diverse businesses in Berkshire's portfolio and each is now headed by the son of the company founders - Jimmy Haslam at Pilot Travel Center and Kevin Clayton at Clayton Homes.

"Each of the men later brought into the business a son with the same passion, values and brains as his father," Buffett said. "Sometimes there is a magic to genes."

Jim Haslam, now 90, has recently authored an inspirational book about his career in which he relates how Jim Clayton's son, Kevin, encouraged the Haslams to sell a large portion of Pilot to Berkshire.

Big Jim Haslam is the father of former Tennessee Gov. Bill Haslam, who is now a visiting professor of political science at Vanderbilt University. A 2015 Forbes article estimated Bill Haslam's net worth at $2 billion, making him the nation's wealthiest elected official at that time.

"When you next fly over Knoxville.. tip your hat to the Claytons and Haslams as well as to the army of successful entrepreneurs who populate every part of our country," Buffett said.

Berkshire Hathaway also owns Shaw Industries, the Dalton, Georgia-based carpet giant which has 20,806 employees who produce carpets, tiles and other floorcoverings around the globe. Berkshire acquired Shaw Industries in 2000 for $2.1 billion.

Shaw is part of Berkshire's building products division, which recorded a 4.5% increase in revenues to $21.2 billion last year and had an 8.4% gain in pretax earnings to nearly $1.4 billion.

Overall, Berkshire reported Saturday that its earnings in 2020 dropped by 48% to $45.2 billion. While the pandemic hurt many of its business lines - and forced Berkshire to again stage its forthcoming annual meeting as an online-only event, this time in Los Angeles - its profits rose 23% in the fourth quarter, as its stock investments were bolstered by soaring markets.

Among the biggest winners in Berkshire's vast investment portfolio was its 5.4% stake in Apple, whose shares have been among the top market winners over the past year. In his annual letter to investors that accompanied the company's financial results, Buffett noted that the iPhone maker was now one of his company's three biggest assets, with its stake worth $120 billion as of Dec. 31. (Berkshire calculates that it paid $31 billion for its holdings.)

- Compiled by Dave Flessner who may be reached at dflessner@timesfreepress.com or at 757-6340