Chattanooga's municipal utility will take advantage of cheaper interest rates, continued growth in its internet service, and a pandemic credit from its power supplier to keep its electricity rates flat for another year.

EPB, the city-owned utility which has not raised its portion of local power rates since 2015, had projected it would need a local rate increase in its electricity charges last year. But EPB decided against raising rates last year during the coronavirus pandemic and favorable weather and continued growth in its fiber-optic business should allow EPB to keep electric rates stable for another year.

A budget plan presented to EPB directors Friday for the fiscal year that begins July 1 envisions only a slight increase in power and internet revenues in the next year.

Electricity sales are projected to rise about 4% from about $566 million this year to $589 million next year, primarily due to differences in weather and the growth in new homes and businesses in EPB's 600-square-mile service territory.

EPB's fiber-optic division, which includes both telecom and internet services, is forecast to remain relatively stable at about $181.6 million in total sales next year. Since its start in 2009, EPB's fiber-optic service has grown to more than 120,000 commercial and residential customers with the first citywide high-speed broadband service available to all homes and businesses anywhere in North America.

But EPB's video services, which once were bought by nearly all of its telecom customers, are now purchased by only about 45% of fiber optic customers.

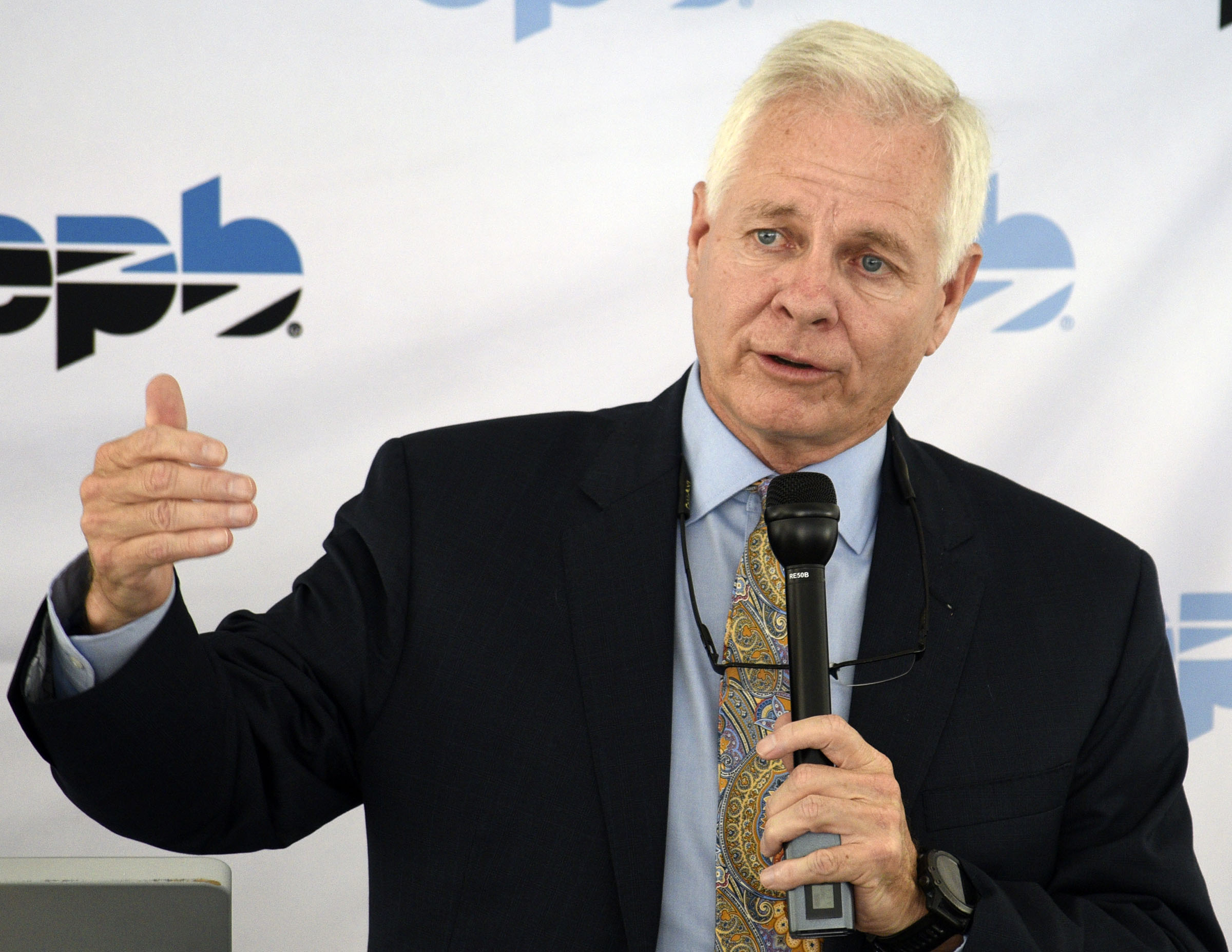

"Internet usage continues to grow, but with streaming options, the share of those buying our video packages continues to decline," EPB President David Wade told the EPB board.

Wade said EPB will not raise internet or telephone rates under the budget plan for next year, but video charges are expected to increase in January. Wade said video content prices for EPB and cable TV companies have grown over the past decade at a compounded annual rate of 9% each year. EPB has had to pass along those higher content costs on its video packages, Wade said. But EPB does offer a free service to aid customers to select the best video service or streaming option to meet their individual needs.

EPB's internet, video and telephone services use the same fiber-optic network that EPB built to help create its smart grid to better dispatch, monitor and control its electric grid that serves more than 180,000 customers. By sharing the costs of the smart grid, EPB's fiber optic division helps keep electricity rates in Chattanooga down by about 7.5% below what they would otherwise be without the telecom network, Wade said.

EPB is also benefiting from a 3.1% pandemic credit that the Tennessee Valley Authority adopted for local power companies like EPB that have signed long-term 20-year power purchase agreements. TVA has pledged to keep its base electric rates flat for the next decade, although power charges vary each month on the fuel-cost portion of electricity charges.

To help fund capital improvements and pay other expense increases for EPB, the EPB board on Friday supported the issuance of a $75 million revenue bond issue next month.

The borrowing plan, which must still be approved by the Chattanooga City Council, is the first for EPB since it the city issued more than $250 million in refinancing and capital improvement bonds for EPB in 2015. EPB expects that the city will be able to issue the new debt at some of the lowest rates ever paid by the utility.

Dan Hartman, managing director and the leader of PFM's Financial Advisory and Consulting practice, said municipal bond rates should significantly reduce the interest charges paid on the new debt compared to the roughly 3% effective rate paid six years ago on EPB' last bond issue.

"Municipal rates are near historic lows," Hartman said.

Currently, 20-year municipal bonds are selling at a 1.63% interest rate, Hartman said. EPB should maintain or even improve its bond ratings, which are now a "AA+" rating from Fitch and "AA"rating from S&P Global.

"The bond issue is part of our regular cycle of capital financing," EPB Chief Financial Officer Greg Eaves said. "But, with interest rates at historic lows, this is a particularly advantageous time because it helps us keep costs down for our customers."

Eaves said the new budget, which the 5-member EPB board will vote on in June, proposes an average 4% raise for the 640 employees of EPB. Last year during the pandemic, EPB did not grant an across-the-board increase for its workers.

Contact Dave Flessner at dflessner@timesfreepress.com or at 423-757-6340.