The father of so-called supply-side economics, former Reagan economic advisor Arthur Laffer, says the sweeping social infrastructure plan proposed by President Biden will hurt future economic growth by discouraging work and investment.

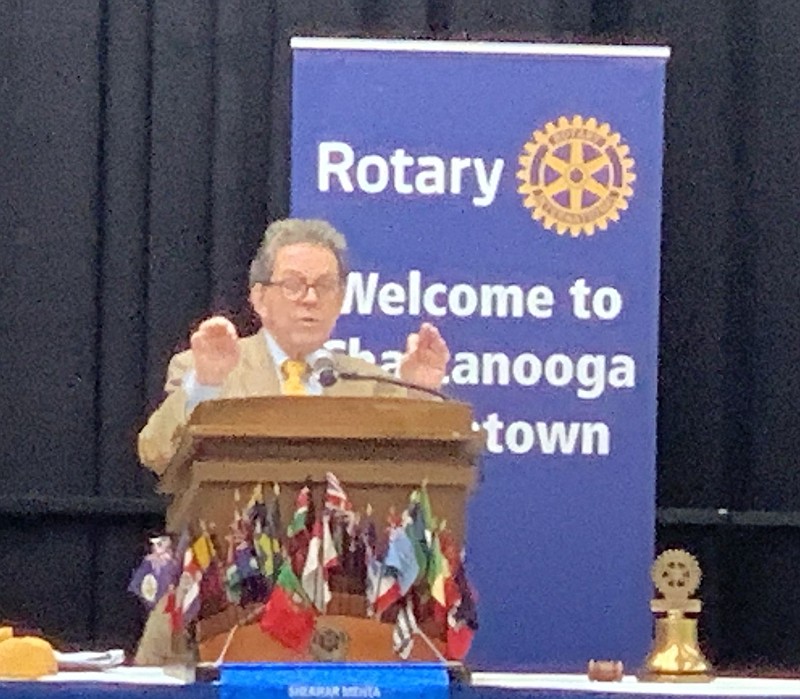

In a speech to the Chattanooga Rotary Club Thursday, Dr. Laffer said economic growth and opportunity in America has been the best when taxes are low, fair and flat. Raising taxes on businesses and wealthy persons and giving more money to the poor as some Democrats are now proposing will discourage investments and work and therefore lower overall economic growth, Laffer said.

"It's simple math that whenever you redistribute income, you always reduce total income," he said. "By taking from someone who has more, you reduce that person's incentives to produce and they will tend to produce a little bit less. Giving money to people with less or to those who are not working means that person too with be less likely to work or will at least be incentivized to produce a little less."

Laffer said the enhanced unemployment benefits given to displaced workers in the past year only encouraged more workers to drop out of the labor force and many have now lost their job skills or desire for employment.

"We're paying people not to work and we're taxing those who do so we shouldn't be surprised that we can't get enough workers today," Laffer said.

The stimulus measures adopted during the pandemic helped the U.S. economy to rebound with one of its shortest recessions in history, lasting just two months in the spring of 2020, according to the National Bureau of Economic Research.

The Federal Reserve has also held interest rates down, which Fed Chair Jerome Powell has said has worked with stimulative fiscal policies to boost both market demand and household balance sheets, according to Fed Chair Jerome Powell and Biden's top economic advisors.

But Laffer said those same stimulus measures are likely to limit employment growth and business investment required to keep the U.S. economy growing. A better approach in Laffer's view would have been to suspend payroll taxes for a year to enourage more employers to keep workers on the job and working.

Laffer, who encouraged Ronald Reagon to cut taxes in the early 1980s to stimulate the economy, said lowering the top marginal tax rate has repeatedly spurred greater economic growth for the U.S. economy under Presidents Harding, Kennedy, Reagan and Clinton in the 20th century. The 81-year-old conservative economist has chronicled the role of taxes and regulations in helping and limiting economic growth in a new book, Taxes have Consequences, on the history of the U.S. income tax.

Laffer, who moved to Nashville five years ago to escape higher taxes in California, praised Tennessee as an example of a state growing by cutting taxes.

Laffer said Tennessee has some of the lowest taxes in the country, especially since it has phased out its Hall income tax on dividends and other so-called unearned income and state inheritance taxes. Tennessee is enjoying budget surpluses even after phasing out the Hall income tax and the state continues to draw a higher share of wealthy persons and business investment into the state from higher-tax states.

A recent study by the personal finance website SmartAssets found that Tennessee was among the top six states in attracting relocating families with households incomes above $100,000 in the year before the coronavirus pandemic hit the economy in 2020. About 11,200 upper-middle-class people moved to Tennessee between 2018 and 2019, while less than 7,800 left Tennessee. In total, the net migration of upper middle-class people in Tennessee was 3,409.

Although lower taxes can reduce tax collections in the short run, Laffer said cutting taxes usually pays off in the lomg run by spurring more economic growth and creating more wealth to tax, even at a lower rate.

"Debt service today is less today that it was in 1981," Laffer said. "Some of that is due to lower interest rates, but we are not on the brink of going under because of our debt. But we are on the brink of going under because of our transfer payments."

Contact Dave Flessner at dflessner@timesfreepress.com or at 423-757-6340.