A citizens taxpayer group sharply criticized a Chattanooga panel on Wednesday after it failed to take up a matter related to the controversial tax breaks provided for the Walnut Commons apartment complex nearly a decade ago.

The result is that a real estate company that owns Walnut Commons will keep a tax break the Accountability for Taxpayer Money watchdog group estimates will total $2.4 million.

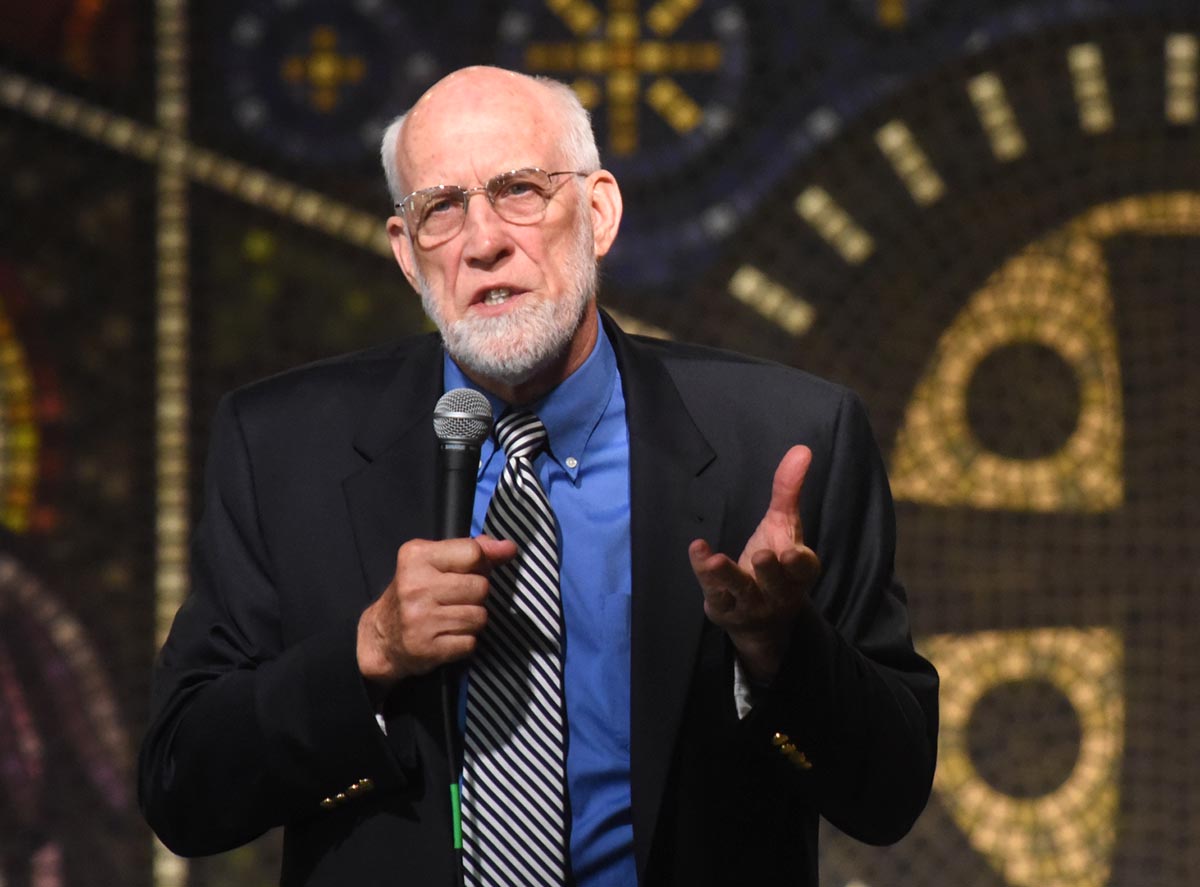

"This was a clandestine act," said local educator Franklin McCallie after a meeting of the city's Health Educational and Housing Facility Board (HEB). "It doesn't belong either in this administration or the public arena."

Helen Burns Sharp, ATM's founder, said after the meeting she's "very disappointed" at the board and that Mayor Andy Berke could have changed the outcome.

"He chose not to," she said. "I had a meeting with him last month. I requested that he ask his city attorneys to study the information the ATM attorney had recently pulled together. I had hoped that it might change the attorneys' recommendation to the HEB if they knew of the breaches in the original agreements."

On Thursday, Sharp said she "sensed a trepidation by most HEB members about 'rocking the boat' with the city."

An early agenda for the panel on Wednesday included a resolution to authorize execution of a special warranty deed related to the apartment complex located at Aquarium Way and Walnut Street.

In 2014, a local development group that built the project sold the stock in the entity, Walnut Commons LLC, to an Omaha, Neb., company for about $15 million. The new owner later wanted to exercise an option to buy the property it had been leasing from another city panel, the Chattanooga Downtown Redevelopment Corp (CDRC).

Members of ATM had asked the board to table the Walnut Commons matter so the panel could hear from attorneys on both sides of the issue.

But, board attorney Phil Noblett said Walnut Commons had been removed from the agenda. He said the Hamilton County Register of Deeds office had indicated that board action wasn't required.

Noblett said the CDRC had earlier assigned it to HEB and that "there's no requirement of this body to accept" the warranty deed.

Board member Lloyd Longnion motioned that the panel reject the decision related to the acceptance of the deed so there could be the public presentation to the board that ATM sought.

However, Longnion's request died after it failed to receive a second.

McCallie raised his hands in surprise at the board's action, later saying the panel didn't understand it had a choice related to Walnut Commons to not accept the future tax breaks.

He said the owner will receive another $1.4 million more in breaks over the next nine years. McCallie termed the figure "a loss to Hamilton County schoolchildren, police and fire and all the other services our taxes pay for." More than $1 million of property tax breaks already have been provided for the project since it was built in 2007.

McCallie said there seems to be "a great fear about doing anything about Walnut Commons."

"It seems in Chattanooga to me that the developers have held great power and the attorneys who spoke for them, and people, some citizens, are afraid to speak to power," he said.

John Konvalinka, an attorney for the taxpayer group, said the Health and Education Facility Board has been "trying to avoid the topic from day one."

"They don't want to listen," he said.

Last month, the board gave approval to documents that helped enable the Nebraska company maintain the property tax breaks.

Alfred Smith, an attorney for the company, said then the board reached the only conclusion it could.

"They honored the will of the City Council and [Hamilton] County Commission as they should have," he said.

Smith said there were no grounds for reopening the structure of the tax incentive agreement, which was agreed upon by the original developer and the city a decade ago.

"To do so would be grossly unfair," he said.

Sharp said Wednesday that ATM is continuing to explore its options. She said someone inside or outside of government could file a lawsuit on behalf of Hamilton County taxpayers, asking the action to continue the tax break be determined to be void.

"The reasons would include that the HEB did not have the authority to continue the tax break without getting the approval of the elected officials on the City Council and County Commission," Sharp said.

Also, she said, another reason would be that the Walnut Commons owners breached the agreements by not meeting their obligations to provide a percentage of housing for low and moderate income persons and to build a parking garage.

Contact Mike Pare at mpare@timesfreepress.com or 423-757-6318.