A sign of a healthy government in Tennessee, according to local CPA Jason Martin, is having between two and four months of operating expenses in reserve. The city of East Ridge has a little over four months' worth on hand, reported Martin, of Henderson Hutcherson & McCullough.

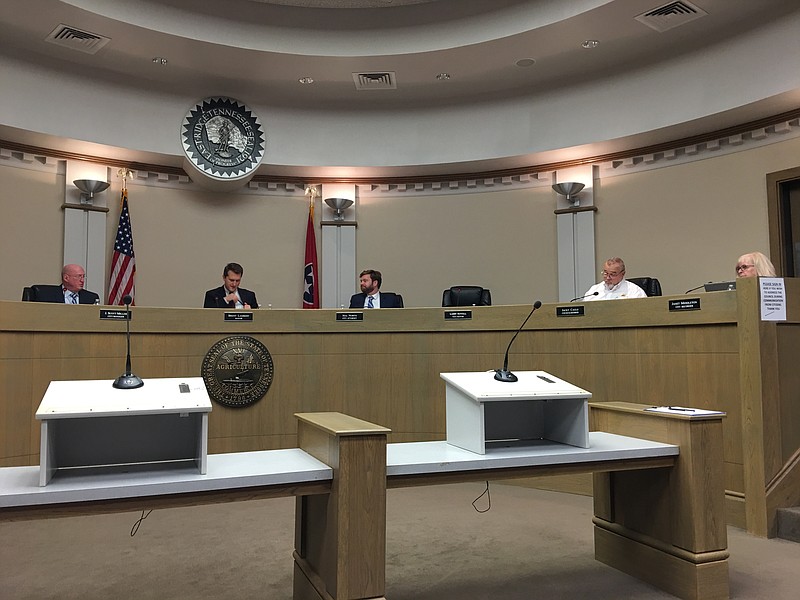

At the East Ridge City Council's final meeting of 2019, officials reviewed the city's financial state through an independent audit by HHM.

"It's always a challenge to meet the needs of any government and maintain an appropriate savings," Martin said, applauding the city for maintaining a healthy reserve.

The audit analyzed FY 2019, which includes July 2018 to June 2019. Martin said the general fund, which covers the city's chief operating costs, ended the fiscal year with about $5 million in equity, which is considered part of the reserve. The city had a total outstanding debt of $13,085,960, but the report notes that "all of this debt is backed by the full faith and credit of the government."

Collegedale’s finances

The city of Collegedale released its FY 2019 audit by Johnson, Murphey & Wright on Nov. 13, 2019.Last fiscal year, the city received about $14,127,323 in revenues from grants and taxes. The city budgeted $13,099,253 in expenses, going toward programs including public safety, public works, the sewer and airport.The city has outstanding debts totaling $5,684,405. According to the report, $738,467 of that is due in fiscal year 2020.The report notes that the city keeps at least one-third of operating revenues in reserve.

The city maintains an "Aa3" rating from Moody's Investors Services for its debt, which is the fourth-best credit rating and signifies very low risk for creditors.

Despite not earning as much revenue as anticipated in 2019, the city has taken to being more conservative in its spending for the FY 2020 budget, said Martin. For comparison, the city budgeted $15,872,425 for FY 2019 and $13,882,746 for FY 2020, according to the city's FY 2020 proposed budget.

Unexpected employee payouts could tip that a bit. The audit pointed out that city employees hired after July 1, 2012 have no cap on paid time off which they can use for sick days or vacation. Currently, employees accumulate and carry over paid time off. Employees hired before that date are capped at 320 hours.

"That creates a perpetual liability for East Ridge," Martin said, adding that other governments have a "use it or lose it" policy.

The city pays out unused PTO when an employee leaves on good terms. The report notes that $650,051 of the city's $13 million in debt from FY19 is for "compensated absences."

"There are some employees who have been here a while," said HHM's Zach Hutcherson. "You might find at some point when one of them leaves you're cutting a check that's a little bit bigger for that accrued vacation pay."

Having run into that issue once in 2019, the city is now looking into restructuring the policy.

The audit also initiated a change in the procedure for depositing money taken into evidence by the police department.

During the audit, unaccounted cash was found sitting in a police safe. It's unsure where the money came from, Martin said.

State law dictates that any money collected must be put into a bank account within three days.

Because of this issue, the city has made it a policy to deposit the money within one day.

Email Sabrina Bodon at sbodon@timesfreepress.com.