Last spring, three local University of Virginia graduates with startup experience in business, law and politics decided to leave other jobs to start a new type of business in Chattanooga.

The trio of 30-somethings, who later added an Alabama MBA to their roster, see a different kind of opportunity for success than other new venture capital funds. Instead of buying high-growth startups to expand and sell, they want to buy or invest for the long term in established companies, often in manufacturing.

The new business is known as Alderman Holdings, named after former University of Virginia President Edwin Alderman who helped transform the school a century ago. With many Baby Boomer founders of local businesses wanting to retire or slow down — and only about 30 percent of small business owners having a succession plan — Alderman principals see a chance to play a key role in keeping and growing existing businesses in the future.

“There is an awesome history of healthy, long-standing companies that are small businesses that play a critical part of the Chattanooga area,” says Andrew Kean, a former chief of staff for Chattanooga Mayor Andy Berke and former chief operating officer at See Rock City and the Tennessee Stillhouse who helped organize Alderman Holdings last year.

Ben Brown, a former CEO of SwiftWing Ventures and previously chief operating officer for American Exchange, says there is an absence of equity funds trying to buy, invest or help manage these companies as they transition from one generation to another.

“We think we can help supply the demand for these businesses by organizing the capital, find the investors and develop a plan to keep the business in Chattanooga and make it work for the long term,” Brown says.

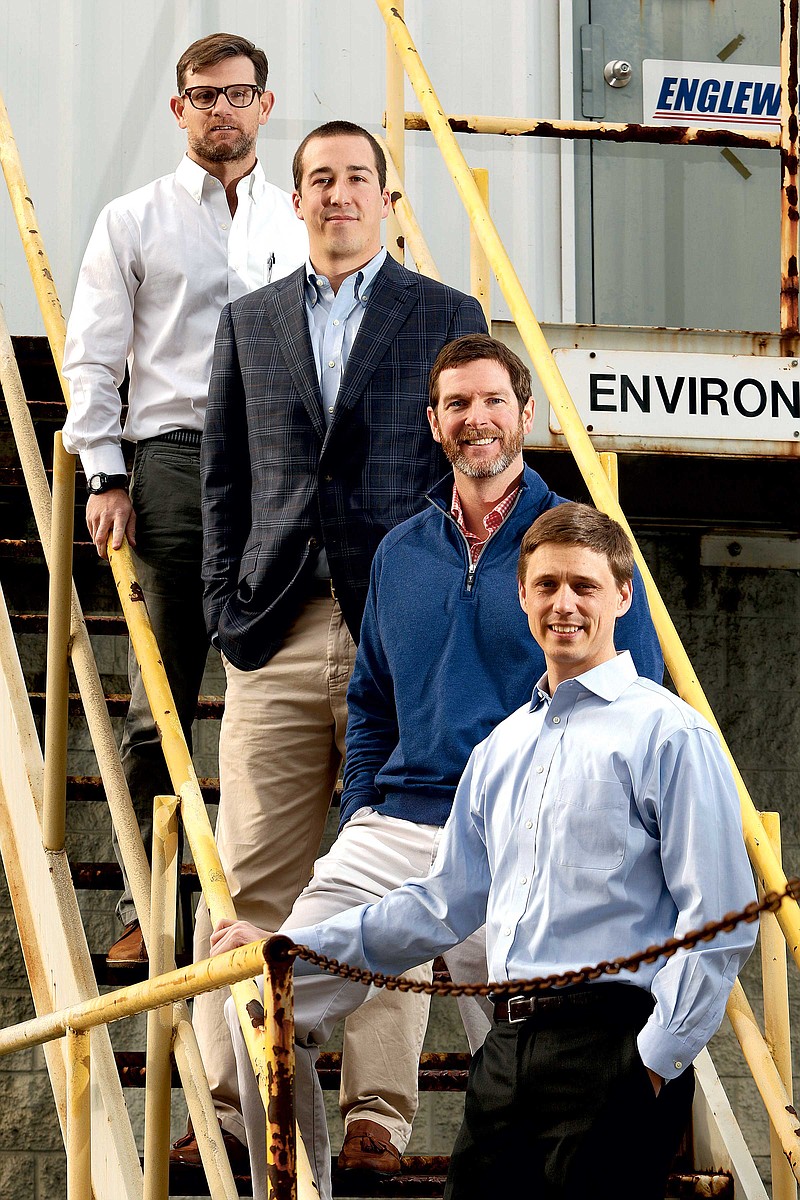

Kean and Brown joined with Jay Hildebrand, a lawyer formerly with Leitner, Williams, Dooley & Napolitan, to start the business in May. In November, the group added Patrick Alderman, who previously worked in a similar private equity group in Mobile, Alabama.

The four are spending lots of time make contacts and talking with potential sellers and investors, along with the accountants and attorneys they work with, to line up potential deals. They are targeting businesses worth between $1 million and $5 million —or annual revenues ranging from $3 million to $15 million — and expect to close their first deal this spring or summer.

“We see ourselves as the solution for business owners seeking a trustworthy and committed partner to carry forward their business … for the long term,” Wells says.