The Tax Cuts and Jobs Act of 2017 created a new incentive program to encourage private investors and developers to invest in low-income communities across the country, including Chattanooga. The Qualified Opportunity Zones program spurs investors and developers to roll capital gains from any sale into a fund that invests in the improvement of designated low-income communities.

Depending on the length investors hold the investment in the fund, the program allows investors to both defer and reduce capital gains taxes on the rolled-over gains, as well as possibly eliminate capital gains tax on all gains earned on the investment in the fund.

The United States Department of Treasury must still issue guidance rules to fill in certain regulatory details, and these are expected later this summer, but the specific opportunity zones have been designated.

Where are the zones?

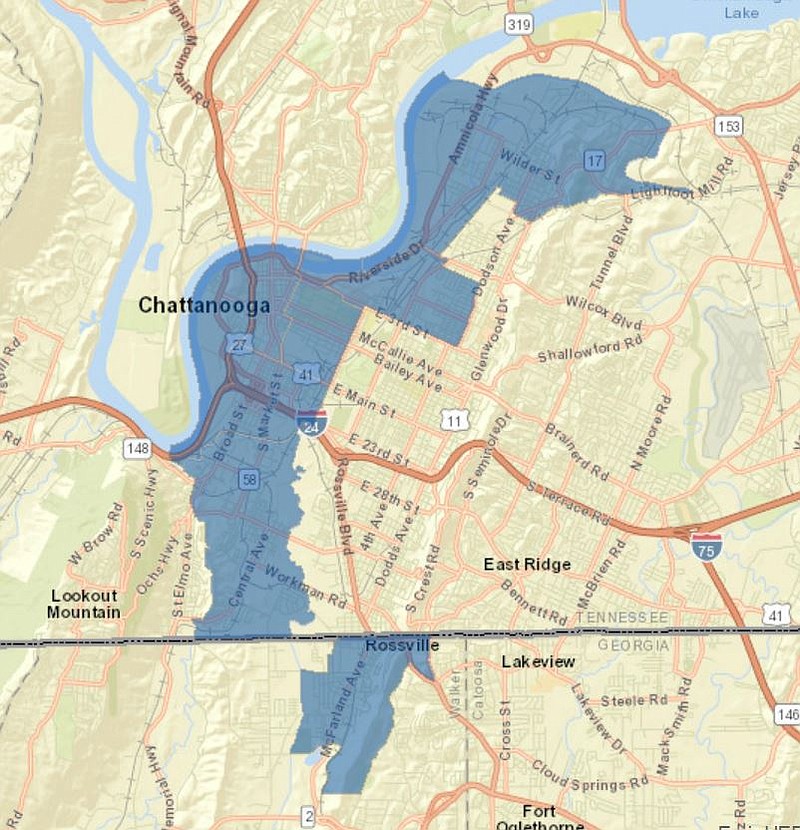

In Chattanooga, the qualified opportunity zone includes portions of East Chattanooga and downtown from the Tennessee River to the Georgia state line, bordered by Tennessee Avenue to the West and Central Avenue to the East.

How will it work?

The capital gains must be reinvested in a qualified opportunity fund within 180 days of the sale. Anyone may set up a qualified opportunity fund, which must be structured as a corporation, partnership or limited liability company, and they must self-certify to the IRS using a special form to be released later this year.

To qualify, an opportunity fund must invest at least 90 percent of its assets in qualified opportunity zone property. The property can be stock or partnership interests in businesses where most of the income is from activity within the zone, or it can be real or personal property put to use or improved as a business within the zone. The assets must have been acquired after Dec. 31, 2017.

There is no requirement that a fund invest in a zone located within its state of formation. With such cross-border private investment allowed to benefit from the program, there may be an influx of out-of-state capital to fund projects within Chattanooga zones such as the riverfront area, which is already experiencing a surge in new projects.

The benefits realized depend on how long the fund remains invested. First, so long as gains are invested in a qualified opportunity fund within 180 days of the subject sale, the capital gains tax may be deferred until as late as Dec. 31, 2026. If the investment is held for five years, then the basis of the property from which the deferred gains are derived will be increased by 10 percent of the amount of the deferred gains. If held for seven years, then the basis is stepped up by another 5 percent, for a total increase of 15 percent. The deferred gains, as adjusted depending on the holding period, must be finally recognized and the capital gains tax paid on Dec. 31, 2026. Though the investor must pay tax on the deferred gains on Dec. 31, 2026, if the investor holds the investment in the qualified opportunity fund for 10 years, then all gains earned as a result of investing in the qualified opportunity fund would effectively be excluded from capital gains tax by way of an automatic increase of the investment's basis to fair market value at that time.

This is only a summary of the Qualified Opportunity Zones program; however, now is the time for investors to consider this unique opportunity and begin shaping a financial strategy to take advantage of the available benefits.

Andy Leffler and Kirby Yost are attorneys with Chambliss Law Firm. Yost is a member of the Business Section, Real Estate Section and Chambliss Startup Group, while Leffler is a member of the firm's Business and Real Estate Sections.