Chattanooga resident Faye Kelly understands the importance of the "tax freeze" policy approved by the Chattanooga City Council in 2017. The often-discussed "tax freeze" allows seniors 65 years or older with a low or moderate income to freeze their property tax payments even when reappraisals by the property assessor or tax increases adopted by City Council increase the tax bill for most property owners.

Kelly signed up for the tax freeze program this year, and if the council approves a tax increase this year, Kelly will be held harmless.

But for Kelly and other seniors 65 years or older with a low annual income, the tax freeze program is secondary to the hundreds of dollars in rebates she can receive on her current property tax bill from another state program designed to aid low-income seniors.

"I am a senior citizen with a limited income and every dollar helps because I want to pay my taxes," Kelly says. "I signed up through the county a couple of years ago, but I didn't know I could do the same thing on my city taxes until I read it in the paper."

Senior property owners have until April 5 to apply for property tax relief on either their city property tax bill, their county property tax bill or both. Applications are accepted for relief on county tax bills at the County Courthouse downtown or at its satellite offices in the Bonny Oaks Industrial Park.

Qualified city property owners can apply for tax relief, and the property tax freeze, at City Hall or a series of locations through the end of February.

Senior tax relief programs

Here is the property tax relief available to qualified seniors:

» The state program, either through the city or county, will pay about 25 percent of the tax bill. The average relief is $157 in the city and $175 in the county.

» Hamilton County approved additional relief in 2018 that equates to half the state payment, or $87, on county property tax bills.

» Qualified property owners in the city also will have the $126.49 water quality fee paid through a program of the United Way of Greater Chattanooga.

The state reported that 106,109 property owners in Tennessee received $16,705,324 in tax relief in 2017. An additional $18 million in relief went to disabled seniors, disabled veterans or spouses of disabled veterans.

Hamilton County Trustee Bill Hullander said 3,346 county property owners qualified for the state program in 2018, and the county paid $330,824 in tax relief through its supplemental program. City officials said 2,018 property owners received $440,690 in state tax relief in 2017. Additionally, 1,490 residents registered for the senior tax freeze.

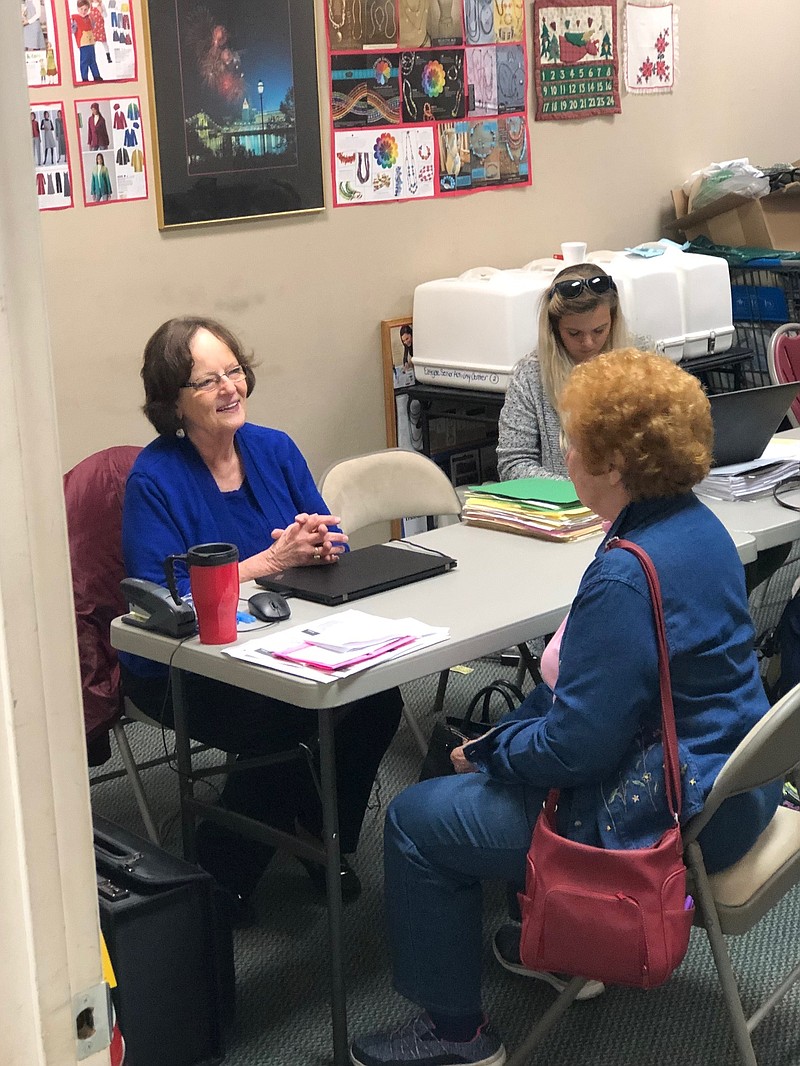

Karen Murphy has worked with the property tax relief program for nearly 20 years and works in the city program six months a year. She says it is important that applicants have documentation relating to all sources of income for all owners listed on the property deed as well as copies of their tax bills.

"It's important to know that you have to reapply every year for the tax relief and the tax freeze," said Murphy, who is retired after a career in the dental industry. "I am a people person and I enjoy helping them through the process."

Tax Relief Programs

Tennessee Tax Relief ProgramThe state has offered a tax relief program for more since the U.S. Constitution was amended in 1972 to mandate property tax relief for seniors, disabled seniors, disabled veterans and spouses of deceased disabled veterans. The program is administered through county trustee offices or municipalities in Tennessee. Property owners qualify if you are 65 years of age or older and the total income of those listed on the property deed is $29,270 or below.Hamilton County Tax Relief ProgramCounty government administers the state program and offers a supplemental program paid for by Hamilton County taxpayers. Property owners may apply for tax relief until April 5, 2019 at either the County Courthouse (625 Georgia Avenue, Room 210, 423-209-7270) or the county satellite offices (Bonny Oaks Industrial Park, 6125 Preservation Drive, Suite 101, 423-209-7270).City of Chattanooga Tax Relief ProgramCity government administers the state program. Property owners can apply at City Hall through April 5. The City will also take applications at the following locations:Feb. 4-6: Avondale YFD, 1305 Dodson Ave.Feb. 11: John A. Patten YFD, 3202 Kelly’s Ferry RoadFeb. 12-14: Eastgate Senior Center, 5600 Brainerd RoadFeb. 18-21: North River Senior Center, 1009 Executive DriveFeb. 25-26: Frances B. Wyatt YFD, 406 Colville St.City of Chattanooga Tax Freeze ProgramThe Chattanooga City Council passed senior tax freeze policy in 2018. This policy freezes the property tax rate for qualified citizens in the event the City imposes a tax increase in a given year. Certification for the tax freeze must be renewed annually. Taxpayers may apply for the tax freeze program at the same times and locations where property tax relief applications are accepted. Property owners qualify for the tax freeze program if they are 65 years or older, own and live in a home in Chattanooga and earn $38,840 or less annually. Call 423-643-7262 for more information.City of Chattanooga Water Quality Fee Relief ProgramAny Chattanooga property owner who meets the requirements for property tax relief also qualify to have a portion of their water quality fee paid for through the United Way. Recertification is required each year.Average Property Tax ReliefThe tax relief program yields approximately a 25 percent savings on assessed taxes. Based on averages of the tax relief programs, a property owner living in the City of Chattanooga could receive $563 of relief on property taxes:City of Chattanooga relief: $157Hamilton County relief: $175Supplemental Hamilton County relief: $87Chattanooga Water Quality fee: $146Total: $565