VIDEO

This story is featured in today's TimesFreePress newscast.

WHAT'S NEXTWhat: Chattanooga Tea Party monthly meetingWhen: 6:30 p.m. todayWhere: Century Club Banquet Hall, 3221 Harrison Pike

WASHINGTON - The IRS subjected the Chattanooga Tea Party to "unnecessary" questioning and "significant processing delays" in the group's request for nonprofit status, according to an inspector general's report and documents obtained by the Chattanooga Times Free Press.

The federal agency's foot-dragging delayed the Chattanooga Tea Party's request to be tax exempt by more than three years and two election cycles. The group was among dozens singled out by the IRS because of their titles and perceived political leanings, putting a local face on a scandal sweeping the nation.

Among dozens of questions in two separate inquiries, the agency requested Chattanooga Tea Party Facebook screen shots, meeting minutes and video recordings.

Additionally, nearly three years after the local group formed, the IRS demanded "copies of all hand-outs distributed, phone calls, emails ... conversations, reactions of speakers, etc." of monthly Chattanooga Tea Party meetings "from inception to present."

"Reactions?" Chattanooga Tea Party President Mark West said Wednesday. "We're supposed to decipher people's thought processes from two years ago? You're dealing with an agency that has unchecked power over 300 million people."

West gave the Times Free Press two letters the IRS sent his organization. The local tea party meets this evening to discuss the situation in greater detail.

Last week the IRS admitted targeting tea party groups and apologized. In an email Wednesday, agency spokesman Anthony Burke did not answer specific questions about the Chattanooga Tea Party.

The Justice Department has launched a criminal probe as congressional leaders prepare their own investigations.

President Obama on Wednesday announced the resignation of Acting IRS Commissioner Steven Miller. That came one day after the president vowed "to hold those responsible for these failures accountable."

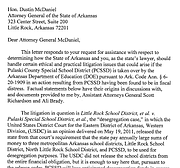

FIRST IRS LETTER

Like many fledgling conservative groups in 2009, the Chattanooga Tea Party sought the 501(c)(4) status from the IRS as a nonprofit, tax-exempt "social welfare group." Such organizations are allowed to engage in political activity, but not as their primary focus.

West said he applied for tax-exempt status in November 2009. Eight months later, on July 6, 2010, the IRS responded with a list of nine questions, including:

• "Provide a list and description of topics discussed at your meetings for the past 6 months."

• "Explain how you will inform the public concerning the operation of the Federal Government and any new proposed legislation that the Federal government proposes to enact."

• "Information on the Internet shows that you may have hosted debates for candidates for Congress. Provide promotional literature from these events and a list of questions asked."

Similar versions of all three questions were deemed "unnecessary" in the inspector general's report released Tuesday.

Still, West said, he responded in a timely fashion.

He heard nothing until 18 months later, when the IRS sent a second letter that withheld nonprofit status and included 20 follow-up questions, many of which had multiple parts.

West was given three weeks to respond, documents show.

The inspector general's report noted that tea party groups were given "two or three weeks" to submit answers "despite the fact that the IRS had done nothing with some of the applications for more than one year."

SECOND IRS LETTER

Dated Jan. 4, 2012, the letter referred to a forum the Chattanooga Tea Party had hosted in early 2010.

The IRS asked for "all hand-outs, brochures, flyers [and] published materials distributed. Provide details of the content of the debate. Provide all questions asked, if not already submitted. Provide conversations, recordings, reactions, etc. on the debate."

The IRS further requested that the tea party provide audio and video recording of each event it had hosted, along with "a transcript of any speeches given by the candidates or speakers."

Other questions in the second inquiry, all of which were flagged by the inspector general as "unnecessary":

• "If you have a board member or officer who has run or will run for a public office, please describe fully."

• "Explain if your organization or its leaders rate candidates, even on a nonpartisan basis."

• "What are the sources of the organization's income?"

The inspector general's report said relevant IRS staffers "lacked knowledge of what activities are allowed" for different types of nonprofits.

"It's wholly inappropriate for the IRS to target groups with the goal of unveiling the political ideology of people within an organization," said Paul S. Ryan, an expert at the Washington-based Campaign Legal Center.

APPROVAL

West said the IRS approved the Chattanooga Tea Party for tax-exempt status in April 2013, nearly four years after it had applied.

Senate Republicans on Wednesday sent a letter to the White House demanding action. Among the signers were U.S. Sens. Lamar Alexander and Bob Corker of Tennessee.

"The public's confidence in the IRS relies on fair and apolitical application of the law," the letter states. "Actions such as these undermine taxpayers' ability to trust its government to fairly implement the law."

Contact staff writer Chris Carroll at ccarroll@timesfreepress.com or 423-280-2025.