Some of the Chattanooga and regional projects included in IMPROVE Act:

* In Chattanooga, the interchange modification project at the Interstate 75 and Interstate 24 split in Brainerd and East Ridge is estimated to cost $70 million. With an estimated 124,000 vehicles passing through daily the area is known for its notorious traffic jams.* Interchange modifications on I-24 at Broad Street (State Route 2) and Market Street (SR-58) is in development. It would upgrade ramps and improve access from I-24 to the south side of Chattanooga. Estimated cost: $37 million.* Apison Pike (SR-317) in the Collegedale area of Hamilton County has two widening projects planned from SR-321 (Ooltewah-Ringgold Road) to East Brainerd Road. It covers over four miles in length and would connect with a widening project currently under construction and complete improvements to the SR-317 corridor between I-75 and East Brainerd Road. Estimated cost: $36.1 million.* The widening of Bonny Oaks Drive (SR-317) from SR-17 to I-75 in Chattanooga. Its near the Enterprise South Industrial Park where Volkswagen and Amazon are located. The 4.8-mile project is in the environmental phase. Estimated cost: $63.1 million.* In Rhea County, an 8-mile section of SR-30 from U.S. 27/SR-29 to the Tennessee River Bridge is undergoing environmental studies. This road is a critical corridor in the region and has numerous safety issues. It also is a controlled evacuation route for TVA’s Watts Bar Nuclear Plant in the event of an emergency. Estimated cost: $70.1 million.* Improving more than 20 miles of U.S. 64/SR-40 through the Ocoee Gorge in Polk County. Now in the environmental study phase, it’s part of the long-envisioned Corridor K and would go west from Ocoee River to SR-68 in Ducktown. Estimated cost: $220 million to $1 billion.* In Bradley County, a 3.2-mile section of SR-60 from Westlake Drive to SR-306 is in development. A high rate of development along SR-60 has led to an increase in congestion. Estimated cost: $40.5 million.* SR-322 in Monroe County has two improvement projects on the books, totaling 7 miles. This road connects Sweetwater and Vonore. Estimated cost: $26.7 million.* In McMinn County, I-75 interchange improvements at and connection improvements to SR-30, SR-305 and U.S. 11/SR-2 are in the environmental phase. The project encompasses over six miles of roadway improvements. Estimated cost: $59 million.

How they voted

Here’s how area legislators voted on the IMPROVE Act:House - Voting yes:Rep. David Alexander, R-WinchesterRep. Kevin Brooks, R-ClevelandRep. Mike Carter, R-OoltewahRep. JoAnne Favors, D-ChattanoogaRep. John Forgety, R-AthensRep. Mark Gravitt, R-East RidgeRep. Patsy Hazlewood, R-Signal MountainRep. Dan Howell, R-GeorgetownRep. Gerald McCormick, R-ChattanoogaRep. Ron Travis, R-DaytonHouse - Voting no:Rep. Judd Matheny, R-TullahomaSenate - Voting yes:Sen. Mike Bell, R-RicevilleSen. Todd Gardenhire, R-ChattanoogaSen. Bo Watson, R-ChattanoogaSen. Ken Yager, R-HarrimanSenate - Voting no:Sen. Janice Bowling, R-Tullahoma

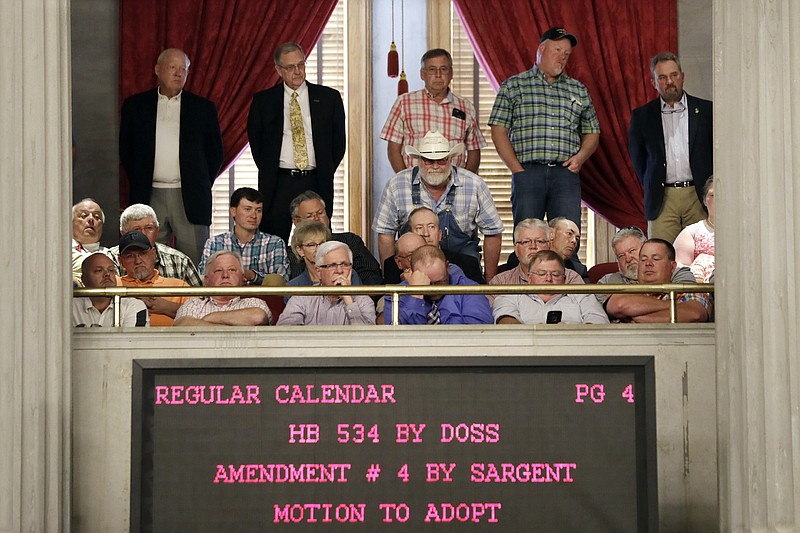

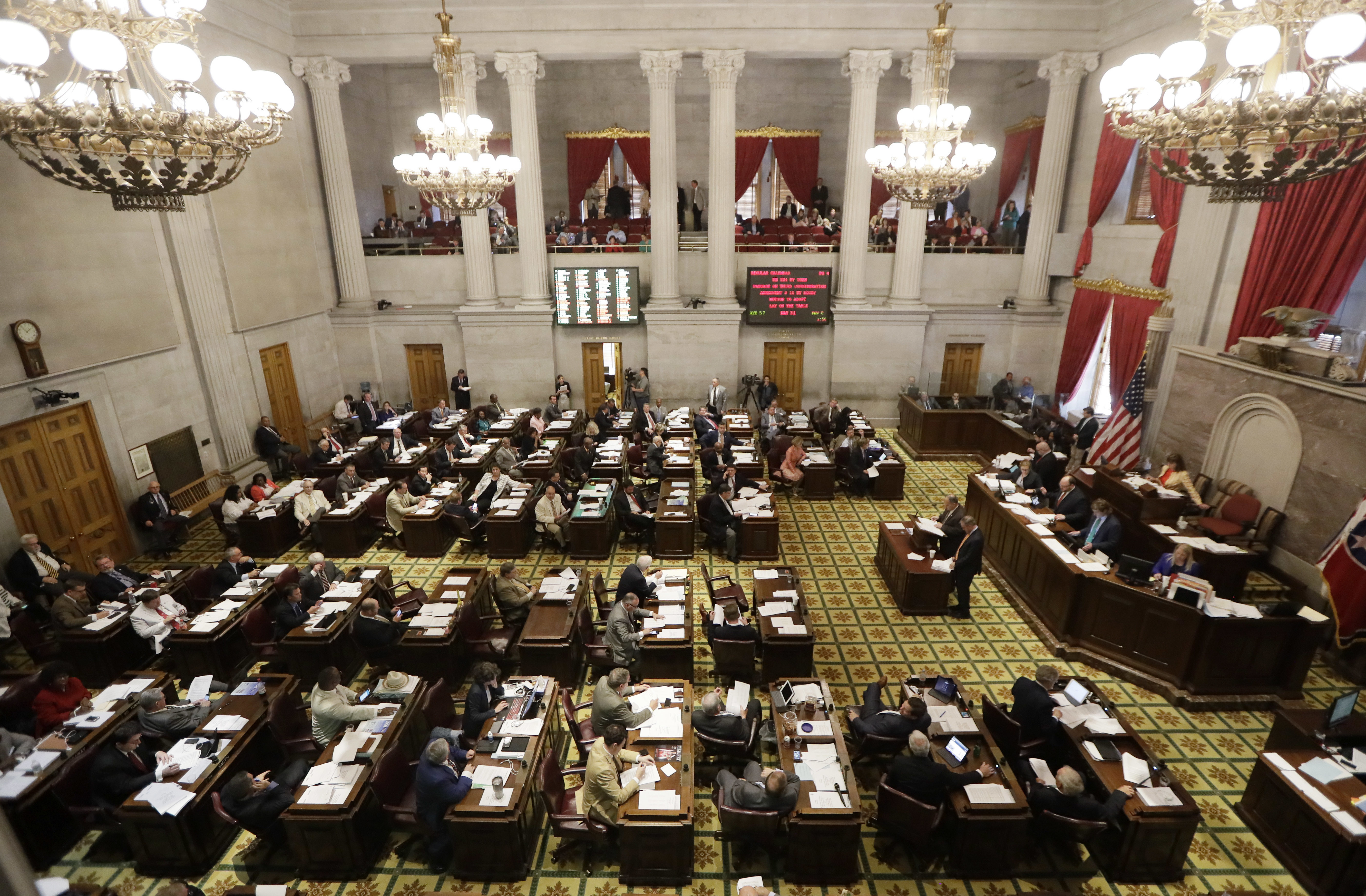

Debate on Gov. Bill Haslam's road and bridge funding bill takes place in the House of Representatives on Wednesday, April 19, 2017, in Nashville, Tenn. A Republican effort to remove Tennessee's first gas tax hike since 1989 from Gov. Bill Haslam's road and bridge funding bill was soundly defeated in the House on Wednesday. (AP Photo/Mark Humphrey)

Debate on Gov. Bill Haslam's road and bridge funding bill takes place in the House of Representatives on Wednesday, April 19, 2017, in Nashville, Tenn. A Republican effort to remove Tennessee's first gas tax hike since 1989 from Gov. Bill Haslam's road and bridge funding bill was soundly defeated in the House on Wednesday. (AP Photo/Mark Humphrey) NASHVILLE - Tennessee lawmakers on Wednesday approved Republican Gov. Bill Haslam's plan to raise gas and diesel taxes - the first increase in nearly three decades for road spending - while also cutting general fund taxes in what the governor says is the largest tax reduction in state history.

House members approved Haslam's IMPROVE Act on a 60-37 vote after a marathon four-and-a-half-hour debate that often pitted GOP majority members against one another.

Passage was far easier in the Republican Senate, which voted 25-6 for the measure that raises $350 million for highway and bridge projects while cutting some $420 million in general fund taxes where revenues have been booming.

"It is a victory on all fronts - for taxpayers, for economic development and for the continued mobility and safety of our citizens," Senate Speaker Randy McNally, R-Oak Ridge, later said. "Good roads and solid infrastructure lead to economic expansion and job growth. Tax cuts result in more money in the pockets of our citizens and more entrepreneurism in our state."

Because senators included a provision to fully restore a state-supported relief program aimed at veterans, the elderly and some disabled people, the measure must go back to the House for final action on Monday.

The bill would raise Tennessee diesel taxes for the first time since 1989, hiking the price of gas per gallon by 6 cents to 27.4 cents and diesel by 10 cents to 28.4 cents. Increases will be phased in over three years.

That, along with a $5 increase in car registration fees, a $100 fee for electric vehicle owners and other measures will generate some $350 million annually. The state's share of the fuel taxes amounts to $245 million. Counties would see $70 million, while cities would split $35 million.

Haslam says the money will allow Tennessee to accelerate work on 962 specific projects totaling some $10.5 billion. An estimated 23 projects projected to cost some $600 million in Hamilton County will be impacted.

The bill also allows the state's largest cities and counties, including Chattanooga and Hamilton County, to increase some existing taxes to fund transit projects. But any increase would have to be approved by voters. It's an issue near and dear to traffic-choked Metro Nashville.

While McNally fully backed the governor's plan - Majority Leader Mark Norris, R-Collierville, pushed Haslam to include a 20 percent reduction in the state's sales tax on groceries - Republican House Speaker Beth Harwell of Nashville was actively trying to find an alternative.

Harwell plans to run for governor in 2018, and Norris is giving a bid a hard look.

Usually a Haslam ally, it was a major break on Harwell's part. It wasn't until earlier this month that Harwell was publicly revealed as actively supporting an alternative to the gas tax increase.

The alternative, which sought to divert existing sales taxes on new and used vehicle sales, failed on the House floor on a 38-58 vote.

Harwell voted for the alternative pushed by Assistant Majority Leader David Hawk, R-Greeneville. But she wound up voting later for the fuel tax increase backed by road builders, the Tennessee Chamber of Commerce and various other interests.

"While this was not the plan I preferred - I definitely preferred the other plan - at the end of the day, infrastructure is a limited role of government and we need to perform it well," Harwell told reporters after the vote.

She also said she doesn't anticipate a major House floor effort to torpedo the gas tax hike when the bill comes back to the floor on Monday. Hawk's amendment failed on a 58-38 vote.

"I think the vote was clear today," Harwell said.

With top House Republicans refusing to handle the bill, the task fell to Transportation Committee Chairman Barry Doss, R-Leoma, to carry it. During floor debate, Doss stressed the benefit to transportation and highlighted the tax cuts.

"The average family of four will save about $2.18 per month," he said.

Opponents like Hawk and Rep. Jerry Sexton, R-Bean Station, argued that with the state running a huge general fund surplus, there was no need for a fuel tax increase that hits many Tennesseans.

Sexton said he didn't hear any clamor from average Tennesseans but plenty from lobbyists representing road builders, corporate interests and others.

"I don't hear any lobby speaking for the average taxpayer in Tennessee," Sexton complained.

Haslam, McNally, Norris and others argued the fuel tax was the fairest for Tennesseans because out-of-state truckers are estimated to pay 40 percent or more of the diesel tax. And in the House, it was noted that more Tennesseans eat food and thus would be helped by the food tax reduction than drive.

House members filed some 80 amendments to the bill, with many of them coming from GOP opponents.

The legislation provides a 20 percent cut in the state's 5 percent sales tax on grocery store food sales, taking it down from 5 percent to 4 percent. Norris says the $125 million cut and other provisions outweigh the monthly cost of the fuel tax increase by a few dollars.

Haslam and companies say another change affecting corporate franchise and excise taxes will encourage businesses to expand or locate new factories in Tennessee. It is expected to decrease state revenues by $113 million annually.

The change has been eagerly sought by Collegedale-based McKee Foods, among others. A state revenue department found 518 companies would benefit. Half the savings would go to 24 companies, which many speculate would benefit auto manufacturers including Volkswagen, although the state analysis mentions no companies by name.

The provision was strongly supported by the Hamilton County legislative delegation in both the House and Senate. McKee is said to have located an expansion in Virginia because that state's tax structure was more favorable than Tennessee's, which critics say punished companies here by considering payroll and plant investment.

During floor debate, Rep. Mike Carter, R-Ooltewah, spoke of an unnamed company that has redesignated 100 executives to another state because of the current tax structure.

Meanwhile, Rep. Ron Travis, R-Dayton, said on the floor that a manufacturer eyeing Rhea County for a plant employing as many as 2,500 workers has indicated its decision will be based in large part on the franchise and excise tax change.

The bill also continues to phase out the state's Hall Income tax on individuals' investments. The bill provides $55 million in reductions annually over the next three years. The corporate and Hall Tax provisions had some Democrats and even a few Republicans complaining that the bill is a boon to the rich.

But in the end, 37 House Republicans and 23 Democrats voted for the IMPROVE Act. The entire Hamilton County delegation votes yes. Thirty-five Republicans and two Democrats voted no.

Twenty Senate Republicans voted yes, and all five Democrats did, too. Six Republicans voted no.

Contact Andy Sher at asher@timesfreepress.com or 615-255-0550. Follow him on Twitter @AndySher1.