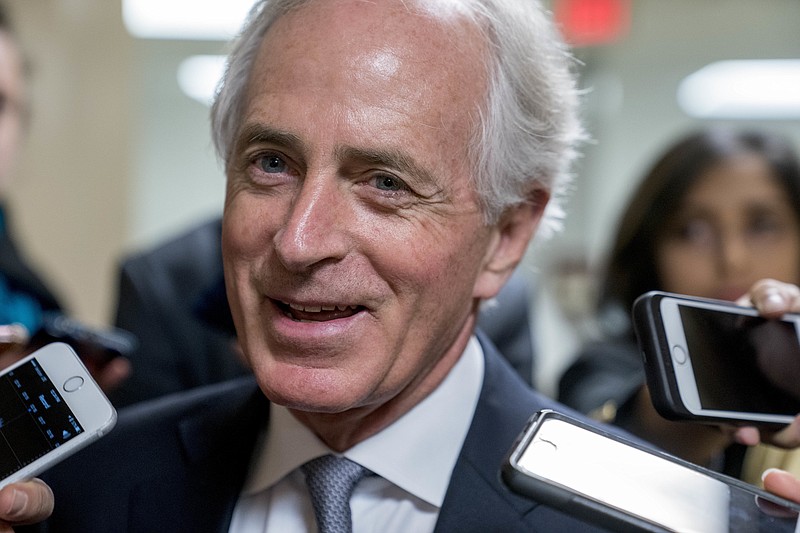

Bob Corker says he will leave the U.S. Senate next January in a similar financial standing as when he was first elected in 2006, and he insists he isn't likely to immediately benefit much, if at all, by the federal tax overhaul he voted for last month that could benefit real estate investors like himself.

"My net worth has gone up slightly, but it is relatively in the same range as when I came into the Senate," the Tennessee Republican said last week during a wide-ranging interview with Times Free Press reporters and editors.

Corker was denounced by his critics for switching his vote last month after initially voting against supporting the GOP tax overhaul package.

After an article appeared in the International Business Times saying he and a dozen colleagues would benefit, social media exploded with the hashtag "#Corkerkickback."

It was the latest blow in a tough year for the former Chattanooga mayor and current Senate Foreign Relations Committee chairman. The blunt-spoken Corker began 2017 at the top of his game only to run into an ongoing feud with President Donald Trump over his publicly critical remarks about the president.

Corker, who'd been wrestling with whether to seek a third Senate term this year, announced in September that he would not. During his first bid he said he couldn't see himself serving more than two terms.

The senator reiterated that he knew nothing in advance about what he calls the "very generous" allowances for pass-through income on real estate investments. The provisions were in the House bill but not in the original Senate-passed bill. But they were included by a House and Senate conference committee in the final bill.

Corker insisted his vote had nothing to do with any personal financial considerations.

"I have had no impact on any tax policy," he said - an assertion that was backed up by Senate Finance Chairman Orrin Hatch. "But I think in general, [taxing of] pass-throughs [has] been dealt with very generously, and my guess is we'll see a technical corrections measure that could change that."

After reviewing his recent tax returns and holdings, Corker and his accountant said last week the new law will reduce some of the property tax deductions he previously took on his two homes. That will largely offset the advantages of being able to pass through more income at a discounted tax value on his commercial real estate holdings, he said.

Corker said the changes are "negligible" for him, at least based upon his recent tax returns, and far less than the $174,000-a-year Senate salary that he donates each year to the Chattanooga Community Foundation.

The senator was sharply critical of International Business Times' article, noting the reporter who called laughed at him over his ignorance of the provision.

"It's the world we're living in," Corker said in a December interview amid the ensuing media firestorm. "I know absolutely beyond the shadow of a doubt that I've conducted myself beyond reproach. And this is the way it is here [in Washington]."

Calculations by the liberal-leaning Center for Economic and Policy Research using the top ranges of what Corker reported in Senate disclosure forms suggested that Corker could save nearly $1.2 million from the new tax law.

That's because of a provision allowing income from real estate investment trusts to be taxed at a 20 percent rate, similar to the new corporate rate, as opposed to the 37 percent tax rate paid by high-income individuals.

Calling estimates of the personal savings to him "malarkey," Corker noted he paid only about half that amount in total income taxes the previous year.

The Chattanooga millionaire, who Senate financial disclosures indicate has assets between $26 million and $119 million and liabilities between $1 million and $5 million, said his family's net worth has probably risen about 20 percent since he first decided to run for the Senate 12 years ago.

In the same period, the Dow Jones Industrial Average and many commercial real estate properties have more than doubled in value.

Most holdings liquidated before becoming senator

In January 2006, before launching his campaign for the U.S. Senate, Corker sold most of his commercial real estate holdings in Chattanooga he had acquired through the Stone Fort Land Co. and Osborne Enterprises. Chattanooga businessman Henry Luken bought most of Corker's commercial properties and assumed all of Corker's debt on the buildings.

The Campaign for Accountability, an ethics watchdog group in Washington, D.C, in 2016 asked federal regulators to investigate Corker's stock trades in 2009 and 2010 in the Chattanooga-based CBL Properties and raised other questions.

The group claimed Corker may have had a conflict of interest in his role as a member of the Senate Banking Committee in knowing about the direction of interest rates or Congressional oversight of bank lenders.

Corker has attributed the group's complaints to billionaire hedge fund investors furious over his effort to overhaul Fannie Mae, Freddie Mac and the U.S. mortgage-finance system.

The senator, meanwhile, said he has disclosed his investment activity and overall done relatively limited trading of stocks or other investments. Most of the trades cited in his disclosure reports, he said, were done while he was liquidating some investments before he became a U.S. senator in 2007 or were part of a managed account he didn't personally direct.

Corker did buy some CBL stock, including some for his daughters. But the value of that stock has declined in recent years.

To defuse what he says are misplaced criticisms about his financial dealings, Corker said he may release his personal tax returns.

Although he had a limited blind trust as Chattanooga mayor, Corker said he declined to put his holdings in a blind trust as senator "but perhaps I should have."

Corker said he wanted to maintain ownership of the Volunteer Building in Chattanooga and a few other properties, and he noted he has relied upon investment firms to handle most of his other financial holdings.

Toughest month in the Senate

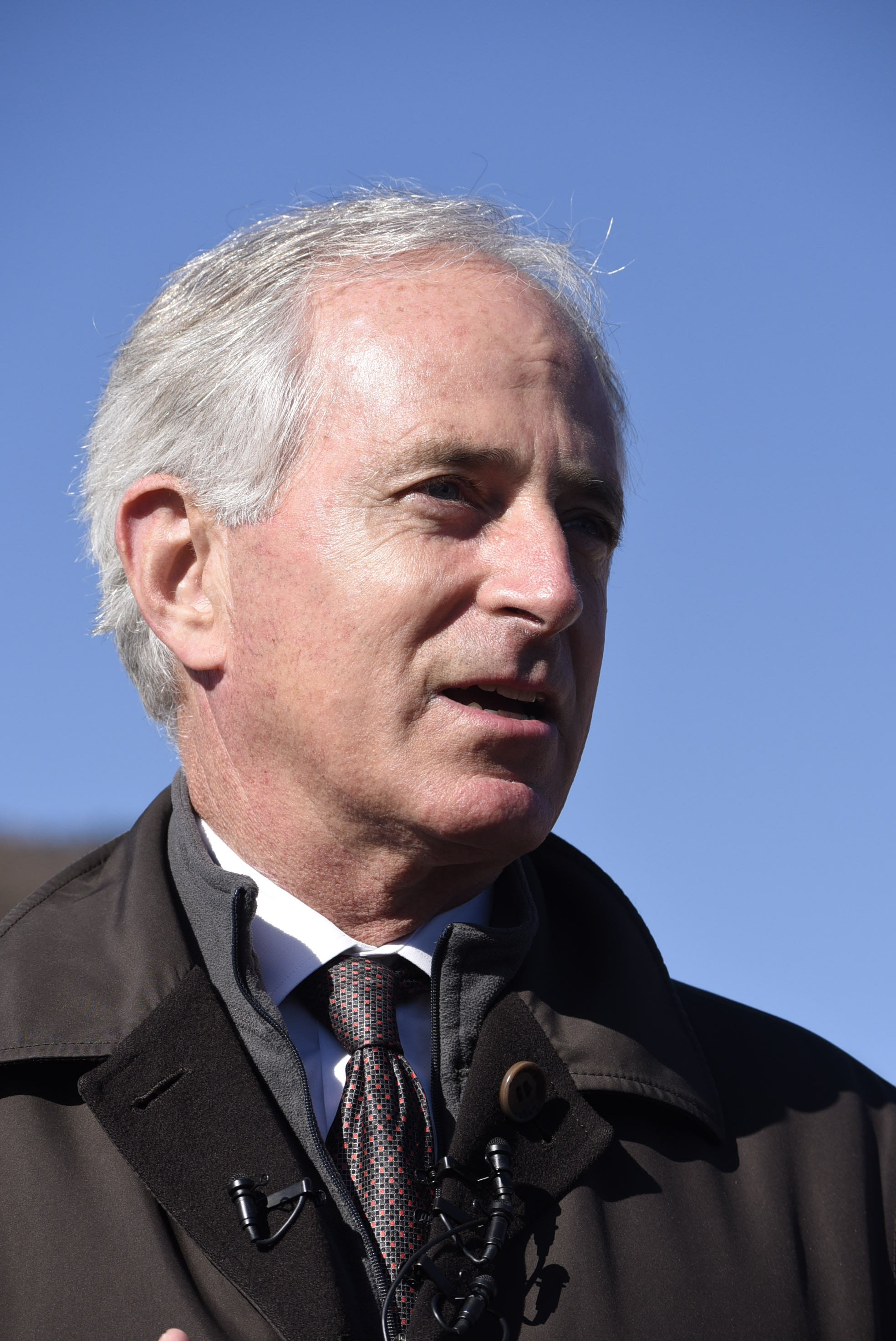

The 65-year-old former real estate developer said the attacks on him during the past month after his switch on the tax-cutting measure were the toughest he's experienced in his two terms in the Senate.

The senator said neither the summary of the conference committee report nor the private briefing he received on the tax bill before his decision made mention of the pass-through tax changes that benefit real estate investors.

Corker said he had hoped to get a bipartisan tax reform plan and initially balked at supporting the GOP Senate measure when he thought revising the plan might pick up some Senate Democrats and help limit the federal budget deficit.

"When we couldn't get a bipartisan agreement - and after I talked with many business leaders who think the tax plan will help the economy - I ultimately decided to support the tax cuts," he said. "As a nation today, I decided we were better off to have a tax system that doesn't encourage international companies to be headquartered outside the United States. It was a tough decision, but that is how I ended up supporting this measure."

The change in Corker's vote on the tax plan also drew fire from some who question the tax cuts' impact on future deficits.

Among them was Norm Ornstein, a political scientist and resident scholar at the conservative American Enterprise Institute in Washington, who was harshly critical of Corker's decision.

But in an interview last week, Ornstein dialed back on his critique of Corker, whom he has known for years.

"I continue to have an enormous amount of admiration for him," Ornstein said. "This shouldn't define him. He's had 11 years as a model senator."

Ornstein said Corker has demonstrated courage since entering the Senate and has been "a guy who defied his party leaders in his first term," developed relations across the aisle and become "a strong force in foreign policy."

He described the Chattanoogan as "conservative but not radical."

"I don't believe and can't believe that Corker did this to make money," Ornstein said. "I don't believe that in the end there was a Corker 'kickback.'"

Kent Syler, an assistant political professor at Middle Tennessee State University, agreed that Corker didn't vote for the tax cuts to personally save money.

"I know a lot of voters are cynical and it's a tough sell for him, but I do take him at his word that he didn't know the provision," he said.

Syler, who spoke in late December, noted, "I'm sure that Sen. Corker will be happy when 2017 is over."

"Full agenda" for final year in Senate

Corker said he still enjoys his job and has a "full agenda" for his final year in the Senate. He said he doesn't know what his plans are beyond his term that ends a year from now.

"I always said I would not serve more than two terms," he said. "But it was a very tough decision. I'm in a very prestigious place, and I'm able to make a call and often make a difference. But I felt this was the right thing to do."

Corker said he "has no idea what I am going to do next."

"It's been the greatest privilege in my life to serve in the U.S. Senate," he said. "But in the past few months, it's been tough on me."

Corker's popularity in Tennessee, as measured by voters surveyed last year by Middle Tennessee State University pollsters, fell last fall after Corker criticized President Trump for some of his comments and many of his tweets.

The feud began in August when Corker criticized Trump's remarks about who was at fault during Charlottesville, Va., protests over Confederate statues that ended in the death of a woman by a man who had voiced racist and pro-Nazi views.

Corker, whom Trump had considered as a running mate and later as secretary of state, said the president had "not yet been able to demonstrate the stability nor some of the competence that he needs to demonstrate in order to be successful."

Trump later mocked the senator as "Liddle" Bob Corker, said "he couldn't get elected dog catcher in Tennessee" and "dropped out of the race in Tennessee when I refused to endorse him."

There have been other exchanges between the two blunt-spoken politicians, with Corker calling Trump an "utterly untruthful president," describing the White House as "an adult day care center" and charging Trump's actions threatened to set the country "on the path to World War III."

Nearly half of the MTSU survey respondents, many of them Republicans, said they had an unfavorable view of Corker after he questioned Trump's leadership. Corker said he thinks those views are likely to change once Tennessee voters understand how he remains friendly with Trump and still talks to him and to top White House staffers.

"Those poll numbers are largely transactional and would flip on their head, I think, if people knew how I relate and work closely with this White House," Corker said, adding he still has "a warm relationship" with President Trump despite his criticism of some of his tweets and actions. "My guess is before I leave the Senate, those poll numbers will be very different."

In his final year, Corker said, he hopes to reform government-sponsored enterprises such as Fannie Mae and Freddie Mac to limit the government's cost and exposure in such programs and to help build more of a private lending market for mortgages. Such changes are drawing fire from some hedge fund operators who invested in Fannie Mae and Freddie Mac and could be hurt by reforms Corker and others are pushing.

Corker said he also is working to modify the Iranian nuclear agreement to ensure the Iranians do more before U.S. sanctions are lifted.

On another front, he said he is working to raise funds and fully implement the anti-slavery and human trafficking legislation he sponsored and helped pass last year.

Corker said he is one of the top supporters and friends in the U.S. Senate of current Secretary of State Rex Tillerson.

"I hope he will be there for a long time," Corker said.

Asked if he might be interested in the job if Tillerson leave the post, Corker said he didn't know what he might do.

"I'm going to take a deep breath when this is all over, and I just don't know," Corker said.

Contact Dave Flessner at dflessner@timesfreepress.com or 423-757-6340.

Contact Andy Sher at asher@timesfreepress.com or 615-255-0550. Follow on Twitter @AndySher1.