The 34-cent property tax increase included in Mayor Jim Coppinger's proposed 2020 budget drew a plethora of residents to speak to the Hamilton County Commission for the second week in a row.

At Wednesday's agenda planning meeting, 10 citizens spoke to the commission during public comments, pleading for or against the tax, which will be voted on in two weeks. The crowd, which consisted of educators, members of the clergy and property owners from the county, had varied responses, with seven in favor of the tax and three opposed.

Passionate pleas came from principals of three area schools, a former teacher, a pastor and concerned parents, including Suann West, the parent of a Soddy Elementary School student with autism.

"My son has flourished because of special education staff and through being integrated in a general education classroom," West said through tears, describing how the integration program at Soddy had helped her son communicate and even sign a Mother's Day card for her for the first time.

"Currently children with special needs are being bused long distances because their home school does not offer a trained special education staff. The budget increase will ensure that all special education students can attend a home zone school and their needs will be met through a trained special needs staff and integration in a general ed classroom."

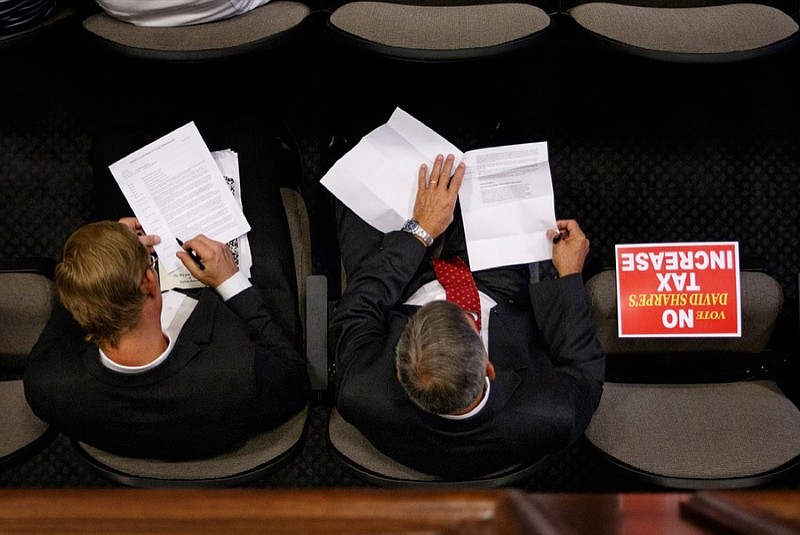

As fervently as some community members advocated for the tax, others opposed it, claiming government waste as a primary reason.

Elgin Gray, a property owner, has come to the commission two weeks in a row to implore the county to find other ways to fund schools.

"Let's look for other ways to save these tax dollars. I think the money is here for us to spend, but we have to find other ways to reallocate the money," Gray said, recommending buying used cars, repairing old equipment and other cost-saving ideas. "We need to look at reallocating the funds that are here, spreading the tax burden across the whole base, not just one segment, and I know that you'll have the money to do what you need to in the school system."

Since the budget rollout last week, developers, business leaders and 18 out of 23 community members at meetings have been in support of the tax, but the actual leaning of the commissioners is a closer call.

As of last Wednesday, the commission was in a deadlock with three commissioners in favor of the increase, three opposed and three unknown/undecided.

The school district's $443 million proposed general purpose budget reflects a $60 million increase over this year, or a 13.6% boost. The $60 million increase includes $34 million from the county that would be funded by the tax hike. The remainder of the $60 million increase comes from federal and state funding.

Though the proposed county budget is up 8.7% overall from this year's budget, Coppinger said it reflects about $13.5 million in cuts to prioritize public education as well as Hamilton County Sheriff Jim Hammond's $59 million budget to improve public safety.

The commission will vote on the budget for the first time on June 26 at 9:30 a.m. in the county commission chambers of the Hamilton County Courthouse.

Contact Sarah Grace Taylor at staylor@timesfreepress.com or 423-757-6416. Follow her on Twitter @sarahgtaylor.