"Erlanger is not for sale" remains the mantra after a private equity firm presented Hamilton County Mayor Jim Coppinger with a $475 million offer last week to buy Chattanooga's public hospital system.

Coppinger said representatives from Pennsylvania-based StoneBridge Healthcare, a new company aiming to buy distressed urban and suburban hospitals, scheduled an unsolicited meeting with him about three weeks ago to discuss the future of Erlanger Health System.

"They called and said they wanted to come in and talk about Erlanger hospital - that's not that unusual," Coppinger said.

The group spent about an hour discussing the company's intentions before adjourning without further communication, he said.

Former U.S. Sen. Bob Corker joined Coppinger, along with Coppinger's chief of staff, to offer insight and another set of eyes.

"I asked Sen. Corker to join us in that meeting after they called and got on the calendar, and I did a little research on what the company was and what they were doing," Coppinger said.

"Not only was he a United States senator, he was one time the mayor of the city of Chattanooga," Coppinger said. "He has a great deal of interest in Chattanooga and Hamilton County being successful. ... Erlanger is something that has always been of interest, I think, to anybody that is or has been a mayor, because you've been engaged in it."

Coppinger said the team told StoneBridge that an offer to buy Erlanger was something they'd never considered.

"But it's never been considered, because it's never been for sale," he said.

That's the last time the two sides communicated until last week, Coppinger said, when StoneBridge showed up for a second visit on Aug. 20 with a letter of intent.

"They just dropped that off at the office in a matter of a couple of minutes," Coppinger said, adding that he wouldn't call that exchange a meeting, because the two sides didn't discuss anything.

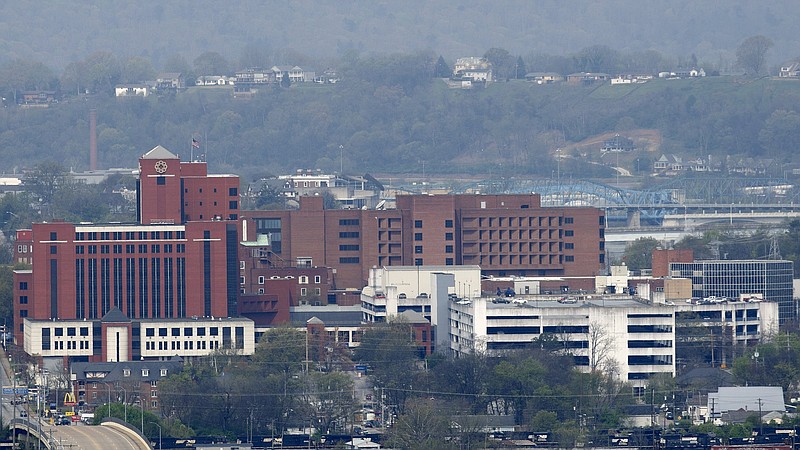

Coppinger said this is the first time he can remember anyone presenting a formal proposal to buy Erlanger - home to the region's only academic medical center, Level 1 trauma center and children's hospital.

But it's unlikely that StoneBridge's offer will be the last that Coppinger or Erlanger's leadership receives, said Paul Keckley, a health care policy analyst and managing editor of The Keckley Report, an industry publication.

Erlanger ended fiscal year 2019 with a $4.4 million loss, and although the hospital's 2020 financial report is not yet public, COVID-19 has dealt a devastating blow to the hospital industry - particularly safety net hospitals such as Erlanger that operate on thin margins and provide high levels of uncompensated medical care.

"This is increasingly common for hospitals that are safety net providers when their finances are in disarray," Keckley said. "Chattanooga is a great market. It would be a fabulous market for a very successful health system"

Keckley estimates that about 130 hospital acquisitions occur in the United States each year. However, most of the time it's a not-for-profit system acquiring another not-for-profit system.

"What's unusual about this one is this is a public health system, which is even more complicated," he said.

Keckley said the rationale for buying troubled hospitals is that the acquiring entity believes they can manage it better by reducing operating costs, finding new revenue sources and growing market share.

Most private equity deals involve making the acquisition, cutting costs, getting a management fee and then selling the hospital in about five to six years so that investors get all their money back plus some, he said.

Most operating costs in a hospital are labor, which accounts for about 60% of costs, followed by direct costs for supplies and technology.

"That means they look at jobs that don't need to be filled. They look at ways to staff that are more efficient. They look at all the contracts they have," Keckley said, adding that there are pros and cons to a deal like StoneBridge's. Generally, financial performance improves.

"But does glass get shattered along the way? Do commitments made by the board or management prior to the deal, do those go away, or do they get changed? And do certain clinical programs get shrunk or disappear? Yeah," he said.

The key is whether or not Erlanger can achieve these same objectives on its own while maintaining the support of the medical staff, he said.

"It's doable. This is the new reality - there's not a hospital in the country, public or private, that isn't having to deal with the same thing," Keckley said. "You can't make everybody happy. So it's gonna be sobering to the board."

StoneBridge CEO Josh Nemzoff offered the following statement regarding his company's effort to buy Erlanger.

"StoneBridge has been tracking the situation at Erlanger Health System for over a year and we believe, based on its financial position, we needed to act now and offer our assistance to Erlanger in order to safeguard this vital Hamilton County institution. For this reason, we reached out to Mayor Coppinger to request a meeting and he was gracious to accept," Nemzoff said. "As we move through this process, we are confident that Mayor Coppinger will continue to do what is in the best interests of the people of Hamilton County and those that rely on Erlanger."

StoneBridge's $475 million offer is comprised of a $200 million purchase price and capital expenditures of $275 million during the first five years following the closing of the transaction, according to a copy of the letter of intent.

Contact Elizabeth Fite at efite@timesfreepress.com or follow her on Twitter @ecfite.