Tennessee's biggest health insurer expects to refund some of the increased premiums it charged nearly 90,000 individual plan members last year because of new requirements of the health care reform law.

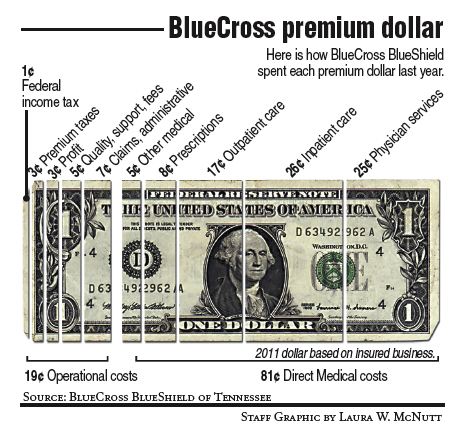

In annual filings with state regulators last month, BlueCross BlueShield of Tennessee estimates it may have to refund up to $13.5 million. That's because, under new federal standards, it didn't pay out enough of a record $5.1 billion in premium income to medical providers from its individual plans.

BlueCross is expected to mail refund checks in August for individual policyholders, although the actual eventual refund is expected to be less than $10 million.

Most of its 3.1 million members won't be getting the refunds, however, since BlueCross appears to have met the new medical pay-out requirement for small and large employer groups, spokeswoman Mary Danielson said.

Under health care reform, insurers must pay at least 80 percent of premiums to medical providers for individual and small group plans. The figure is 85 percent for providers to large employer groups. Any shortfall must be refunded to customers by Aug. 1.

Many of the nation's major health insurers are expected to make similar refunds late this summer, although the final calculations are not due until June 1.

Had such rules been in place a year ago, an industry study by The Commonwealth Fund estimates that consumers nationwide would have received about $2 billion in rebates.

More Green for Blues

In whatever amount, the refund will hardly scratch the insurer's fiscal health: Tennessee BlueCross last year boosted its net income nearly 47 percent to $175.7 million, its second-highest ever.

At the end of 2011, BlueCross' surplus grew to $1.7 billion and reserves topped $1.3 billion, or $309 million above what the state requires.

Beth Uselton is executive director for the Tennessee Health Care Campaign, which supports President Barack Obama's health care reform plan.

BLUECROSS' FISCAL HEALTH• 3.1 million: BlueCross members in 2011, up 2.1 percent from 2010• $9.7 billion: Claims paid in 2011 for insured and self-insured members• $175.7 million: Net income for 2011, up from $119.6 million the previous year• $288.3 million: Federal, state and local taxes paid last year• $1.7 billion: Surplus at the end of 2011• $1.3 billion: Statutory reserves at the end of 2011, $309 million above state requirementsSource: BlueCross BlueShield of Tennessee

Uselton said those who buy insurance want their money used primarily for medical care, "not marketing overhead, lobbying or multimillion-dollar CEO salaries."

"As their premiums keep rising, people have every right to be angry knowing where their money is going," she said. "Now, thanks to ObamaCare, they have some measure of protection that insurers have to spend their premium dollars on actual medical care or, as in this case with BlueCross BlueShield, owe them a rebate."

BlueCross officials insist the extra income helps ensure the business can better handle an uncertain health care future. They say its profit rate is below the industry average and only about half of what the company paid in taxes and community contributions.

"As a not-for-profit health plan, BlueCross BlueShield of Tennessee continues its near seven-decade performance of proven value," BlueCross Chairman Lamar Partridge said in the company's annual report for 2011.

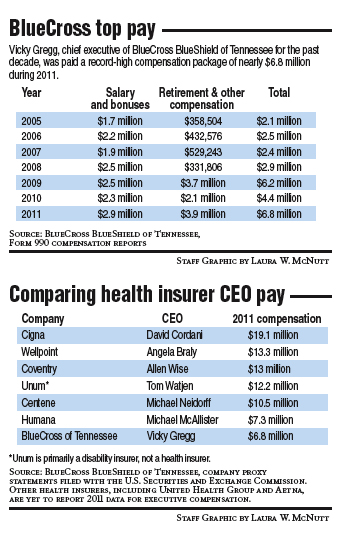

Partridge and BlueCross' 12-member board awarded chief executive Vicky Gregg a record compensation package of nearly $6.8 million in 2011. Gregg, who had been paid more than $25 million in the past five years to head Chattanooga's biggest private employer, will retire at the end of the year and be succeeded by Bill Gracey.

Gregg's pay was still below that of most CEOs at America's biggest health insurance companies. Cigna CEO David Cordani took home $19.1 million last year.

Premium Hikes

BlueCross raised premiums for employer groups an average of 7.3 percent last year, which spokesman Roy Vaughn said reflected the rising costs of providing medical care in Tennessee.

"Not unlike when the price of steel goes up for an automaker and they have to charge more, when the unit price of medical care goes up, we have to increase our rates," he said.

Russ Blakely, an independent insurance agent who sells health plans to a variety of Chattanooga-area businesses, said employers continue to look for ways to control their rising health care costs.

"Most employers are making whatever changes are necessary to keep the end result of any increase under 10 percent," he said.

"The new rules under ObamaCare are adding a lot of paperwork and regulations, but they are also making carriers very aware of every dollar they spend because they know they need to keep their administrative expenses within the allowable limits."