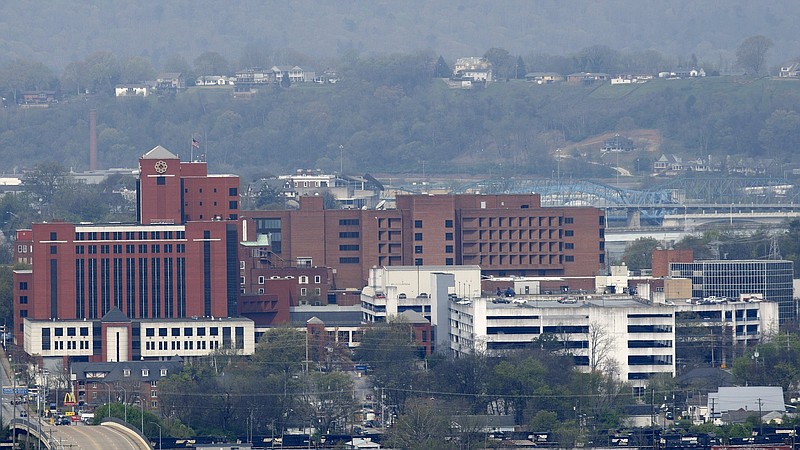

Hamilton County Mayor Jim Coppinger says Erlanger Health System is not for sale, but the question is should it be?

StoneBridge Healthcare believes the answer is yes, so the Pennsylvania-based company made an unsolicited offer for the county's only Level 1 trauma center last week, which, like many hospitals in the coronavirus pandemic, has struggled with its bottom line.

The offer of $475 million was seen as a "lowball" offer by some local officials, but the managing director of a consulting firm familiar with Erlanger says he believes the potential buyer is considering the hospital system's current value, based on its "poor-to-mediocre profit performance."

It's the ideal buy-low, sell-high desire of many big businesses.

But that's not what StoneBridge says it plans to do with Erlanger.

READ MORE: Erlanger's financial situation attracted unsolicited purchase offer

"It's been in trouble for a while," Joshua Nemzoff, the chief executive officer for the private equity firm, told the Times Free Press last week, "and somebody needs to help fix this hospital, and we think we can do it. We have the talent to do it, we have the financial strength to do it, and that's why they should think of selling the hospital."

StoneBridge is led by a group of longtime health care executives and backed by Medical Properties Trust, a $20 billion real estate investment trust that owns nearly 400 acute care hospitals, and a global investment manager called Oaktree Capital with $120 billion in assets under management, a news release states.

Meanwhile, Erlanger in fiscal 2019 had a $4.4 million operating loss. It provided about $135 in uncompensated medical care by treating large numbers of uninsured and underinsured patients.

The question county leaders and hospital trustees must ask themselves, if the hospital were to be sold to StoneBridge or any other company, would be whether that company would continue to provide care to patients who need treatment but can't always afford to pay for it, how it will treat those who work at one of the county's leading employers and what its commitment is to the hospitals and clinics Erlanger currently owns.

Uncompensated care and for-profit hospitals don't necessarily go together, although there is nothing wrong with not-for-profit hospitals. But the purchase of Erlanger by a private equity firm necessarily means that firm at some point must answer to its investors.

The proposed purchase agreement says the "Buyer would adopt reasonable indigent care policies for the Hospitals," that it would treat any patient "who has a medical emergency or who, in the judgment of a staff physician, has an immediate emergency need."

However, whether a "reasonable" policy on indigents and the definition of "medical emergency" are the same Erlanger currently uses cannot be known.

Similarly, the agreement's vague language involving employees and hospitals - Erlanger has hospitals in Bledsoe County and Western North Carolina as well as in Chattanooga - could give one pause.

On employees, the agreement states the "Buyer would commit to hire substantially all" of the hospital's employees, and they would be hired at compensation levels "reasonably consistent" with those provided by the seller. "Substantially all" and "reasonably consistent," though, could mean different things to different people.

On hospitals, the agreement states that "[f]or a period of at least five (5) years following the closing, Buyer will continue to operate the Hospitals as general acute care hospitals subject to (i) the availability of qualified physicians, (ii) community needs, and (iii) economic feasibility." In other words, if the buyer determines community needs and the hospitals' economic feasibility no longer fit their bottom line, the hospitals could be closed.

READ MORE: Private company offers $475 million to buy Erlanger from Hamilton County

Hospital acquisitions in the United States are not uncommon - statistics suggest there are about 130 in any given year - but they usually involve a not-for-profit hospital buying another not-for-profit hospital. Public hospitals are more rarely in the mix.

We're under no illusions that public hospitals like Erlanger can't improve on their operating costs or rethink their strategies or find ways to improve their bottom line, but we would worry that an investors-first policy - later if not sooner - would begin to dilute Erlanger's mission.

We can't say that for sure about StoneBridge because it's only just made an offer.

But we note that the company hasn't been dissuaded from its interest in Erlanger even after the county mayor, the Erlanger board chairperson and the leader of the Hamilton County delegation in the Tennessee legislature said "no" to a sale.

Perhaps, StoneBridge believes "no" eventually might mean "maybe."