ATLANTA (AP) - Georgia lawmakers may remember the 2020 session as the year the good times ended.

The state has seen nine years of strong revenue growth coming out of the great recession, with tax receipts climbing an average of nearly 6% each year. That has allowed lawmakers to cut taxes, increase teacher pay and education funding, and sock away more than $3 billion into the state's savings account.

But tax receipts were down $33.6 million through November compared to the same five months of the 2019 budget year. That might not sound catastrophic for a government that is supposed to spend $53 billion this year once federal aid is factored in. But this year's budget projected that state revenue would increase by $800 million to $27.5 billion. The shortfall led Gov. Brian Kemp to order mid-year budget cuts of 4% for some agencies, and order them to prepare another 2% in cuts for the 2021 budget beginning July 1.

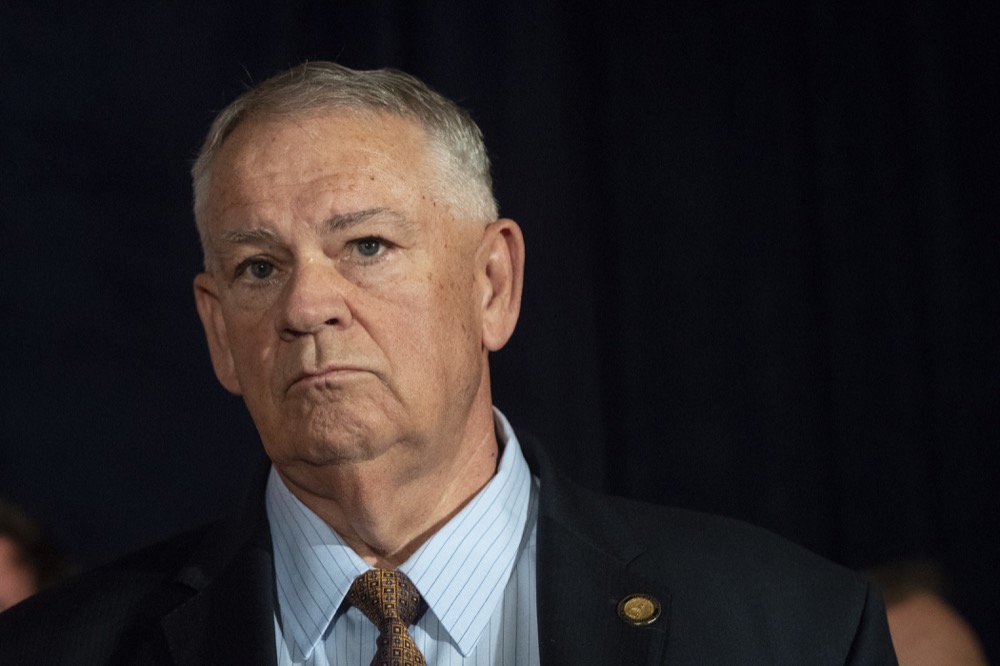

"People who haven't been around a budget-cutting session are going to be in for a real surprise," said House Speaker David Ralston, a Blue Ridge Republican.

Worse, with elections looming in November for all 236 seats in the General Assembly, lawmakers may not be able to honor some expensive promises as they convene Monday.

"It's an issue that's going to consume the entire session," said House Minority Leader Bob Trammell, a Luthersville Democrat.

First up is a proposal for a second cut in Georgia's top income tax rate. A cut from 6% to 5.75% began in 2019, and another cut to 5.5% was foreseen for this year.

Then there's the teacher pay raise. The Republican Kemp muscled through a $3,000 pay raise for teachers last year, and promises another $2,000.

Kemp says he won't seek money now to partly expand Medicaid health insurance coverage and subsidize some current high-cost patients. Despite budget cuts, Kemp has so far shielded most K-12, college and health spending, and has sought to prevent state employee layoffs.

Ralston is putting his chips on the tax cut, which could cost $550 million.

"I view the income tax cut we did as a commitment we made to the taxpayers of Georgia," Ralston told reporters Thursday. "I'm hopeful we can do that. There's a lot of support to do that."

But the Senate's top budget writer, Senate Appropriations Committee Chairman Jack Hill, questions whether it's possible.

"That is hard to imagine given the tenuous revenue picture now being painted in the state," the Reidsville Republican wrote last week. "This vote and the reduction could be delayed until state revenues improve."

The tax cut could be a key electoral consideration. Democrats will fight it; a failure to deliver could demoralize GOP voters.

"It's pretty much been promised, so pushing back from that is going to be a disappointing move and legislators may come to regret it," said Benita Dodd of the conservative Georgia Public Policy Foundation.

Kemp in recent weeks has reiterated his "commitment" to the remaining $2,000 in teacher pay raises, but has been coy about what he will seek this year. The full amount could cost a cumulative $325 million.

Ralston downplayed the pay raise, saying "That was not my campaign promise, even though it's a laudable goal."

Hill, though, said the pay raise might be possible. Some observers have said a $1,000 raise, not $2,000, might be a compromise.

Lawmakers could also consider limiting existing tax breaks or increasing taxes. A critical audit has focused attention on $900 million Georgia gives to movie and TV production. Ralston, for one, wants to keep the tax credit but said he's open to "tweaks."

Although unlikely in the Republican-led General Assembly, some are pushing an increase in Georgia's relatively low tobacco tax rate. Gambling expansion will be debated, but is unlikely to boost the 2021 budget.

That leaves cuts. Thus far, Kemp has pushed an across-the-board approach, exempting some large funding areas. Lawmakers could want more case-by-case scrutiny. Trammell, for example, said Democrats would seek to make sure budget cuts "are not disproportionately borne by those who can least afford it."