PATTEN FAMILY'S FOUNDING FATHERSZeboim came to Chattanooga shortly after the Civil War and bought a stationery store with Thomas Henry Payne. The pair bought The Chattanooga Times newspaper in an 1875 bankruptcy sale. Though they sold the paper six months later, Zeboim kept the proceeds to trade for a 540-acre farm in Chattooga County, Ga., which he later traded for one-third controlling interest in a "liver regulator" later called "Black Draught."With that laxative and a drug dubbed "Wine of Cardui" used for "female ailments," Zeboim founded Chattanooga Medicine Co. in 1879. It is now known as Chattem.Zeboim later opened the Volunteer State Life Insurance Co. and built the Patten Hotel, now known as Patten Towers. The family also was involved with the Coca-Cola Bottling Co. work here.

When the scion of one of Chattanooga's most distinguished families admitted last week that he drained the accounts and mortgaged the home of his dementia-addled sister, the event underscored a grave truth - most exploitation of the elderly and disabled occurs at the hands of those closest to them.

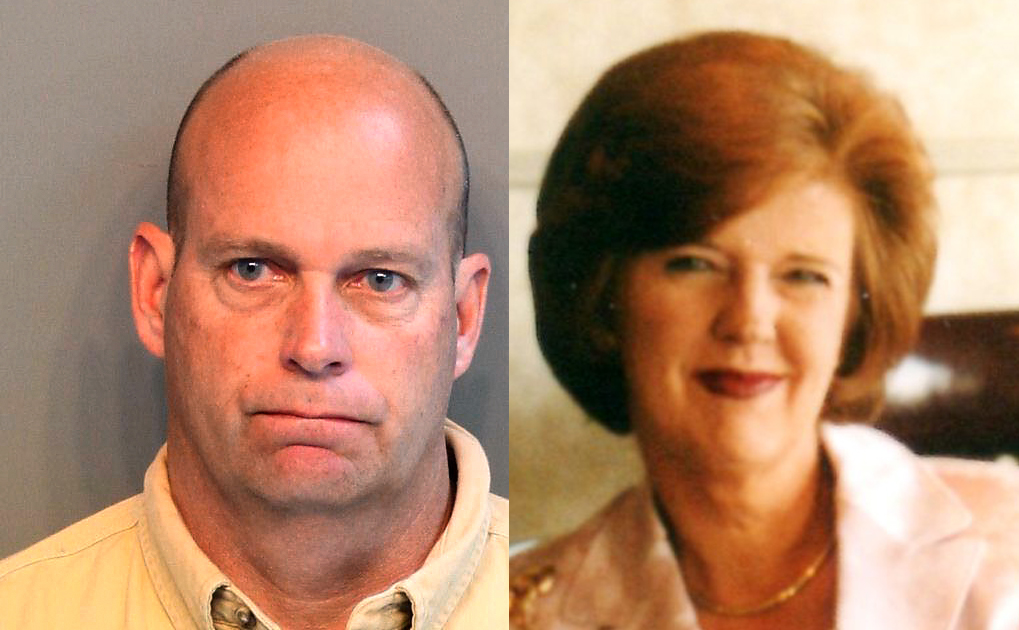

On Tuesday, George "Zeb" Patten Jr., 48, pleaded guilty to three counts of theft over $10,000 in Hamilton County Criminal Court. Judge Rebecca Stern ordered him to pay $100,000 restitution over the next six years to his sister's estate while he serves probation.

His sister, Terry Alice Patten, died last year from complications of early-onset dementia.

The siblings are descendants of the Patten family, which included brothers Zeboim Cartter Patten and George Washington Patten. The family has connections to Chattem, Patten Towers, Coca-Cola Bottling and other historical backbone businesses of the region.

Research nationally and in Tennessee shows that elders and the disabled are increasingly victims of financial exploitation and that much of the time it is family or close friends committing the abuse.

A 2009 study by the National Center on Elder Abuse showed 90 percent of overall elder abuse - physical, sexual, financial - was committed by family members.

Financial exploitation specifically was done by family 34 percent of the time.

The same group analyzed reported incidents of elder abuse for a three-month period in 2010 and estimated $2.9 billion was taken from the elderly, a 12 percent increase from 2008.

•••

Bill Tobin has worked in elder-related fields since the 1990s. He has headed the SARAH project for The Partnership for Families, Children and Adults here over the past three years.

The grant that allowed his project to educate law enforcement and the public about elder abuse was specific to a younger set of victims than is traditionally covered - 50 to 59 years old.

Most government programs describe the elderly as those over age 65 because that is often when citizens begin receiving Social Security benefits or reach retirement age.

Terry Patten was 54 when she signed over control of her estate to her brother. But the effects of dementia had already emerged.

"Given the state of the economy, financial exploitation is definitely on the rise," Tobin said. The increased numbers of elderly in the population also means more targets for perpetrators.

There are now 40 million people aged 65 and older living in the United States, according to U.S census data. That number is expected to double by 2040.

Through the Partnership program, Tobin has formed a "financial abuse specialist team" of lawyers who look at cases involving elder abuse and finances. The project has also conducted training for police.

•••

George "Zeb" Patten Jr. and Terry are pictured smiling alongside their other siblings and flanking their father, Bome Patten, in a black-and-white photograph in the 1986 book "The Patten Chronicle."

On the opposite page is a photograph of Terry's son Bo, a toddler at the time.

The book documents the detailed family tree and its branches from the brothers Patten and their descendants through the generations.

In repeated passages, marriages between the Pattens and other local families and the children born from those unions led to the formation of successful local businesses.

Terry turned to her brother in 2007 as the effects of her dementia worsened, and she signed a power of attorney to him to control her finances.

Within months, according to court documents, Zeb had begun withdrawing tens of thousands of dollars from her retirement accounts. He later sold her Jaguar car and took out a $238,000 line of credit on her paid-for home.

In total, Terry Patten's estate claims Zeb Patten took $650,000.

He is scheduled for a Nov. 5 trial in his nearly $2 million bankruptcy. The trial is over allegations by the trustee that he has lied in depositions about how he spent and used money both from his 2004 inheritance of $2 million and his later control of his sister's estate.

In court records, Zeb Patten says money he took from his sister's accounts was repayment for money he loaned her in previous years. He first claimed he loaned her $200,000-$250,000 but later changed that to $400,000.

As much as $800,000 of his small fortune was used to purchase the Minnekahda House, a home built by his ancestors in the Riverview area. That home was sold in the bankruptcy for $600,000.

It was Bo Patten, Terry's only son, who was at the hearing last week to see his uncle admit to stealing from his mother.

Afterward, Bo said, friends and relatives called, texted and messaged words of support. He knew his mother had signed a power of attorney and trusted it was the right decision. At the time he was 25 and working on starting a career in politics.

It wasn't until two years later, when the banks started calling with foreclosure notices and medical bills were not being paid, that he found out what was happening with his mother's money.

Shortly afterward a court-appointed conservator took over the estate.

•••

The Tennessee conservator system recently was changed. Rewritten laws went into effect this month that normalize how often conservators report to the court. That is a move to help judges stay informed on conservator cases, said Tennessee Bar Association Executive Director Allan Ramsaur.

The TBA held a series of public hearings across the state this year. They heard a lot of horror stories of people being taken advantage of and the courts not knowing.

The Legislature passed the new law mandating regular reporting and annual competency evaluations to ensure that the person under a conservatorship still needs to be, Ramsaur said.

Though the law change means that the conservatorship rules will be applied evenly across the state, there is a dearth of resources to investigate elder abuse claims, Ramsaur said.

The Tennessee Bureau of Investigation's Medicaid Fraud Division is the statewide agency that sometimes encounters such cases. But only if those cases touch Medicaid.

Norman Tidwell, head of the division, said what he often sees is that people's finances have been drained and they are destitute, forcing them into Medicaid.

He does get calls from siblings or relatives worried about what a family member might be doing with an elderly relative's money.

"We get a lot of calls like that," he said. "Those are private-pay matters; we really can't do anything."

After suffering through his mother's decline, the depletion of her estate and his uncle's betrayal, Bo Patten said one valuable lesson was having a court-appointed conservator handle the estate.

As the bankruptcy of his uncle continues and the restitution payments begin in February, some of the money may return.

But trust is gone.

Bo Patten said he's moved on from the situation but has no desire to reconcile with his uncle.

"I don't look at this as a win-or-lose situation," Bo Patten said. "My mother was a victim."