BY THE NUMBERSStudents receiving Pell grants last year in the tri-state area:• Tennessee: 155,576• Alabama: 150,284• Georgia: 275,455Source: Education Trust

Half a million students across the country and thousands in Tennessee and Georgia could lose their federal Pell grants for college if a proposal in Congress passes during the next few weeks of Washington budget talks.

Many more students in Tennessee and Georgia and beyond could see their awards trimmed, officials said.

Brenda Anderson, a 19-year-old sophomore at UTC, said she doesn't know how she will continue school if she loses some of her Pell grant.

Already, the grant doesn't cover the cost of tuition. She has taken out loans and relied on scholarships to bridge the $2,000 gap each year, along with her living costs.

"My dad recently lost his job," she said. "I have been working since I was 16 to support myself. I am blessed to be in school ... This is do or die. You have to make something of yourself."

With Pell facing a $1.3 billion shortfall and many government programs on the chopping block because of the federal deficit, some lawmakers say they want to protect the country's largest financial aid program for college students, but something has to go.

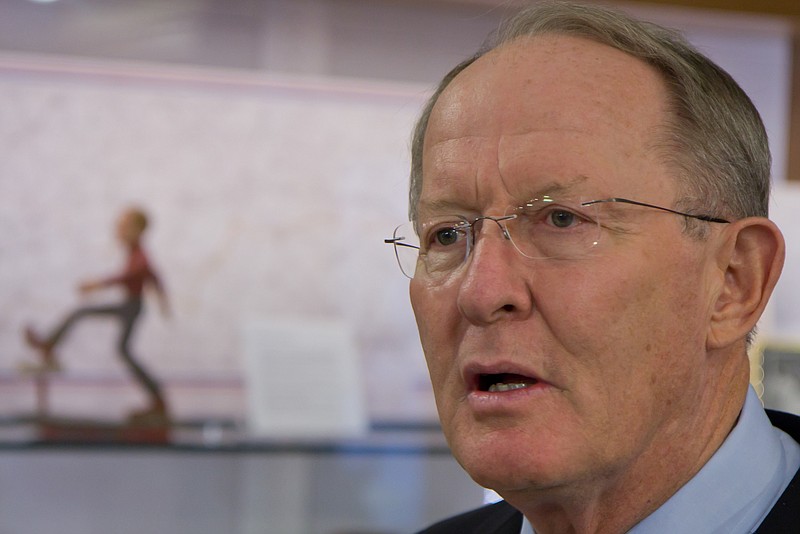

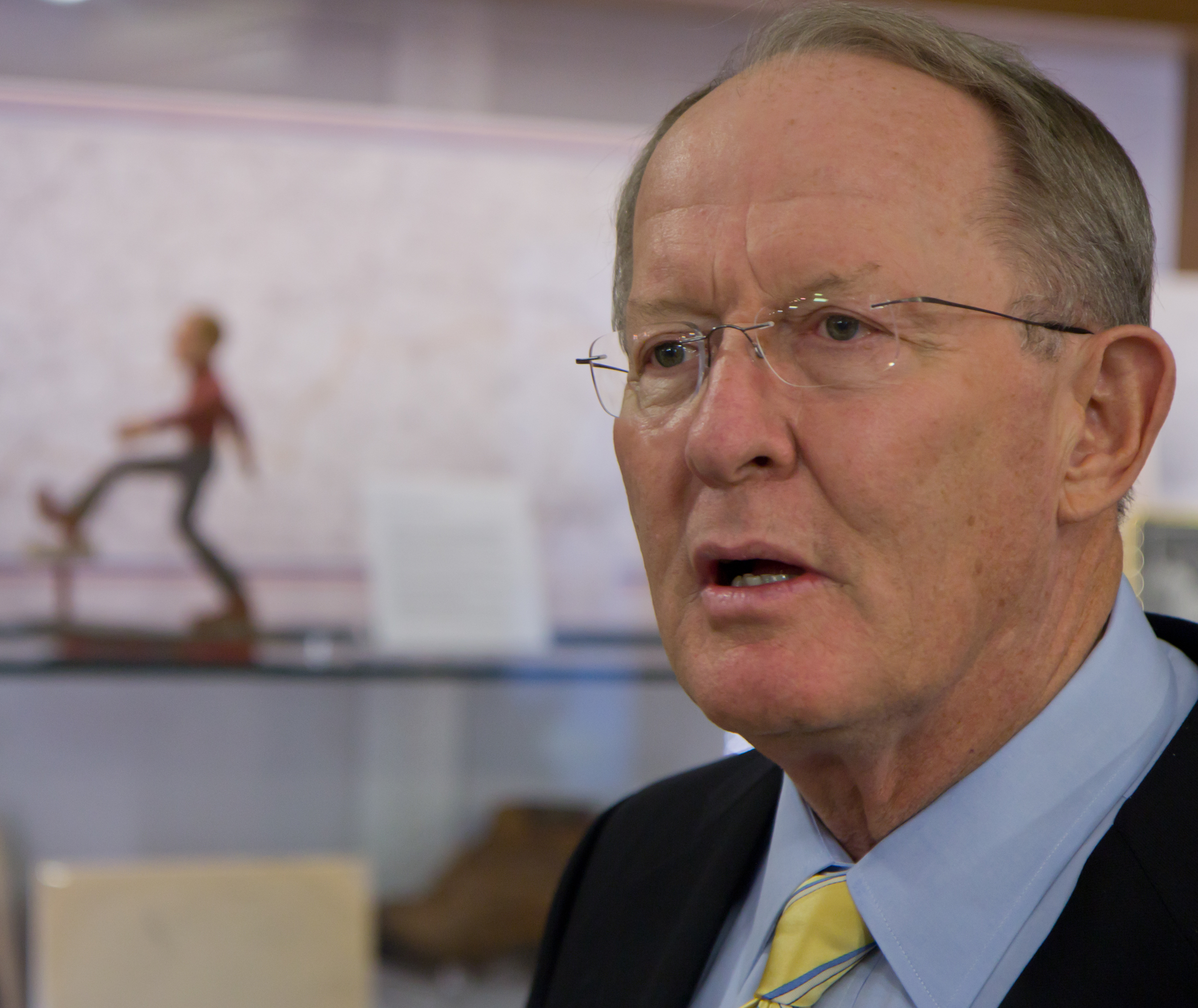

"Especially in tight budget times, we have to set priorities, and Pell grants to help low-income students pay for college are a priority for me," said U.S. Sen. Lamar Alexander, R-Tenn. "But the growth of Pell grants by 76 percent over the last decade obviously can't continue at a time when Washington is borrowing 40 cents of every dollar it spends."

Republican Rep. Chuck Fleischmann and Republican U.S. Sen. Bob Corker wouldn't comment about the ideas being discussed. They said they will make up their minds about how much to protect the Pell program when they see all the cuts and spending included in the budget.

Local college officials and national education activists are calling for the House leadership to take Pell cuts off the table, saying more families have less money to put toward college and that increased debt will burden a post-recession generation that is likely to have poorer job prospects.

"Students with a lower income would be the most affected by this," said Jeanne Hinchee, director of financial aid at Chattanooga State Community College. "It will hinder their ability to attain a degree at a time when we are trying to push more people to get a degree."

Almost half of Chattanooga State students -- around 5,589 -- qualify for Pell grants and receive an average grant of $5,000 for an academic year, but Hinchee said she isn't sure how much aid at Chattanooga State could be at risk if a cut is approved as part of a larger budget bill.

At the University of Tennessee at Chattanooga, the number of students receiving Pell grants has increased 64 percent since 2007 to include 3,476 students, while enrollment has increased only 20 percent, records show.

The amount paid to UTC students in Pell grants rose 120 percent since 2007, records show.

"This is the perfect storm," said Dianne Cox, director of financial aid at UTC. "We know reality is that probably there are going to be cuts somewhere. I would be on the 'save Pell grant' bandwagon. We don't have a lot of state aid we can offer them."

One of the proposals out of the House Appropriations Committee calls for stiffening financial qualification guidelines, making fewer people qualify and cutting $44 billion in Pell funds over 10 years, according to the Institute for College Access and Success.

Right now, students can earn up to $6,000 while in school and still receive federal grants. Under the new spending bill, that would be scaled back to a $3,000 cap on student earnings, said Kate Tromble, director of legislative affairs at the Education Trust, a D.C.-based think tank.

Families with earned income tax credits or untaxed Social Security or disability benefits also could have to start counting that income, which could knock them out of Pell eligibility. The length of time students could receive Pell would shrink from nine to six years and that change would be retroactive, said Tromble.

"If you are in school today and have a semester left, you are done. You don't get any more aid," she said.

Many of the rollbacks proposed for Pell actually were approved as expansions in the last five years. Later, in 2010, when Congress ended the Federal Family Education Loan Program, lawmakers also passed a measure that would raise the maximum award from $5,550 to $5,975 by 2017 and increase the number of grants by 820,000 by 2020.

Throughout much of Pell grants' nearly 40-year history, all household income, including untaxed income, was considered when deciding eligibility. Many times poorer families who receive Social Security or disability benefits would make just a little too much to get a Pell grant.

"They weren't way over the top [in earnings]. They would be just on the edge," she said. "Some of those that were just on the bubble came into eligibility once [untaxed income wasn't counted toward earnings]."

But more families are in desperate financial situations today, too, said Cox. Many times this year, students have come in and pleaded for grants or increases in their grants because one of their parents had lost their job and their families' income had sunk.