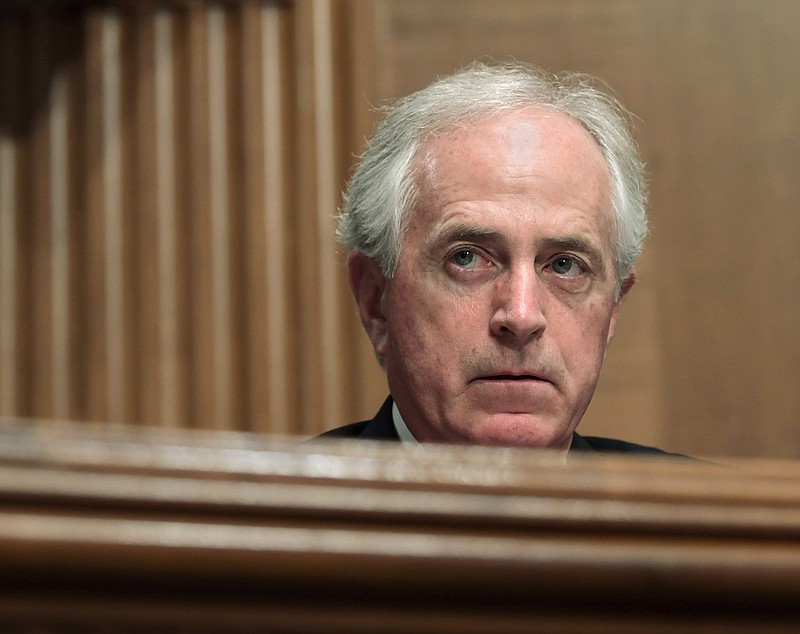

U.S. Sen. Bob Corker, R-Tenn., still has concerns the tax cuts adopted this week might add to the federal deficit and provide overly generous tax breaks for some investors, including real estate developers such as himself.

In media interviews Thursday, Corker said "some adjustments need to be made" to the sweeping tax reform plan to make it fairer and more fiscally responsible.

But the former Chattanooga mayor said he decided to switch his vote on the tax measure last week after talking with business and economic development leaders across Tennessee about the overall benefits of the tax changes.

Corker denounced social media reports of a "Corker kickback" being inserted in the GOP tax plan to help his own commercial real estate business. He said such reports "have been completely debunked" and he called the #Corkerkickback campaign "a travesty" that is an example of the "fake news" President Trump has denounced.

"It's been totally inappropriate," he said, claiming he had no hand in writing the joint tax bill. C0rker said he was unaware of provisions on how real estate earnings will be handled and how he could personally benefit from the change.

"I have had a healthy respect for the media and have not liked the tearing down of the media," Corker said during an interview on MSNBC's Morning Joe. "But I have to tell you I have a little bit of empathy now for what the White House has to deal with. This has been totally torn down as a fact and yet people I respect are still repeating it."

Corker's colleagues in the Senate, including Senate Finance Committee Chairman Orrin Hatch, said Corker had nothing to do with inserting a measure last week that extends the tax benefits for pass-through businesses to commercial real estate companies with few employees, like those owned by Corker.

"I had absolutely nothing to do with any clause whatsoever in this bill," Corker said.

The tax plan offers a special 20 percent deduction for business owners for so-called pass-through income in an attempt to encourage more hiring and expansions by such businesses. The deduction had originally been designed to exclude businesses like real estate partnerships, which often have few employees.

But last week, the joint bill changed to allow owners of real estate businesses. The Center for Economic Policy and Research estimates Corker could save as much as $1.2 million in taxes a year from the tax provision, based on his 2016 earnings. Records obtained by the International Business Times and MapLight also show Corker's top aide, Todd Womack, who owns about 20 rental properties in $2 million worth of real estate through Generation 4 Properties in Chattanooga, could benefit.

"It was in the House bill and has been in there since the first of November," Corker said. "This is something that Kevin Brady and others have been pushing for."

Corker on Sunday called the provision "totally unnecessary and borderline ridiculous" and repeated Thursday that some provisions in the tax reform plan are "overly generous" and should be reconsidered.

"My sense is that over time some adjustments are going to need to be made," he said.

Corker, who has made headlines this year for feuding with President Trump, was the only Republican to vote against the president's signature legislative effort when it initially passed the Senate earlier this month. At the time he said he would not support any tax reform plan that added even 1 cent to the federal deficit.

The Congressional Budget Office projects the tax changes will increase the deficit by $1.4 trillion over the next decade, although the Treasury Department argues that the tax cuts will pay for themselves by spurring more economic growth.

Corker said he "did everything I could" to limit the deficit impact of the tax reform plan when it was in the Senate. But he said he ultimately decided to vote for the measure because its economic benefits outweigh its problems.

"I lost on the Senate floor [in the initial tax vote] when I did everything I could to attempt to deal with what might have been its shortfalls," Corker said Thursday. "I had hoped that we still might have been able to do something in a bipartisan way, working with many people and talking with the White House."

But ultimately, Corker decided to support the final tax reform measure considering how it will benefit businesses and jobs in Tennessee.

"I talked to people at the Chattanooga Chamber, I talked to Knox Chamber, two of the Tri-Cities' chambers, the Nashville Chamber, the Memphis Chamber. I talked to the head of our ECD [Department of Economic and Community Development Commissioner] Bobby Rolf," Corker told the Times Free Press. "When you make a decision on these big, big votes, you've got to decide is the country better off with this or not? At the end of the day, to cause our companies to be competitive around the world, to keep companies from locating in other places, to continue to build on this dynamism that we have here in our nation, I felt like this was the right thing to do."

Although Corker said he expects the deficit to be less than the CBO estimate because of the economic benefits from the tax changes, "there is a great possibility of a $500 billion gap" between tax revenues and spending to add to the deficit.

Corker said his concerns over the deficit remain, "but we have a lot of momentum right now as it relates to economic growth" and with a more favorable trade and immigration policy, economic growth could be even greater.

Contact Dave Flessner at dflessner@timesfreepress.com or 423-757-6340.

Contact Andy Sher at asher@timesfreepress.com or 615-255-0550.