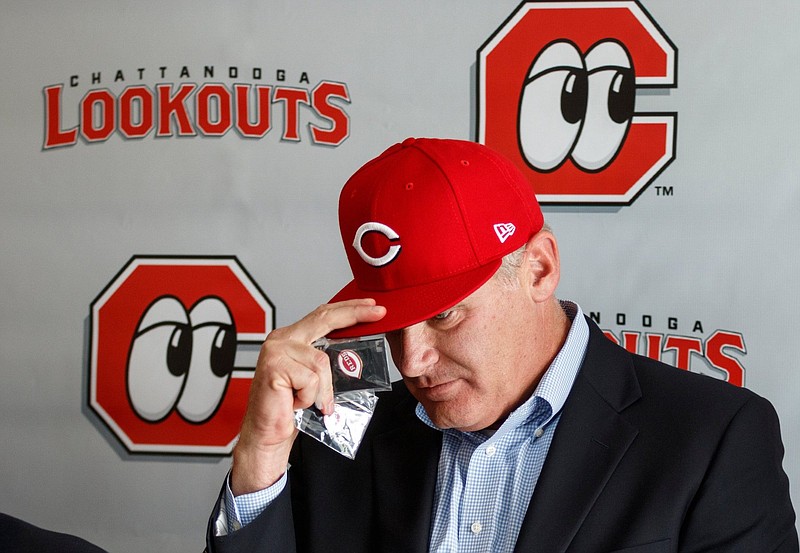

A Georgia man best known as an investor in the Chattanooga Lookouts is denying allegations by federal regulators of running a Ponzi scheme and bilking more than 400 investors, and he's asking for a jury trial in the case.

Answering a complaint filed in federal court in August, attorneys for John J. Woods denied the six counts of securities fraud leveled by the U.S. Securities and Exchange Commission. The allegations involve $110 million the agency claims he collected from investors with little prospect of paying them back.

Woods, an investor in the Lookouts and a number of other entities in Chattanooga, acted "in honest and reasonable reliance on the advice and experience of others, including legal professionals, as to matters within the area of their expertise and experience," his lawyers said.

But Woods' attorneys admit he didn't tell all investors in the Horizon Private Equity III fund that their money would or could be used to make payments to earlier investors for interest or return of principal.

Woods told certain investors that Horizon would pay a fixed rate of return and that they could get their principal back without penalty subject to a waiting period, said attorneys Stephen Councill and David Chaiken of Atlanta.

However, the Marietta, Georgia, man denied allegations that when soliciting investors, he told them the investments were "very safe," his attorneys said.

"Defendant denies that he has been running a Ponzi scheme - including a massive and ongoing Ponzi scheme," court papers said.

But the SEC said that many of the victims in the alleged scheme are elderly retirees who were preyed upon by investment advisers at Livingston Group Asset Management Co., doing business as Southport Capital.

The SEC said Chattanooga-based Southport is a registered investment adviser firm owned and controlled by Woods. The regulators' complaint also named Southport in the alleged scheme, although its attorney denies it's a part of it.

"Woods and his cohorts at Southport generally told investors that Horizon would earn a return by investing their money in, for example, government bonds, stocks or small real estate projects," the SEC said in August.

The SEC said investors were not told their money would or could be used to pay returns to earlier investors, but that's what the defendants did, the SEC alleges.

The agency said "they were only able to pay the guaranteed returns to existing investors by raising and using new investor money. Horizon has not earned any significant profits from legitimate investments; instead a very large percentage of purported 'returns' to earlier investors were simply paid out of new investor money."

The investors trusted Woods and the Southport investment advisers working at his direction, "and they stand to lose significant portions of their retirement savings when the Ponzi scheme inevitably collapses," the SEC said in its complaint. "The longer the scheme continues, the larger the losses will be for those left holding the bag."

The receiver in the alleged scheme has said she plans to deal with liquidating assets in the case, including more than $55 million in Chattanooga area entities, as soon as possible.

Woods, who grew up in East Ridge, heavily invested in entities ranging from the Lookouts minor league baseball team to real estate ventures involving strip centers and the former Sears and J.C. Penney stores at Northgate Mall.

U.S. District Court Judge Steven J. Grimberg in Atlanta recently approved a Lookouts request to buy the share of the team owned by Woods for $1.87 million. Woods owned a 20.1% interest in the team, court papers showed.

Contact Mike Pare at mpare@timesfreepress.com or 423-757-6318. Follow him on Twitter @MikePareTFP.