CORRECTION: This story was updated at 12:47 p.m. on Nov. 8 to correct the name of the Tennessee Justice Center.

–––––

Most Chattanoogans who don’t have health insurance through their employer, Medicare or TennCare will be paying higher premiums next year to buy individual insurance plans through the health exchange marketplace.

But as sign-ups for 2023 coverage begin this week, consumers will have more options and are more likely to qualify for government assistance with their health plans.

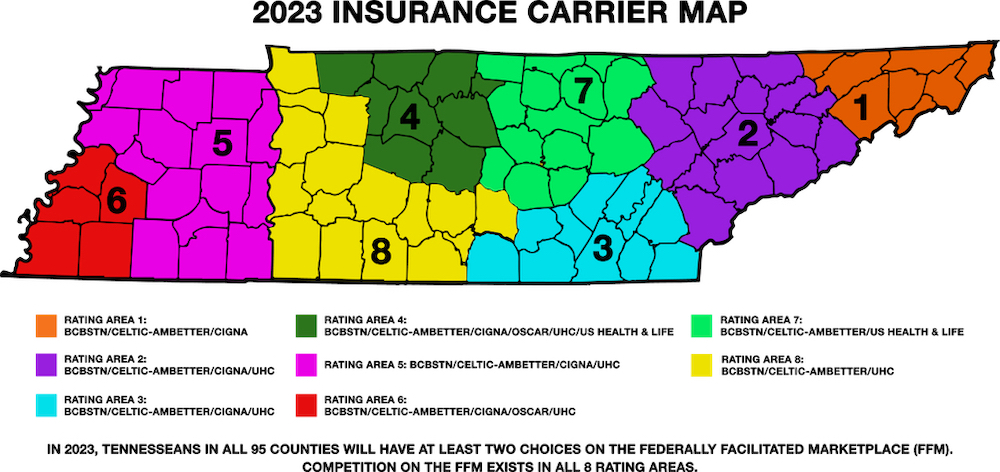

The Tennessee Department of Commerce and Insurance has approved six insurers for individual policies offered through the Affordable Care Act health exchange for 2023, including four in Chattanooga. Bright Health is exiting the individual and family market in Tennessee at the end of the year, while Ascension Personalized Care/US Health and Life has joined the Tennessee exchange for 2023.

On average, insurers were granted rate increases averaging 8.5% for next year, which is nearly double the average 4.4% approved by state regulators for plans in 2022.

Most consumers should be able to offset some or all of the increase by shopping around for other plans or taking advantage of some extra government aid, however.

During the pandemic, subsidies for plans offered through the Affordable Care Act were expanded, and Congress locked in the improved subsidies through 2025 under the Inflation Reduction Act. The Centers for Medicare and Medicaid Services estimates four out of five customers on Healthcare.gov will be able to find a plan for $10 a month or less after subsidies.

The new “family glitch” change will allow more people to be eligible for subsidies who were not eligible in the past. In the past, many Americans were forced to buy more expensive family or individual plans without any subsidies because their spouse had health insurance through work even if they couldn’t afford to add a spouse or children to the plan. The Urban Institute estimates that by extending subsidies to those unable to afford or get access to their spouse’s coverage at work could aid up to 125,000 Tennesseans, or 2.2% of the nonelderly population.

“This is a change that should help a lot of people,” Bobby Huffaker, founder of the Chattanooga-based American Exchange, said in a telephone interview. “Rates are going up, but in most instances, government subsidies should keep plans relatively affordable.”

American Exchange helps consumers sign up for individual health plans in 47 states. For the 2023 open enrollment period, American Exchange has hired 17 additional workers to help consumers navigate Affordable Care Act and Medicare open enrollments, which began Tuesday for next year’s coverage.

“In 2023, the advanced tax credits that reduce client premiums are higher due to the extension of the COVID emergency level subsidies, which were extended through 2025, so plans are very affordable in the greater Chattanooga area,” Andrew Hetzler, CEO of American Exchange, said in an email.

Consumers will have at least two insurance choices for individual health care plans through the exchange program in all 95 Tennessee counties. One insurance carrier has also expanded its coverage area for 2023.

According to research by the Kaiser Family Foundation, 14.5 million Americans, including 273,680 in Tennessee and 701,135 in Georgia, have enrolled in one of the marketplace exchange programs offered under the Affordable Care Act, also known as Obamacare, during the past five years.

Despite Republican calls in the past to repeal Obamacare, Michele Johnson of the Tennessee Justice Center said political opposition to the federal program has weakened over time.

“Obamacare is here to stay because people see how it has helped so many people get needed health care coverage at an affordable rate,” she said in a phone interview.

Johnson said she is disappointed Tennessee didn’t expand its TennCare program to include more Tennesseans as other states have done with expanded Medicaid programs.

In 2021, the number of Americans covered by health insurance from their employer totaled about 156 million, or 49% of the country’s population. The average annual premium for employer-sponsored health insurance is around $7,739 for an individual and $22,221 for a family, according to the Kaiser Family Foundation.

Although the Affordable Care Act requires employers with more than 50 workers to provide health insurance for their employees or pay a penalty to the IRS, nearly a third of full-time workers in Tennessee are still not covered by health insurance because they work for smaller employers. Only 28.4% of part-time workers have employer-sponsored health insurance, according to the Kaiser Family Foundation.

“Inflation is hitting a lot of families and creating a real need for help in paying bills of all types, including health insurance,” Johnson said.

BlueCross BlueShield of Tennessee, the state’s biggest health insurer, gained approval from state regulators in August for a 6.4% increase in its premium rates for the health exchange program. But in Chattanooga, BlueCross doubled its offerings for 2023 with 16 different plan options, including seven Bronze, seven Silver and two Gold plans. This year, BlueCross offered four Bronze, three Silver and one gold plan.

“Because some of our new 2023 plans hit lower price points, existing consumers may choose to switch and offset some of the rate change,” BlueCross spokeswoman Alison Sexter said in an emailed statement. “We know affordability matters to our members, so we’re glad we can offer more competitive rates next year.”

Before enrolling in any plan, state insurance officials recommend:

— Review each policy to ensure it provides the coverage for services you are seeking or might need in the coming year. While it may be tempting to enroll in a plan with the lowest premium, consumers should take into account other potential costs such as co-pays and deductibles.

— Ask questions and contact the carriers about their plans. Consumers can learn more details about individual plans and view a map of insurance carriers’ areas by visiting the website for the Tennessee Department of Commerce and Insurance.

— Research premiums, deductibles, co-pays and cost-sharing along with reviewing each insurance carrier’s networks for their most accessible and/or preferred providers and hospitals. Consumers should always visit in-network providers to avoid high costs. The health insurance company can provide a list of in-network providers near you.

More information is available by calling 1-800-318-2596 or visiting Healthcare.gov.

Contact Dave Flessner at dflessner@timesfreepress.com or 423-757-6340. Follow him on Twitter @DFlessner1.

2023 rate increases

The five health insurers that are once again offering health care coverage in Tennessee next year are raising their premiums in 2023 by more than the average 4.4% increase made a year ago. The insurers offering insurance on Healthcare.gov and their approved rate changes next year are:

* BlueCross BlueShield of Tennessee: 6.43% increase

* Cigna: 9.9% increase

* Celtic/Ambetter: 5.8% increase

* Oscar: 5.8% increase

* UHC: 11.35% increase

* US Health: New entrant to the market

Source: Tennessee Department of Commerce and Insurance