Many donors to "The John Ankerberg Show" thought they were funding audio Bibles that would bring Christianity to people who had never before heard the gospel, a whistleblower said.

Only a small portion of the donations went to that cause, the whistleblower said, making claims that have drawn a lawsuit from the ministry.

The money, he said, was mostly diverted to other, often luxurious purposes for the prominent Chattanooga-based ministry, including unnecessary private jet rides that went unreported to the IRS.

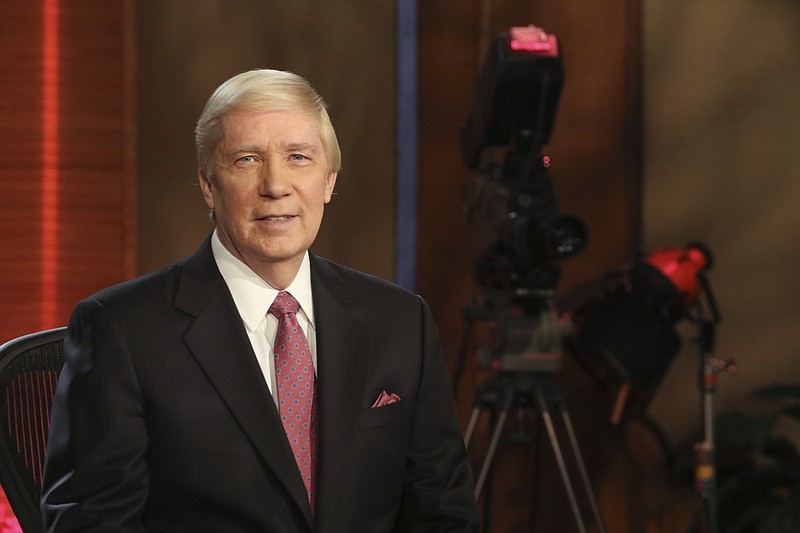

Andrew Jaeger, a former director of donor relations at the Ankerberg Theological Research Institute, filed an internal whistleblower complaint in the fall of 2022 to "The John Ankerberg Show." The program has for decades broadcast conversations and debates seeking to show that Christianity is true, and in recent years reported annual revenue approaching $10 million.

Jaeger left the institute around November, not long after filing the whistleblower complaint.

Last week, the organization sued Jaeger, accusing him of breaching the termination agreement, in which it said Jaeger promised he wouldn't keep or disclose confidential information about the organization and its donors.

At the institute's request, a Hamilton County Circuit Court judge has temporarily forbidden Jaeger from making further disclosures.

Reached for comment following the order, Jaeger said he was unable to discuss the matter.

But in a previous phone interview and emails with the Chattanooga Times Free Press, Jaeger said he was motivated by a sense that "The John Ankerberg Show" was misleading well-meaning, often older adult, Christian donors.

"This is blatant tax fraud and tax evasion," he said in an email to the Times Free Press earlier this year.

(READ MORE: Technological Gospel: Ankerberg spreads the Word through TV, smartphones and apps)

"The John Ankerberg Show" has for nearly a decade prominently featured the work of Faith Comes By Hearing, an Albuquerque, New Mexico-based ministry that says it produces recordings of audio Bibles in uncommon languages and distributes them via "proclaimers" — speaker devices it sends to cultivate Christians in far-off regions of the world where people don't know about Jesus.

The show solicits donations for the proclaimers and related products like digital memory cards. But according to Jaeger, as well as recent comments reportedly made to the website Ministry Watch by the husband-and-wife duo John and Darlene Ankerberg, a relatively small portion of this money actually goes to this cause.

The Times Free Press contacted the ministry's attorney, James Catanzaro, on Thursday seeking comment. Citing insufficient time to respond, Catanzaro did not answer several questions posed by the newspaper. But he said the ministry has sued Jaeger not because it is trying to silence him, but because he broke a promise to return all the ministry property in his possession. And, he said, while there was use of private aircraft, it was funded through the gifts of a donor. He did not elaborate further.

YELLOW FLAG

Jaeger said since summer 2019, more than $15 million has been donated to the institute as part of its audio Bible campaign. He estimated about 15% of this went to Faith Comes By Hearing and the ministry kept millions for itself.

"This was a huge cash cow for Ankerberg," Jaeger told the Times Free Press, adding the overwhelming majority of show revenue came in the form of donations earmarked for audio Bibles.

Jaeger's allegations were first reported by Ministry Watch. The Ankerbergs, the online publication reported, disputed the details of Jaeger's statements about how the money was used. They told the website they have raised about $20 million for audio Bibles, and that they kept about 80% — as opposed to Jaeger's claim of 85% — for ministry expenses.

Darlene Ankerberg said donors understood this.

Even if a charity highlights a specific cause in marketing campaigns, donors often understand their contributions may go toward other organizational expenses, said Lloyd Mayer, a nonprofit tax law expert at the University of Notre Dame, by phone this week.

Charities can veer toward fraud, however, depending on specific representations made about the money, he said.

For example, two associates of Steve Bannon, the former adviser to Donald Trump, were this week sentenced to prison for defrauding donors to their nonprofit organization, We Build the Wall. The Bannon associates said they would not take a penny of compensation from the donations contributed to build a wall between the U.S. and Mexico, but prosecutors said they pocketed hundreds of thousands of dollars. (In one of his final acts while in office, Trump pardoned Bannon, who still faces state-level legal exposure.)

None of "The John Ankerberg Show" audio Bible marketing material reviewed by the Times Free Press explicitly stated the show would not take any of the donor contributions for itself. However, until a recent episode, none of the segments reviewed by the newspaper made clear that a portion of the money would go to the Ankerberg ministry.

In several episodes dating from 2021 to early 2023, Ankerberg invited viewers to give a $500 gift for one audio proclaimer.

"If you will give a gift of $500 for one audio proclaimer, your gift will be matched, and you will actually provide two audio proclaimers, which on average will reach 180 people and win 90 people to Christ," John Ankerberg told viewers in one representative segment from more than a year ago.

Jaeger said the people viewing such advertising thought they were giving their money specifically to the audio Bible cause — which many donors found profoundly moving.

Mayer, the tax law expert, viewed a sample marketing solicitation from the show and said he could imagine it raising a "yellow flag" for consumer-protection-minded law enforcement.

"The John Ankerberg Show" appears to have recently moved toward more transparency. In its latest episode, the donor solicitation segment remained essentially unchanged but ended with a disclaimer that said, "A portion of donations received will be used to pay for broadcasting costs and expansion of the airing and production of 'The John Ankerberg Show.'"

The same message is also included at the bottom of the ministry webpage that solicits donations for the audio Bibles.

"1 AUDIO PROCLAIMER - FOR A GIFT OF $500," the website said, allowing visitors to select how many proclaimers they want to purchase. Then it goes on to explain: "Your gift of $500 provides 1 Audio Proclamation to churches and villages who need to hear God's Word in their language!"

On its own website, Faith Comes By Hearing sells the proclaimer devices for $75 each.

UNCHECKED BOX

The Ankerberg Theological Research Institute reports millions in annual expenses for things like employee compensation and broadcast airtime. Another significant expense in recent years, Jaeger said, has been private jet travel — sometimes for questionable ministry reasons or even plain personal reasons.

It's not a crime for a charity to fly leaders around on private planes, Mayer said. Though some might wonder about the optics, the ministry could theoretically claim the flights, even those destined for a leisurely ministry retreat, served a legitimate business purpose. Or, even if the trip had no legitimate business purpose, it could be claimed as a form of compensation for a ministry official — though this would then need to be explicitly reported to tax authorities.

The IRS does, however, ask charities whether they transported their leaders by charter plane. This is because, in the rare event of an audit, the answer might guide an investigation into whether charity insiders are receiving indirect compensation that was not reported or is unreasonable, Mayer said.

The Ankerberg Theological Research Institute did not check the box on Schedule J of its 2021 990 tax form asking if members of its leadership team traveled by first class or charter plane. The Ankerbergs told Ministry Watch the omission was an administrative mistake and would be corrected.

If in fact the private planes were only used for ministry business and the box was left unchecked by mistake, the IRS would most likely just warn the ministry not to make the mistake again, Mayer said.

But if, as Jaeger suggested, the Ankerbergs use of the planes veered into personal travel, and if they brought companions along, this would constitute a form of compensation for the Ankerbergs and other beneficiaries, which should have been included in the compensation figures reported to the IRS.

The ministry reported paying John Ankerberg $222,604, Darlene Ankerberg $84,644 and their daughter, Michelle Ankerberg, $77,549 in compensation in 2021. Tax records do not provide a breakdown clarifying whether these totals include any personal jet travel they took at ministry expense.

FLYING IN STYLE

When, a few years ago, "The John Ankerberg Show" leaders were considering hiring the services of the charter plane operator NetJet, Jaeger wrote in his whistleblower complaint, he was highly skeptical. He wrote that it seemed grossly cost prohibitive and that it was bad stewardship of donor funds, given NetJet's services cost several thousand dollars per hour.

The corporate jet programs became one of the largest expenditures for the show, Jaeger said. Over a span of 18 months, he said, costs approached $1 million. When Ministry Watch reported this figure, Catanzaro called it "patently false," and John Ankerberg said the cost was about half that.

Jaeger said the flight expenses were not disclosed to even major donors, and the reasons why were no mystery.

"A full disclosure of the flight costs and expenses for the duration of these extravagant personal leisure trips to donors who have contributed in the calendar years 2019 thru 2022 would most certainly be met with disapproval, if not contempt for the extravagance," Jaeger wrote in his whistleblower complaint.

Earlier this year, Jaeger provided a document to the Times Free Press that he said traced the NetJet trips taken by the Ankerbergs and other ministry officials. He said he was on some of these flights himself.

Some trips, Jaeger said, involved traveling short distances, for example to Shelbyville, Tennessee — a less-than two hour drive from Chattanooga — to visit a donor.

Other trips to farther-off destinations seemed to be plainly for personal leisure, Jaeger said. For example, he said that in June 2021, the Ankerbergs traveled from Chattanooga to South Carolina's Hilton Head Island.

"There were no events, no conferences, no face-to-face with donors or anyone associated with the ministry, pure leisure," Jaeger wrote, recounting the trip.

Darlene Ankerberg told Ministry Watch that the ministry board governs airplane use. She, like Catanzaro, said a donor pays for the plane they sometimes use, which is necessary because of the challenges in reaching ministry business destinations with commercial travel options. She said all ministry travel overseas is done commercially.

Certain airplane tail numbers provided by Jaeger link, in the Federal Aviation Administration registry, to Cessna business jets. But sometimes, Jaeger wrote, ministry leaders opted for more expensive aircraft.

For example, Jaeger reported that in October 2021 John and Darlene Ankerberg took a Bombardier Challenger to Washington, D.C., to attend a meeting that could have easily been conducted by Zoom or phone.

Jaeger estimates the total costs of the flights there and back to have been $60,000.

MINISTRY SUES

Jaeger began working as the Ankerberg Theological Research Institute director of donor relations in 2019, managing two people. According to the ministry's lawsuit against him, he was responsible for cultivating relationships with existing and prospective donors. Often, he handled donors who contributed significant sums of money. As part of his job, the suit said, Jaeger had access to confidential information of the organization.

As part of the $50,000 severance package in late 2022, Jaeger said he would return records and other information and copies of it to his employer, the suit said. Names and contact info of donors were among the information he was supposed to return, the suit said.

In early 2023, the institute learned Jaeger had been contacting donors, encouraging them to demand their donations back and reduce their relationship with the ministry, the suit said. Jaeger, it said, offered to share with them documents that he could not have obtained publicly. The lawsuit seeks the return of this information along with an award of damages and litigation expenses for breaking his promise, Catanzaro said.

Contact Andrew Schwartz at aschwartz@timesfreepress.com or 423-757-6431.