Investors seeking claims in an alleged Ponzi scheme involving former Chattanooga businessman John J. Woods will receive an initial payout of $18 million, a judge ruled Tuesday.

But the payout is only about a quarter of the $70 million in claims filed by investors who federal regulators alleged were defrauded by Woods' scheme.

U.S. District Court Judge Steven D. Grimberg of Atlanta, following a Zoom hearing, agreed with a request by the case's receiver for the initial distribution to investors.

A. Cotton Wright, the court-appointed receiver who has been selling off the assets of an investment fund Woods used to allegedly bilk investors, said during the hearing that she expects two more distributions, though the one approved Tuesday likely will be the biggest.

"This would be the largest distribution of the bunch," she said.

She said another distribution to investors could come in late spring or early summer. Wright said a third distribution could be carried out in early 2024. She said there is about $19 million in the receivership account.

According to the U.S. Securities and Exchange Commission, Woods collected more than $110 million from investors with promises of 6-7% rates of return. But the commission said in August 2021 that the investments in the fund, Horizon Private Equity III, were "worth far too little for there to be any realistic prospect that the Ponzi scheme will be able to pay back existing investors their principal, let alone the promised returns."

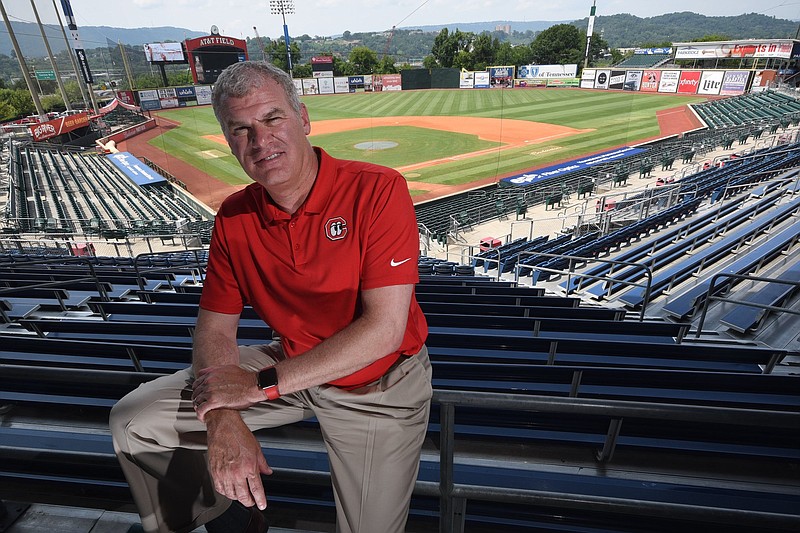

Woods, 57, who grew up in East Ridge before moving to Marietta, Georgia, and was a co-owner of the Chattanooga Lookouts minor league baseball team, has denied wrongdoing in court papers.

His lawyer, David M. Chaiken of Atlanta, said earlier in an email that the commission's claims don't meet the FBI's definition of a Ponzi scheme. He said the government's "use of this pejorative term in its press release and in its complaint mischaracterized the actual facts and unfairly portrayed" Woods and others. Chaiken said Woods had been managing the private equity fund with real assets that would have been worth more than what the fund owed investors.

David Bain, identified as an attorney for investors Jan and Linda Gorman, said during the hearing that he is wholeheartedly in favor of the distribution.

He also urged the receiver to deal directly with investors so none of the distribution is eaten up by a third party. Wright said she planned to do so.

Commission attorney Harry B. Roback also agreed with the receiver's distribution request.

Wright has said the latest accounting shows claims of $70 million by 431 investors. Wright said claims range from about $85 to $4.6 million at the highest amount, which is $3 million more than the next largest.

Woods' fund, among other investments, had included interests in Chattanooga area entities ranging from the Lookouts to real estate ventures involving strip centers and the former Sears and JC Penney stores at Northgate Mall.

In October 2021, the judge agreed to let the Lookouts buy Woods' share of the club for $1.87 million.

Contact Mike Pare at mpare@timesfreepress.com or 423-757-6318.