NASHVILLE - Tennessee is getting lousy returns on state taxpayers' $200 million investment in its experimental state venture capital program, according to a new state Comptroller's performance audit which questions its successfulness.

And it isn't exactly clear whether all the original money plowed into TNInvestco will be readily recouped after the experiment is scheduled to ride off into the sunset in 2021.

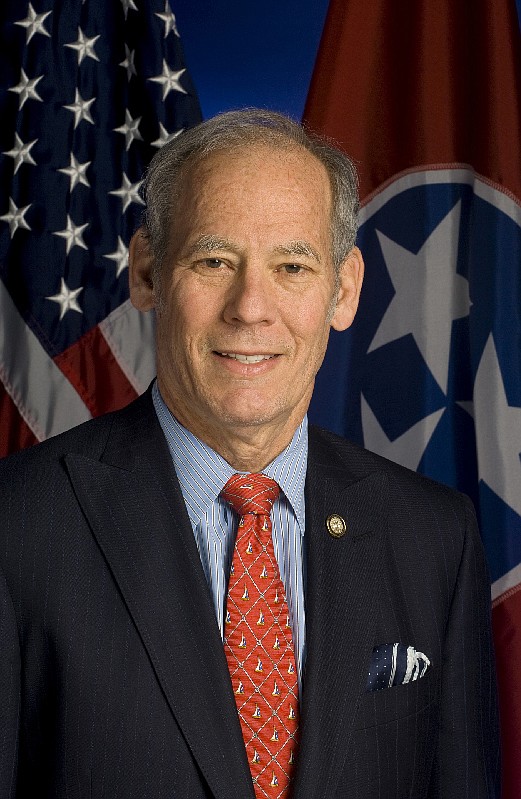

Comptroller Justin Wilson's office says that after six years of the program at the end of 2015, Tennessee has only seen $5.3 million or 2.6 percent on its return on investment from its TNIvestco experiment.

"We're dealing with taxpayer money, and it doesn't appear that the TNInvestco program has been successful," said Wilson, who was skeptical seven years ago when then-Gov. Phil Bredesen's administration pushed the program. "In the future, the administration and the General Assembly should consider the effect on taxpayers before even considering similar programs."

Conceived in 2009 and 2010 as a "public-private" venture capital program, the idea was to help start-up companies to encourage and generate small business jobs in Tennessee while making money for state government or at least recouping whatit spent.

In a statement, Economic and Community Delopment Commissioner Randy Boyd declined to directly respond to Wilson's criticism or defend the investment program, claiming his department's role "is to administer and provide oversight" so the program is transparent and conforms with state rules.

"The program, created under a previous administration, was intended to provide greater access to capital for early stage companies," he said. "The department does not have the responsibility to assess or give opinions as to the effectiveness of investments made. In 2015, legislation was passed to allow for an organized wind-down of the program in partnership with the Tennessee Department of Treasury."

Through a deal involving use of gross premium tax credits given to state insurance companies, Tennessee exchanged $200 million in future state revenue for $150 million in cash which then went to venture capital firms or TNInvestcos.

The TNInvestco firms were approved by the Department of Economic and Community Development, based on their qualifications. They, in turn, are required to invest the money in small, early-stage companies, minus $20 million for management fees.

The state receives half the profit upon liquidation of the investment through merger, sale, spinoff or other type of transaction. Auditors say there have been 85 of these "liquidity" events, generating $10.7 million of which half or $5.3 million came back to the state.

It's based only on profit, not the principal. Beginning next year, however, both will be included with some restrictions.

"Because this program is very unpredictable, the department cannot determine how much of the $200 million the state will recoup when the program ends in 2021," auditors wrote. "The department states that neither the timing nor the amount of the funds returned to the state is governed by statute, rules or policy."

Auditors said the department, however, needs to report amounts returned to provide both the public and state lawmakers information.

Wilson spokesman John Dunn said by email that "the state will continue to recoup some of its initial investment through 2021. My understanding from speaking with the auditors is that the state may also recoup additional dollars from companies that have liquidation events after 2021."

Watchdogs also issued another finding for the department and the program, now being run by the Haslam administration.

"The department did not report and track all TNInvestco program data and did not accurately report jobs created and retained." That includes information on jobs held by women and minorities.

And yet another dart: Economic and Community Development officials didn't list amounts of designated capital invested by a "participating investor" in a "qualfied" TNInvestco company, although auditors they're supposed to do so, auditors said.

Economic and Community Development officials agreed in their audit response that their annual report doesn't list the designated capital for each TNInvestco company. They argue "participating investor" is actually the insurance company that gave the money to the TNInvestco.

But departmental officials said that based on discussions with auditors, they'll disclose the information in their next annual report.

And the department pushed back in several areas, including not accurately reporting jobs created and retained. Each TNInvesto's investments, follow-on capital and job count figures are "presented in the body of the annual reports," the department argued.

And on the finding involving minorities and women, officials said "we do not concur that the department should track and encourage each TNInvestco company the number of minority-owned businesses that receive capital."

Contact Andy Sher at asher@timesfreepress.com or 615-255-0550. Follow on twitter at AndySher1.