Former Chattanooga businessman John J. Woods was charged with one felony count of wire fraud stemming from an alleged Ponzi scheme in which federal regulators accused him of bilking investors.

Woods is accused by the U.S. Attorney's Office in the Northern District of Georgia of causing a victim of the alleged scheme to wire more than $251,000 to an account to invest "based on material misrepresentations and omissions," according to court documents.

The charge filed in U.S. District Court in Atlanta said Woods on or about June 21, 2021, caused the victim, identified only by initials, to wire the money "for the purpose of executing and attempting to execute the scheme" to defraud.

Woods, who grew up in East Ridge but now lives in Marietta, Georgia, pleaded not guilty at an arraignment before U.S. Magistrate John K. Larkins III on Tuesday, the same day he was charged. Bond was set at $25,000 with travel restricted to North Georgia with 72-hour advance notice.

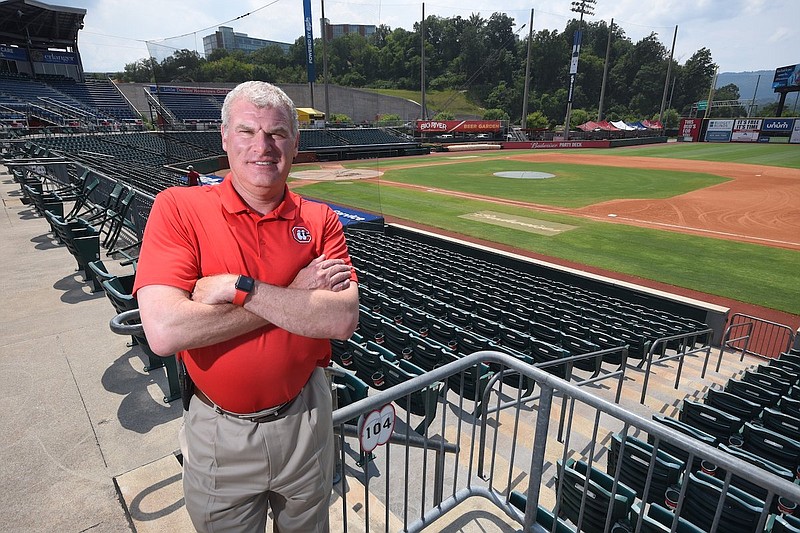

The former Chattanooga Lookouts investor, who also had headed a money management firm in the city, Southport Capital, faces up to 20 years in prison if convicted, according to federal statutes.

A spokesman for the U.S. Attorney's Office declined comment in a phone call Wednesday on the criminal charge against Woods.

An attorney for Woods didn't respond to an email seeking comment.

The wire fraud count comes just a few days after a final judgment was issued in the earlier U.S. Securities and Exchange Commission complaint that claimed Woods ran "a massive Ponzi scheme for over a decade."

The commission complaint in August 2021 said he had collected more than $110 million from more than 400 investors and had continued to illegally raise more money to try to pay off previous investors in the alleged scheme.

A document signed last week by U.S. District Court Judge Steven D. Grimberg of Atlanta said Woods consented to the judgment with the commission without admitting or denying the allegations in the complaint. The judgment prohibits Woods from any future violations of commission regulations.

The court document also said the commission and Woods will try to settle a claim by regulators for monetary relief such as a civil penalty.

Commission spokesman Cory Jarvis said in an email Wednesday that the parties will try to resolve the remaining issues in the case, but if they can't do so, they will ask the court to determine remedies. Jarvis had no comment on the result of the commission's original complaint.

Federal prosecutors claimed in court documents Tuesday that the alleged Ponzi scheme caused the loss of $25 million of investors' money.

Prosecutors charge that Woods failed to tell investors in the Horizon Private Equity III fund that their money would or could be used to make payments to earlier investors.

"As Woods well knew, Horizon was only able to pay guaranteed returns to investors by raising and using new investor money," court documents said.

Woods had promised Horizon investors of 6% to 7% annual interest on their investments paid in monthly installments for two to three years, documents said.

Prosecutors also said Woods caused Horizon to issue monthly statements that "fraudulently misled investors by failing to disclose that the Horizon investments had not generated a positive percentage of return sufficient to cover the interest and simply paid the interest using new and existing investor funds."

Woods attorney David M. Chaiken, of Atlanta, said in an August email that the commission's claims didn't meet the FBI's definition of a Ponzi scheme and unfairly portrayed Woods, whose fund had invested in a half dozen or so Chattanooga real estate projects.

Chaiken said government regulators created "a catastrophe" through a "tragic shoot-first/ask-questions-later strategy." He said Woods was managing a private equity fund with real assets that would have been worth more than what the fund owed investors.

He said Woods also had nearly $1 million of his own family's money invested in the fund, 100% of which he expected to lose as a result.

In addition, Chaiken said he is unaware of evidence that Woods stole investor funds for himself or lived a lavish lifestyle. He said Woods did not receive compensation or fees for running the fund.

Late last year, judgments totaling $65 million were entered in the commission's case against Southport Capital and Horizon. The entities are to give up that amount by forfeiting profits or paying penalties. The amounts are to be satisfied by how much is collected from the ongoing sale of the entities' assets by a court-appointed receiver.

The receiver, attorney A. Cotten Wright, of Charlotte, North Carolina, has said there could be two or three instances of distributions of money to investors.

Contact Mike Pare at mpare@timesfreepress.com or 423-757-6318.