Top states for foreclosures1. Nevada, one of every 57 properties2. Arizona, one of every 58 properties3. Georgia, one of every 63 properties4. California, one of every 64 properties5. Florida, one of every 65 propertiesU.S. average, one of every 126 propertiesSource: RealtyTrac filings of default notices, auction sales and bank repossessions.Fast factIn the first half of the year, 29.4 percent of the houses sold through Chattanooga Realtors' Multiple Listing Service involved foreclosed properties.

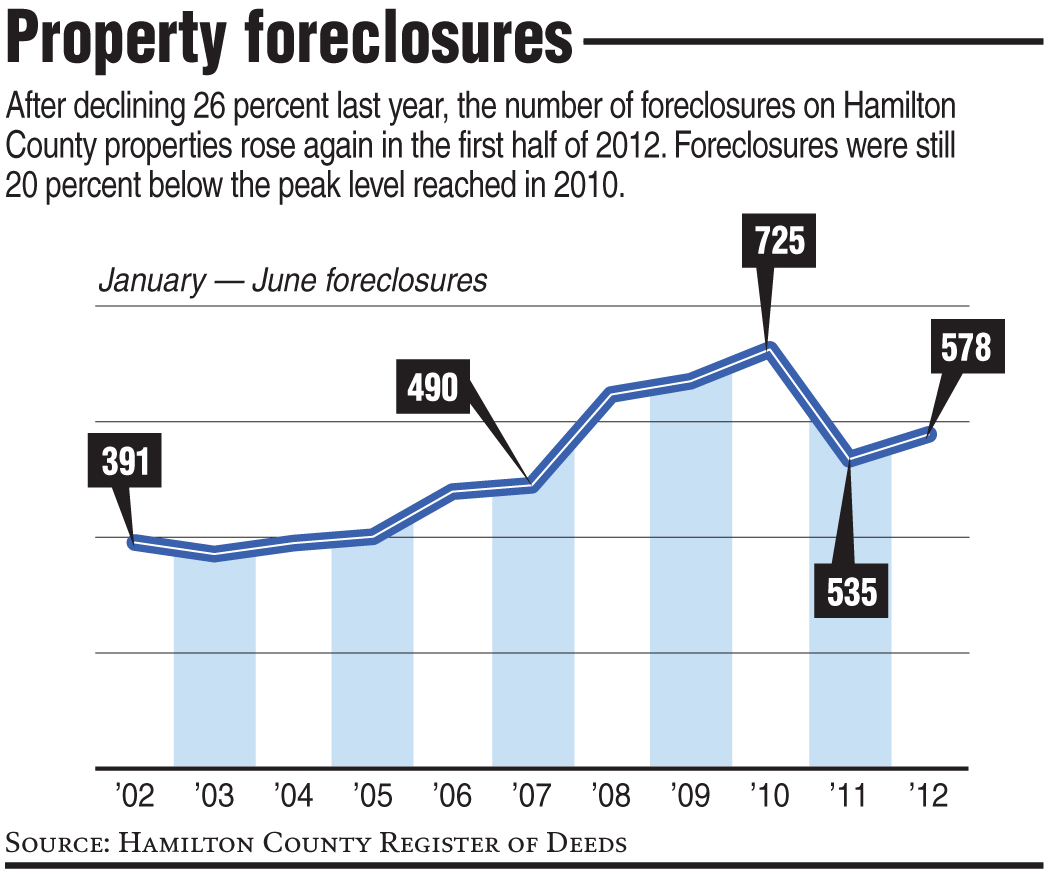

Despite the drop in interest rates and unemployment this year, property foreclosures were still up 8 percent in Hamilton County during the first half of 2012.

Banks that withheld some foreclosure actions in early 2011 because of questions over documentation and notices appear to be seizing more properties this year from homeowners unable to keep current on their mortgages.

But foreclosures are still down by more than 20 percent from the peak in 2010, and a new report released today indicates that initial notices for future foreclosures are declining in Tennessee and 29 other states.

"Lenders and servicers are slowly but surely catching up with the backlog of delinquent loans that under normal circumstances would have started the foreclosure process last year," RealtyTrac CEO Brandon Moore said in a report issued today. "That catching up is why the average time to complete the foreclosure process started to level off or decrease in the second quarter."

RealtyTrac, an online service that tracks notices of loan defaults, auction sales and bank repossessions, said foreclosure notices in the first half of 2012 were down by 10.6 percent nationwide, including a 17.5 percent drop in Tennessee and a 6.1 percent decline in Alabama.

But foreclosure notices in Georgia, which ranks third among all states for property foreclosures, rose nearly 7.4 percent this year compared with last year. Georgia's foreclosure rate was double the U.S. rate and trailed only Nevada and Arizona during the first six months of the year.

"Chattanooga has certainly fared much better than markets like Atlanta, which have been hit hard and where prices have taken a real hit," said Tina Christein, a 17-year mortgage lender in Chattanooga who now serves as branch manager for Churchill Mortgage in Chattanooga. "Our market has been more stable and with interest rates down we are making more loans, both refinancing and new home loans."

Mortgage interest rates are hovering near historic lows, although most lenders have tightened their lending requirements for borrowers from what they allowed before the recent recession.

In the first half of 2012, Chattanooga Realtors sold a total of 3,183 housing unit, including 936 foreclosed properties. Foreclosure sales comprised 29.4 percent of all homes sold through the Realtors' multiple listing service.

"Foreclosures have obviously had an impact on prices, especially for those selling their houses "as-is" and in need of repairs or improvements," Chattanooga Association of Realtors President Mark Hite said. "Home buyers looking for bargains and able to fix up existing homes are looking at foreclosed properties and that is keeping prices down for many older homes. But the prices for new or improved houses are doing better."

Bootsie Yates, a mortgage loan originator who recently joined CapitalMark Bank, said she is seeing an increase in mortgage demand.

"Hopefully, the worst is behind us," she said. "The lower interest rates today certainly create better opportunities for more buyers."

RealtyTrac said one of every 126 properties in the United States received a foreclosure notice in the first half of 2012 with more than 1 million such notices filed from January through June. Not all of the notices ultimately result in foreclosure, however.

Five major U.S. banks and mortgage servicers, including Bank of America, agreed in February to a $26 billion settlement to end an investigation by 50 state attorneys general into claims the banks improperly noticed or documented loan defaults by home borrowers.

The investigation held up many foreclosures through much of 2011 and the settlement allowed the banks to proceed with actions against delinquent borrowers this year.