For the first time in its 81-year history, the Tennessee Valley Authority will no longer offer employees hired after Monday a traditional pension that pays a worker a monthly check for the rest of his or her life at retirement.

TVA will become one of the largest electric utilities next week to give up the defined-benefit retirement plan in favor of making contributions to an individual 401(k) retirement plan. In the new plans, workers will retire with a lump sum payment based upon what they and TVA contributed to the 401(k) plan and what investment returns were earned on the money over time.

"We're transitioning to the more modern 401(k) plan that more employers are offering today, and we think it offers some real advantages to employees in terms of flexibility, mobility and individual control of their money," TVA Chief Financial Officer John Thomas said Friday. "We benchmark our compensation levels with other utilities, and we feel like we have a very competitive plan for new hires that should help us in attracting talent to TVA. This change is not being done as a cost-saving initiative."

But the change will help TVA to meet its benefit obligation when it makes its retirement contributions each paycheck for eligible employees and not expose the utility to any unfunded liability like what it now has for its underfunded defined-benefit pension plan.

Because of investment losses in the market during the Great Recession and retirees living longer than in the past, actuaries estimate that TVA's current pension fund is short more than $4 billion from what it would need to immediately pay all of its promised benefits.

TVA spokesman Jim Hopson stressed that TVA will pay its retirees all of their promised benefits and is working with the board of the TVA Retirement System to shore up the underfunded pension plan for existing employees.

The new retirement savings option, which has been endorsed by both the TVA board and the board of the TVA Retirement System, will remove such funding obligations for TVA for new employees in favor of regular contributions to individual retirement accounts.

The change does not impact TVA's 12,000 existing employees or TVA's 24,000 retirees and their family members included in the pension plan, except if they are rehired by TVA.

TVA has offered its employees defined benefit pensions since its creation in 1933 and the utility created a hybrid program with both a pension and a 401(k) matching program for employees in the 1990s.

Under such traditional programs, workers that stay with a company for 25 or 30 years could expect a gold watch and a steady stream of checks lasting until the person died.

But if current trends continue, those steady checks -- which came courtesy of a defined-benefit plan backed for private employers by the U.S. Pension Benefit Guaranty Corp. -- may soon be a thing of the past. Workers will save for their retirement in individual accounts based upon what they and their employers decide to contribute, plus what investment income they earn over time.

The historic shift next week to only a 401(k) plan for new employees puts TVA among a growing number of businesses that have given up traditional pension plans for employees in favor of individual savings accounts controlled by workers.

Chattanooga's biggest private employer, BlueCross BlueShield of Tennessee, froze its defined benefit retirement plan at the end of 2007 for more than 4,000 employees "due to increasing current and anticipated benefit obligations," communications manager Mary Danielsen said. Employees who were participants in the plan do not accumulate any more age or service credits. But such workers and hire hires at BlueCross receive a 100 percent company match for contributions into a 401(k) plan on the first 3 percent of earnings and a 50 percent company match on the next 2 percent of pre-tax earnings put into a 401(k) by workers.

BlueCross also offers a Retirement Accumulation Program (RAP), in which the company contributes 3.5 percent of the employee's eligible compensation beginning with their date of hire.

Unum Group, the world's biggest disability insurer with more than 3,000 employees in Chattanooga, replaced its defined benefit pension plan with a defined contribution plan on Jan. 1, 2014. Diane Garofalo, Unum's senior vice president of corporate human resources, said the new individual savings accounts "represent a more contemporary approach to retirement planning" and give workers "greater control of your retirement savings and investment choices."

Unum now contributes 4.5 percent of total pay into a new retirement account and the company increased its 401(k) matching contribution up to 4 percent of a worker's pay, if the worker contributes 5 percent into the plan.

"There's been a continual shift from defined benefit to defined contribution plans by private sector employers over the past three decades and we're beginning to see more of that trend now in the public sector," said Steve Blakely, director of communications for the Employee Benefit Research Institute (EBRI), the Washington D.C.-based trade group that monitors employer benefit programs.

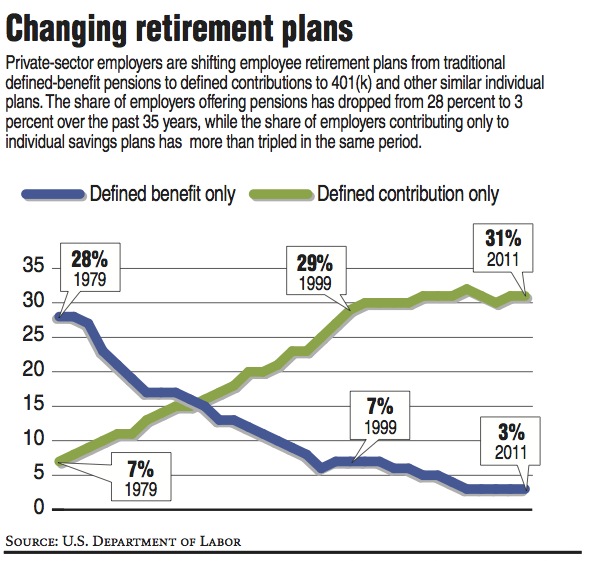

The share of private-sector employers offering only defined benefit pension plans fell from 28 percent in 1979 to only 3 percent in 2011, the most recent year for which complete data is available for EBRI.

In the same period, the share of employers offering contributions to individual retirement plans like 401(k) plans jumped from 7 percent to more than 31 percent, EBRI said.

Most government employers still offer traditional pensions, but EBRI studies showed the share of workers in the public sector participating in traditional defined benefit pensions slipped in 2011 to 71.5 percent from a high of 75.4 percent three years earlier.

Contact Dave Flessner at dflessner@timesfreepress.com or at 757-6340.