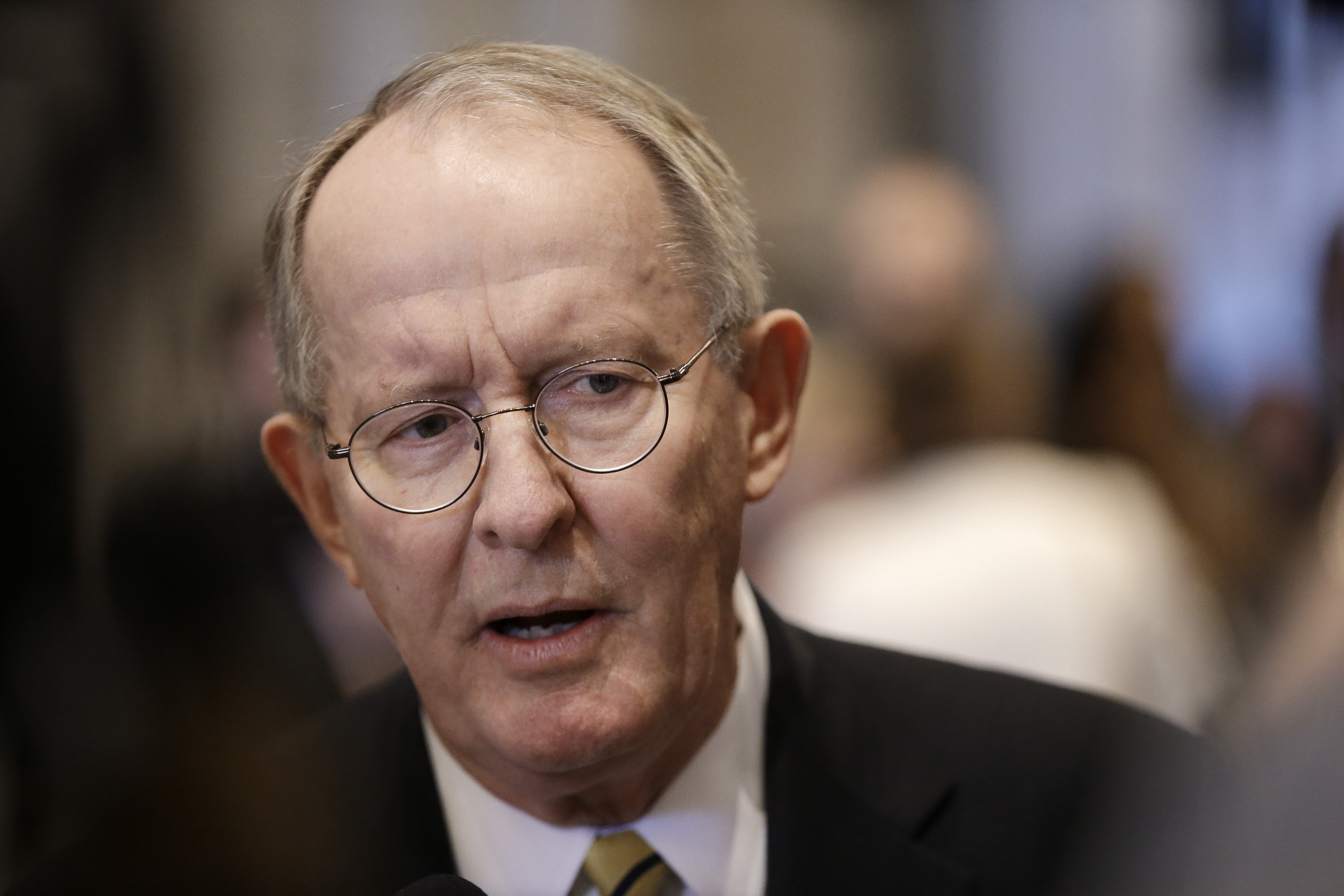

U.S. Sen. Lamar Alexander wants to repeal a chunk of the Affordable Care Act, better known as Obamacare, that could cost Tennessee manufacturers millions of dollars and lead to thousands of layoffs in the Volunteer State.

The 2.3 percent excise tax levied on medical device manufacturers, which is designed to help pay for President Barack Obama's signature health care overhaul, could cripple the largest source of Tennessee's foreign exports, Alexander said.

"This amendment is about ending two damaging tax policies that are costing Americans billions of dollars, and costing Tennesseans good jobs," Alexander said of the budget amendment that he sponsored on Thursday.

Alexander would make up for the lost tax revenue by cutting a $12.1 billion tax credit that subsidizes wind turbine production, with the goal of repealing both provisions without increasing the federal debt.

"It gets rid of a 20-year-old, multibillion-dollar subsidy for unreliable, expensive wind energy that stands no chance of powering our nation's 21st century economy, and it repeals the Obamacare tax on life-saving medical devices -- Tennessee's top export and an important source of good jobs," Alexander said.

Tennessee's medical device exports accounted for $2.1 billion in revenue for 2012, or 10 percent of the state's total exports. Officials rank Tennessee as second only to California when measured by the value of its medical device exports, with medical manufacturers generating more than $15 billion in export revenue between 2007 and 2012.

Michael Fillauer, head of manufacturing at Chattanooga-based Fillauer Cos., a worldwide manufacturer of orthopedia and prosthetic devices, said the tax would hit his company "right on the bottom line," forcing it to raise prices and lose business to foreign competitors if he was forced to pay.

"It's one thing to tax beer or something, but these devices are things that people use to live healthier lives," Fillauer said.

Chattanooga is home to a handful of medical device manufacturers, though the bulk of the state's medical sector is in the Nashville area.

Obama's tax would raise $30 billion over the next decade, generating cash that the administration says is needed to pay for poorer Americans to receive affordable health care. Obama and his supporters have argued that by bringing new customers into the health care system, medical device manufacturers, like the country's insurance companies, could ultimately benefit from increased demand.

Both Democrats and Republicans have supported efforts to delay or dilute the effects of the tax on manufacturers, but the White House has rebuffed each attempt.

In the meantime, the 2.3 percent medical device tax could cost the state more than $40 million in additional expenses on exports alone, which could impact jobs, said Clint Brewer, assistant commissioner for communications and creative services at Tennessee's Department of Economic and Community Development. If Tennessee manufacturers are forced to become less competitive on the national state, a small boost in U.S. consumption may not be enough to make up for sales lost to cheaper foreign competitors, he said.

"I think it takes money out of the pockets of the companies that are charting the path, economically, for the state," Brewer said. "It keeps them from reinvesting in their companies to the level that they might, and may very well keep them from growing."

In fact, some companies have already announced plans to shrink in response to the tax on manufacturing, according to a news release.

London-based Smith & Nephew, a medical device manufacturer with a presence in Tennessee, said in February that it would lay off almost 100 employees in both Tennessee and Massachusetts as a direct result of the new tax, according to news reports. That came on the heels of medical device manufacturer Stryker announcing in November that it would cut more than 1,000 jobs, a report said. In total, the tax could cost as many as 43,000 jobs across the U.S., according to estimates by the Advanced Medical Technology Association.

Brewer praised Alexander's amendment as a positive for Tennessee's medical sector, where wages are 40 percent higher on average than the rest of the economy.

"Sen. Alexander's amendment is certainly appreciated," he said. "It's good for business when you can keep more of your dollars in your state and in your sector and company rather than send them to D.C."

The wind industry's economic impact in Tennessee is too small to measure, Brewer said, and ECD could not immediately provide figures on sales, exports, or the impact cutting federal subsidies.