Pinnacle Financial Partners Inc., the Nashville bank that agreed this month to buy CapitalMark Bank in Chattanooga for $187 million, boosted its first quarter profits by nearly 32 percent over last year.

Pinnacle said Monday it earned $21.8 million, or 62 cents per share, in the first three months of 2015. In the same period a year earlier, the Nashville bank earned $18.7 million, or 47 cents per share.

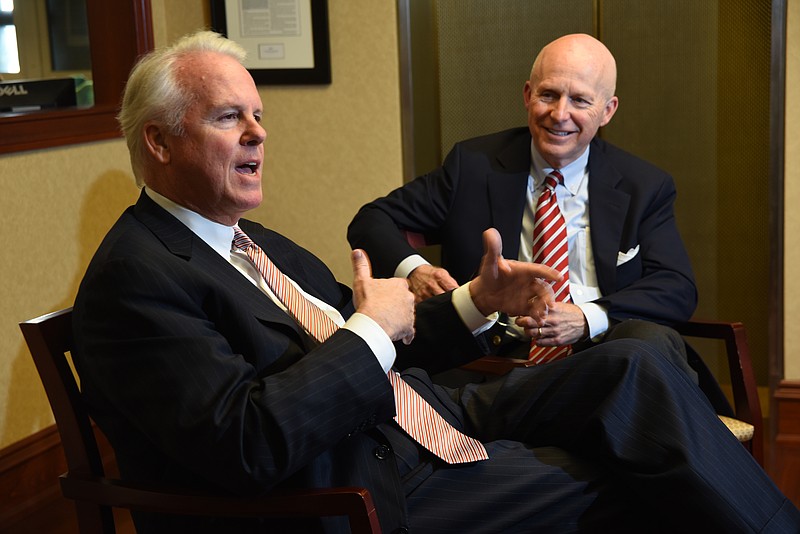

"Our investment in Bankers Healthcare Group LLC, which occurred on Feb. 1, as well as our anticipated merger with CapitalMark Bank & Trust in Chattanooga, which we announced two weeks ago, represent two significant milestones for our firm," said M. Terry Turner, Pinnacle's president and chief executive officer.

"Additionally, we launched a capital markets initiative that will provide a new revenue stream that's been routinely conceded to others in the past, and we also hired several commercial real estate professionals that position us to develop a higher profile in the commercial real estate segment to match that we've developed in the commercial and industrial segment. Those building blocks, plus our record core earnings for the 16th consecutive quarter, serve as a great platform to achieve our long-term growth objectives."