Taxes would be due at midnight tonight, but the April 15 deadline has been pushed off until Monday because Emancipation Day celebrations take place today in Washington, D.C.

So tax procrastinators can breathe a sigh of relief, or curse the prospect of doing taxes on what promises to be a nice weekend - or a little of both.

The weekend means taxes, taxes and more taxes for Mark Longley, a certified public accountant with an office at 345 Frazier Ave. in North Chattanooga that employs three CPAs.

"Life? What life? There's not much free time right now," said Longley, who's been in the accounting business since 1972 and has owned his own business since 1981.

Longley expects to work hard all weekend, and won't have dinner until 8:30 or 9 at night.

"Last night, I didn't eat dinner at all," he said Thursday, adding that his wife "works here, too, so we're both grumpy."

"But it is kind of nice when it's over," said Longley. He and his wife plan to take vacation at April's end.

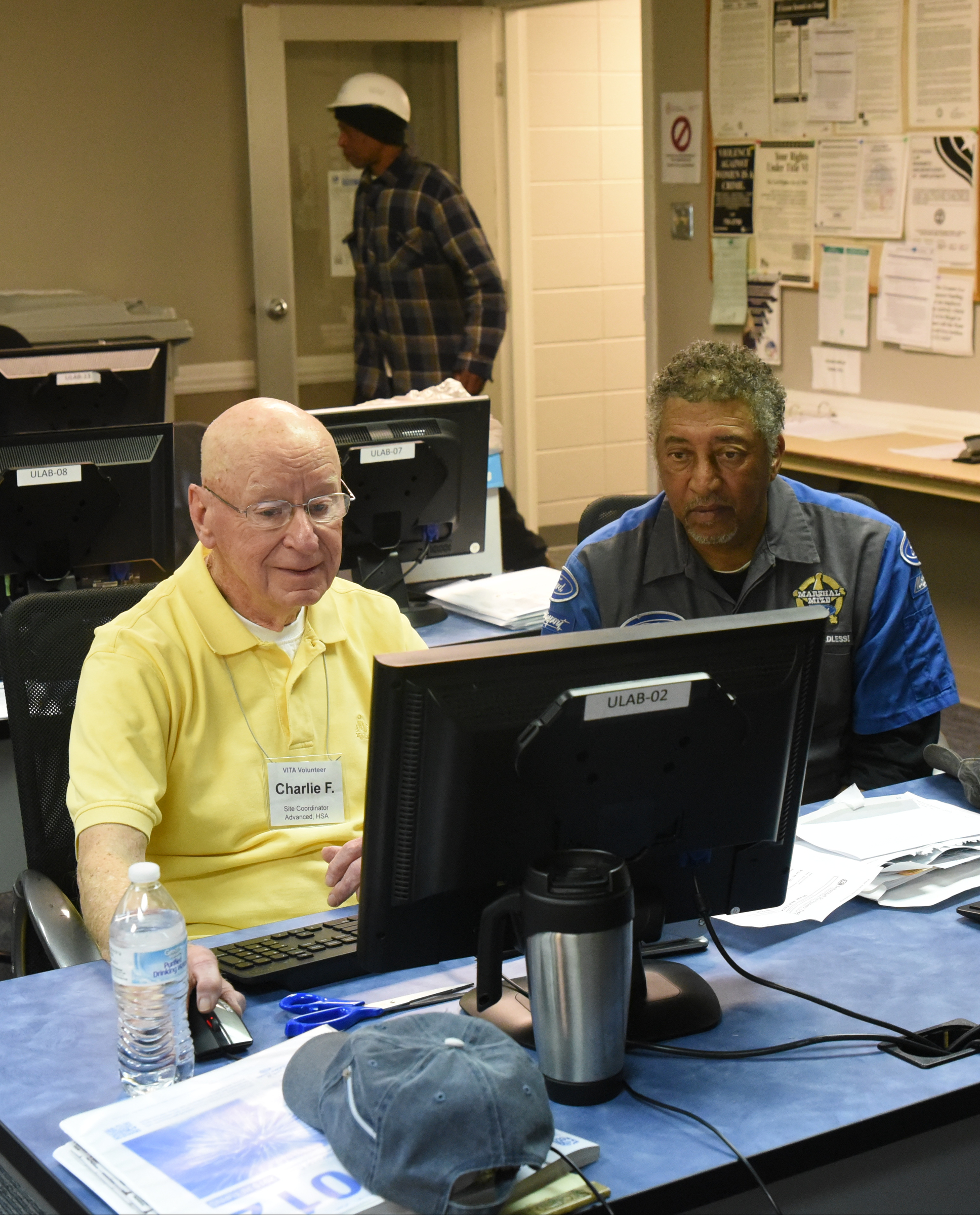

Last-minute tax filers were lined up Thursday at the Urban League of Greater Chattanooga's headquarters at 730 M.L. King Blvd. where volunteers helped Chattanoogans file electronically through the Volunteer Income Tax Assistance (VITA) program.

The program, which has operated since January at 14 locations in Chattanooga, Cleveland and - for the first time this year - South Pittsburg, Tenn., is on track to serve about 10,000 people, said Keesha Marshall, executive assistant at the Urban League, which coordinates the VITA program.

"We've had a lot of people," Marshall said. "Every year, we try to reach that goal of 10,000."

More than four out of five tax returns are filed electronically, the IRS says, and Tennesseans have embraced E-filing.

"Tennessee has once again, set a record with the most electronic filed tax returns ever at this period," said IRS Spokesman Mark Green. "We had estimated that Tennessee would file 2.6 million E-file tax returns for the whole calendar year. Thus far, Tennessee has filed over 2.2 million E-file tax returns."

No midnight mailings

The U.S. Post Office used to accept mail until midnight on tax filing day at many of its branches so that last-minute mailed returns would be postmarked on deadline day. But it won't do that anywhere in Tennessee this year because of the popularity of E-filing, Postal Service spokeswoman Susan Wright said.

"None of the offices in Tennessee are extending hours beyond normal retail hours," said Wright, who added that has been the case for several years. "We're just responding to the number of customers E-filing."

Avoiding scams is one incentive for doing taxes early, said Jim Winsett, president and CEO of the Better Business Bureau at 508 N. Market St. in Chattanooga that serves southeast Tennessee and northwest Georgia.

Tax scammers don't need much information to pounce, according to Winsett.

"If they get your name and they get your Social Security number, that's really all they need to file a tax return," he said.

Armed with that information, Winsett said a scammer can make up fraudulent earnings, fraudulent deductions and have the refund sent to a new address of the scammer's choosing.

"Oftentimes, a [victim] doesn't know that's happened until they submit their tax return," Winsett said. "The IRS comes back and says, 'This has been filed already.'"

For those who won't make Monday night's filing deadline, the IRS says don't panic. Tax-filing extensions are available to taxpayers who need more time to finish their returns.

However, the IRS stresses it's an extension of time to file; not an extension of time to pay. That said, taxpayers who are having trouble paying what they owe may qualify for payment plans and other relief, the IRS says.

Contact staff writer Tim Omarzu at tomarzu@timesfreepress.com or www.facebook.com/MeetsForBusiness or twitter.com/meetforbusiness or 423-757-6651.