The number of Chattanoogans going broke fell in the past year to the lowest level in six years, but Tennessee still boasts the dubious title of having the nation's highest bankruptcy rate.

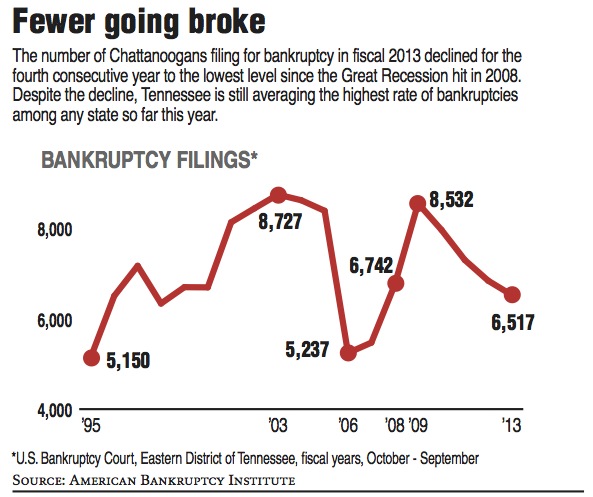

Consumer and business bankruptcies filed in Chattanooga declined for the fourth consecutive year in fiscal 2013 as the economy improved, interest rates remained muted and borrowers took on less credit.

"Banks are unwilling to lend with as much freedom as they did before, and families and businesses are just carrying less debt than they did before the recession," said Kara Bruce, a law professor at the University of Toledo who serves as a resident scholar for the American Bankruptcy Institute. "Is the worst behind us? I wouldn't guarantee it because as we see credit markets loosening up, bankruptcy filings are likely to bounce back, at least to some extent."

Ken Rannick, a 30-year bankruptcy attorney in Chattanooga, said while bankruptcy filings have declined in recent years he has seen an increase in the number of people seeking debt relief in federal bankruptcy court.

"There's still a lot of economic uncertainty," Rannick said. "I fully expect we'll see some more bankruptcies as some businesses cut back staff or hours in response to the changes coming from Obamacare."

From the peak reached in 2009, local bankruptcy filings have dropped by nearly a fourth, including another 4.6 percent decline in the federal fiscal year ended Sept. 30. But the decline in Chattanooga filings in the past year was still less than half the nationwide decrease, helping to keep the share of Tennesseans filing bankruptcy in the past year at nearly twice the national average.

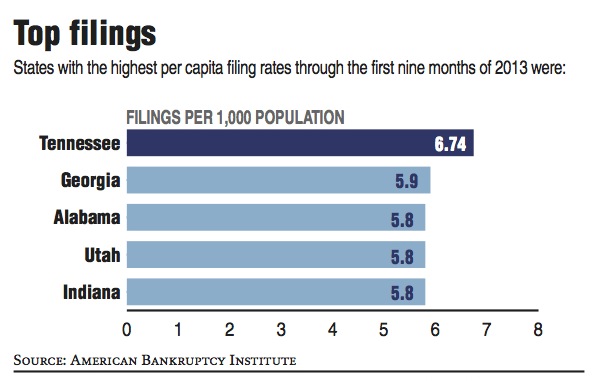

Tennessee, Georgia and Alabama ranked as the top states for per-capita bankruptcy filings during the first nine months of 2013, according to new figures compiled by the American Bankruptcy Institute. Those states allow creditors to garnish wages or foreclose on property more easily than many states, so more consumers file for bankruptcy to avoid such actions.

A study done, in part, by University of Maryland economist Lawrence Ausubel found that "strict garnishment laws in states such as Tennessee make it easy for creditors to attach debtors' paychecks, inducing individuals into bankruptcy" for debt relief.

Southern states also have higher rates of poverty and unemployment and lower rates of health insurance and education -- all factors linked with higher rates of bankruptcy filings.

Credit counseling agencies report fewer individuals are seeking help than during the Great Recession. Latricia Schobert, program director for Consumer Credit Counseling in Chattanooga, said the economic downturn made most people more wary about taking on as much debt as in the past.

Rising home values and job opportunities also have helped the financial standing of most households, but experts warn that doesn't necessarily mean fewer bankruptcies.

To seek court protection from creditors, people usually need some money to hire a bankruptcy attorney.

"Some individuals are too broke to afford the cost to file for bankruptcy," said Samuel Gerdano, executive director for the American Bankruptcy Institute.

As the economy improves and credit becomes more available, some people are tempted to borrow again too heavily, Schobert said.

"We are seeing some people get 'frugal fatigue' and get overextended again," she said.

Nonetheless, the number of people seeking help with debt problems with Consumer Credit Counseling has dropped by more than half from three years ago.

"A lot of lessons were learned about the value of making and staying on a budget," she said.

Contact staff writer Dave Flessner at dflessner@timesfreepress.com or at 757-6340.