A tax break watchdog is calling for more public oversight after compiling Hamilton County Trustee records that show $26 million in property taxes waived for nearly 40 companies in 2014.

But local government and Chattanooga Area Chamber of Commerce officials say trustee numbers only tell part of the story.

Helen Burns Sharp, who's been a dogged critic of tax breaks given to commercial and residential developments, collected information on about 39 active payment-in-lieu-of-tax agreements covering more than 60 parcels in the 2014 tax year. The records show companies paid $9.1 million in taxes for properties that would have brought in $35 million had they not been reduced by PILOTs.

The uncollected $26 million could have paid for a new middle school or helped dent the school system's $200 million maintenance backlog.

Sharp hopes the numbers get the attention of the public and elected officials.

"Tax incentives need to be reserved for projects involving significant public benefit where the incentive really makes a difference in a company's location or expansion decision," Sharp said. "We have lots of needs in our community, and we are seriously eroding our revenue base with the number and magnitude of PILOT agreements."

But city and county officials say the raw tax data doesn't express one critical fact: Without the agreements, many of the companies wouldn't be here, and listed property values would be much lower.

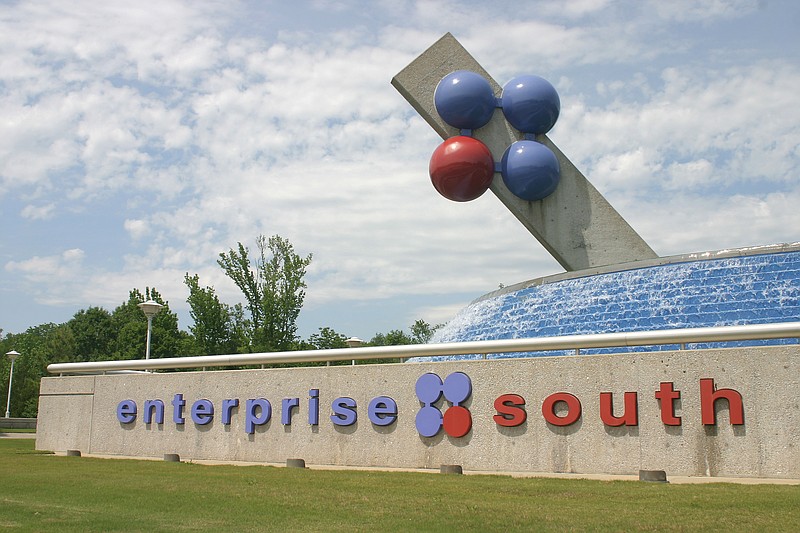

Nick Wilkinson, director of economic development for Chattanooga, said that before the city and county started leveraging PILOTs at Enterprise South, the land that now houses the county's largest PILOT and development didn't bring a dime in property taxes to local coffers. It was the former site of a federally owned ammunition plant.

"Were there hundreds of thousands of dollars of robots at Enterprise South before Volkswagen?" Wilkinson asked. "Oftentimes, this takes places that are generating no revenue and puts them on a long term [track] to get on the tax rolls."

Other numbers also should be mentioned alongside the costs to taxpayers, said Charles Wood, vice president of economic development with the chamber.

The chamber partnered with the city and county in 2008 to recruit business, so it doesn't monitor some of the older PILOTs. For 2014, the chamber monitored 24 agreements. Nine of those ended last year.

Of the 15 active PILOTs the chamber will monitor going forward, the companies have promised to create 4,505 additional jobs in the area, invest $1.628 billion into the local economy and pay a total of $5.6 billion a year in new payroll, Wood said.

In addition, over the life of those agreements, the companies will pay $125 million to county schools, Wood said.

Not included in those figures are unmeasured impact that companies such as Volkswagen have on the local economy.

"Without VW, our community would not be the same as it is today. VW has had a mammoth impact," Wood said.

In 2014, Volkswagen paid $3 million of the total $9.1 million in taxes by companies with PILOT agreements. The automaker's total local tax burden would be $10.4 million without a PILOT.

But without the PILOT agreement, VW would not have settled in Hamilton County, Wood said.

"There are more than 5,000 economic development organizations in the country competing for projects. And we compete at a global level. We saw that when we lost Audi to Mexico," Wood said.

Audi chose to build a plant in Mexico over Chattanooga in 2012.

"This is not about being nice to people. This is a competitive dynamic," Wood said.

Hamilton County Mayor Jim Coppinger agreed.

And he said the success of past economic development has allowed recent PILOT agreements to be more stringent.

In the past, local officials couldn't be as tough with claw-back provisions when companies didn't keep their side of the agreement. And some past agreements waived school taxes as well. All contemporary PILOTs have defined claw-back provisions and education taxes are not waived, he said.

Since he took office in 2011, Coppinger said, he has played a role in seven commercial PILOTs and one residential agreement.

"We are tightening the reins a little bit. We look at the claw-backs, we look at the length of these PILOTs," Coppinger said. "We are going to always continue to look for better ways. We are taking economic development fees we used to not have. ... It was even more difficult for our predecessors because we weren't as hot as we are now."

Sharp is not the only one seeking to shed light on PILOT agreements. Last week, Tea Party President Mark West and others questioned the relationship between elected officials and the bond boards that oversee PILOT agreements.

Contact staff writer Louie Brogdon at lbrogdon@timesfreepress.com, @glbrogoniv on Twitter or at 423-757-6481.