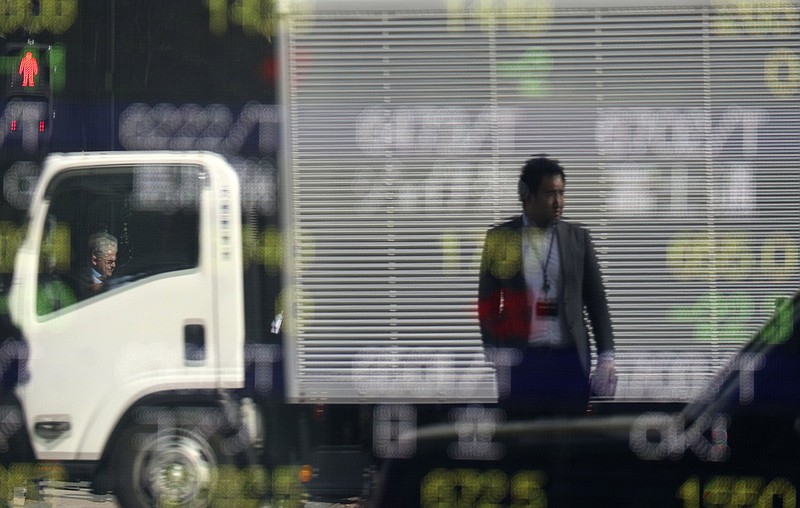

KUALA LUMPUR, Malaysia (AP) - Asian shares were mixed Wednesday following a subdued session on Wall Street as energy stocks were weighed down by falling oil prices.

KEEPING SCORE: Tokyo's Nikkei 225 rebounded from early losses to rise 0.5 percent to 19,007.60 points while Hong Kong's Hang Seng rose 0.6 percent to 23,470.28. The Shanghai Composite index added 0.4 percent to 3,165.02 and Sydney's S&P ASX 200 gained 0.5 percent to 5,651.40. India's Sensex fell 0.1 percent to 28,298.81 and benchmarks in New Zealand, South Korea, Taiwan and Southeast Asia also were lower.

WALL STREET: Wall Street capped a subdued day of trading Tuesday with tiny gains led by consumer goods makers and technology companies. Energy sector stocks rode a rebound in oil prices to gain 23.7 percent in 2016 but are off 5.1 percent this year. The Dow Jones industrial average rose 0.2 percent to 20,090.29. The Standard & Poor's 500 index was flat at 2,293.08. The Nasdaq gained 0.2 percent to 5,674.22, another record high.

ANALYST'S QUOTE: "The way that prices have been moving in U.S. markets, it seems to be telling us that the market clearly does not want to err on either side of being too bullish or bearish in this 'wait-and-see' climate under President Donald Trump," Jingyi Pan of IG said in a commentary.

ENERGY: Benchmark U.S. crude extended losses, falling 43 cents to $51.74 a barrel in electronic trading on the New York Mercantile Exchange. It lost 84 cents to close at $52.17 a barrel on Tuesday due to a stronger dollar and after weekly data showed a sustained build-up in U.S. oil inventory. Brent crude, the benchmark for international oil prices, shed 28 cents to $54.77 a barrel. It slipped 67 cents to $55.05 a barrel the previous session. The American Petroleum Institute data showed crude inventory at 14.2 million barrels, the second highest on record. Official government data is due later Wednesday. Ric Spooner, chief market analyst with CMC Markets, said the drop in oil prices "reflects the near term reality that, despite OPEC production cuts, it will take some time for the world's large oil inventories to be reduced."

JAPAN'S CURRENT ACCOUNT: In news that could auger extra friction with the U.S., Japan reported that its current account surplus hit a 9-year high in 2016, helped by lower costs for imported oil and improved exports. The perennial trade surpluses Japan runs with the U.S. are a sore point for U.S. President Donald Trump, and the data announced Wednesday came just as Prime Minister Shinzo Abe was preparing for summit meetings with Trump later in the week.

CURRENCY: The dollar rose to 112.40 yen from 112.19 on Tuesday. The euro fell to $1.0667 from $1.0696.