ATLANTA (AP) - Georgia lawmakers had to decide whether to permit concealed handguns on college campuses and cut some residents' income taxes as the legislative session drew to a close on Thursday.

Lobbyists and advocates were in for a long night as they tried to keep watch on lawmakers rushing to pass dozens of bills before adjourning for the year. This way of lawmaking amid the chaos can lead to dramatic last-minute changes to legislation, some intentional and some by accident.

Lawmakers used to consider midnight a hard deadline for ending the session, but in recent years they've continued passing bills past that hour.

Here's a look at some of the top issues at the Capitol:

GUNS ON CAMPUS

Lawmakers remained at odds about the details of a bill allowing anyone 21 and older with a state-issued permit to carry a concealed handgun on campus. Currently, Georgia is among 17 states that ban firearms on public university and college campuses, according to the National Conference of State Legislatures.

Gov. Nathan Deal, a Republican, vetoed a similar proposal last year but hasn't taken a firm stance this session. That veto indicated the governor's opposition is deeply rooted, but Republican lawmakers were hoping to negotiate a version that Deal will sign.

Both chambers agree that student housing, athletic facilities and on-campus preschools should be exempt. But the House objected to the Senate's addition of an exemption for buildings at some technical colleges where high school students take courses.

A committee of six lawmakers, three from each chamber, would likely be appointed to hash out differences in the final hours of the session.

TAX CUTS

The House and Senate also remained far from agreement on bills affecting income taxes and tax credits.

House GOP leaders wanted to change the state's somewhat progressive income tax levels to a flat 5.4 percent. Current law sets income tax rates between 1 and 6 percent, increasing along with taxable state income. The Senate altered the House-approved plan to boost certain tax refunds while cutting the rate for the top tax bracket.

The chambers also have differing proposals to tax limos, taxis and ride-hailing services, new-car leases and used-car purchases.

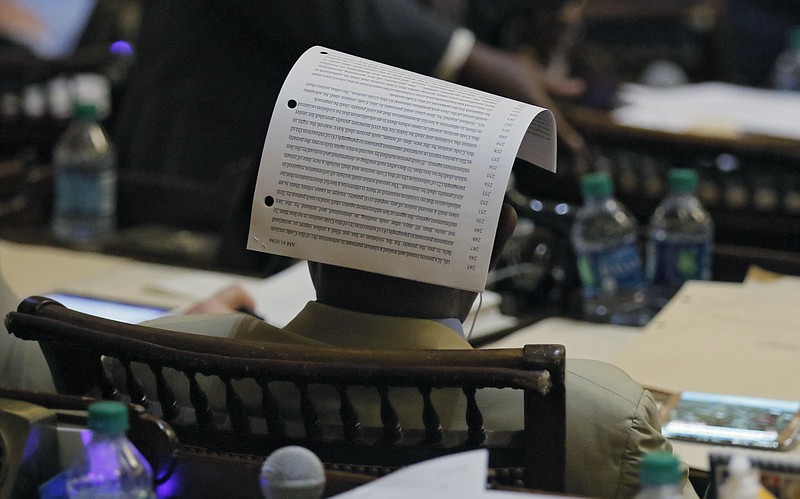

These bills also were being assigned to small committees of lawmakers whose last-minute changes could force lawmakers to cast votes on items that they have little time to read or analyze.

VOTING RIGHTS

Information on Georgia voters' registration forms would have to match state or federal databases for them to be eligible to cast a ballot under legislation sent to Deal's desk.

Voting-rights advocates opposed the bill, arguing that the requirement will disproportionately affect minorities and undermine the recent settlement of a lawsuit against Secretary of State Brian Kemp.

The lawsuit challenged a similar matching procedure Kemp's office implemented in 2010 and used until September, saying the process prevented thousands of eligible voters from registering based on data-entry errors, typos or other issues.

The bill would give rejected applicants 26 months to respond if their information doesn't match. Lawmakers approved it after adding language saying the process is intended to verify an applicant's identity.

MEDICAL MARIJUANA

An expansion of Georgia's program allowing patients with certain conditions to possess oil derived from marijuana is headed to the governor's desk

After House and Senate leaders announced a compromise, the bill adds new diagnoses to the list of qualifying conditions for medical cannabis oil, including autism, AIDS, Tourette's syndrome, and Alzheimer's disease.

However, many diagnoses will be restricted to when the condition is severe or in the end-stage.

Additionally, anyone in a hospice program, regardless of diagnosis, will be allowed access to marijuana oil as long as it's low on THC, the chemical responsible for the marijuana high.

SELF-DRIVING CARS

Self-driving vehicles could be used legally in Georgia under another measure.

Supporters said car and technology companies, insurance providers and injury attorneys signed off on the proposal and warned that Georgia would be left behind as other states pass similar legislation.

The proposal requires drivers of the vehicles to have a higher amount of insurance coverage than what is required for traditional vehicles until the end of 2019.