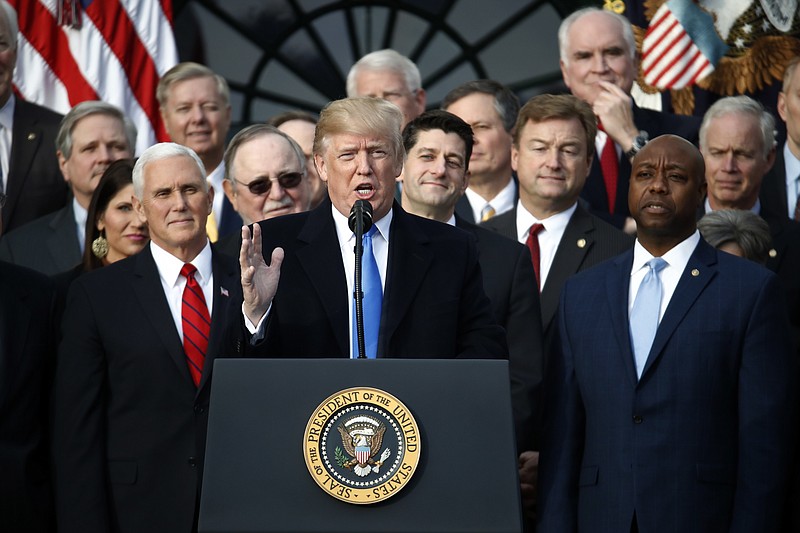

In case you haven't heard, nearly all that's good and pleasant in the world died last week. The tax bill passed.

The bill has variously been described as "a disaster," "one of the great robberies" of history and a "massive attack" on the middle class - and that's just Bernie Sanders. Other critics say it will explode the deficit, enrich the undeserving rich, immiserate the underserved poor and ring a "death knell" for the sinking middle class. Nancy Pelosi calls it a "Frankenstein," albeit one that will return to kill its Republican creators.

To which any Republican political strategist would rejoin: Keep it up, folks.

There are things genuinely to dislike in the tax bill. It raises taxes on too many people. It barely cuts the top income-tax rate. It doesn't eliminate the Alternative Minimum Tax. Taxpayers will get kicked into higher brackets (of which there are still too many) sooner, thanks to a new measure of inflation.

Worst of all is probably the provision for full expensing, which allows companies immediately to deduct the cost of capital investments from their tax bill. This is supposed to be the most stimulative part of the bill, especially for smaller companies looking to grow. But it's also an invitation to invest - and over-invest - based on tax incentives rather than the straight business case. Bankruptcies will follow.

OK, no doubt your objections are different than mine. But here are two things to know: Slashing corporate rates - the bill's central achievement - is good economics. And wailing against the bill as an American Armageddon is dumb politics, at least for Democrats.

On the first point, consider the following case against the outgoing system:

"Our current corporate tax system is outdated, unfair and inefficient. It provides tax breaks for moving jobs and profits overseas and hits companies that choose to stay in America with one of the highest tax rates in the world. It is unnecessarily complicated and forces America's small businesses to spend countless hours and dollars filing their taxes. It's not right, and it needs to change."

That was Barack Obama in 2012, with a proposal to cut rates to 28 percent. Other prominent Democrats who have previously called for cutting corporate taxes include Tim Geithner, Pelosi and Chuck Schumer.

Maybe the current bill cuts the rate too far - or, as I think, doesn't cut it far enough. Maybe the argument that companies will use additional revenues to hire more workers is too optimistic, if only because the United States is already close to full employment. Maybe they'll reward their shareholders instead - which, however, probably means you, assuming you have an IRA.

And maybe there's something to be said for Google parking several billion dollars in profits in a Bermuda shell company, just to take advantage of the islands' zero rate. It's delightfully devious coming from the well-heeled apostles of "Don't Be Evil."

But the suggestion by senior Democrats that it is now a moral abomination to enact the very type of tax reform they themselves favored until quite recently smacks of partisan dishonesty, if not ideological hysteria. Many developed countries, including Germany, Sweden and Britain, have all slashed their corporate rates in recent years. Lo, the sky did not fall.

Now to the bad politics. Democrats think it's politically smart to oppose the bill because some 58 percent of Americans were against it, according to a recent poll.

A Times analysis of the poll also found that half of the people who will get a tax cut under the bill don't think they're going to get one, likely out of distrust for the president.

But nothing is so splendid in life or politics as a good surprise, and Democrats have positioned themselves to be on the wrong side of it. In 2018, according to the Tax Policy Center, 91 percent of middle-

income filers will get a tax cut, averaging close to $1,100. That's real money, or at least enough to give Donald Trump and congressional Republicans a good opening for a "we told you so" moment.

The cuts also coincide with some of the most robust economic growth in over a decade. Ostensibly expert economic opinion now tells us the tax bill will do little or nothing for growth. But some of the same experts also told us Trump's election would cause a worldwide recession and send stock markets tumbling. If there's one thing every conservative lives for, it's liberal whoopsie moments like these.

Time will tell, and stuff happens - think: war on the Korean Peninsula, or perhaps a bitcoin meltdown. For now, the GOP's legislative triumph is only being sweetened by the wildly overblown reaction to it. Why liberals would want to give the administration a holiday gift like this is beyond me, but, anyway, happy new year.

The New York Times