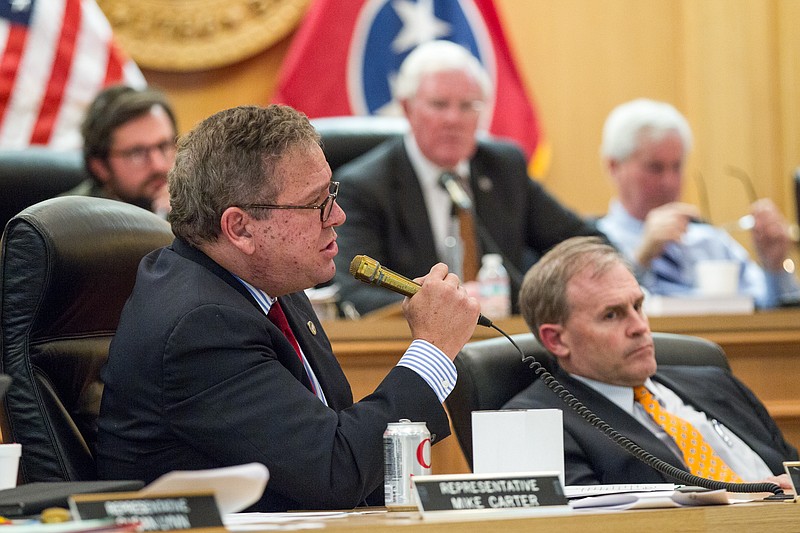

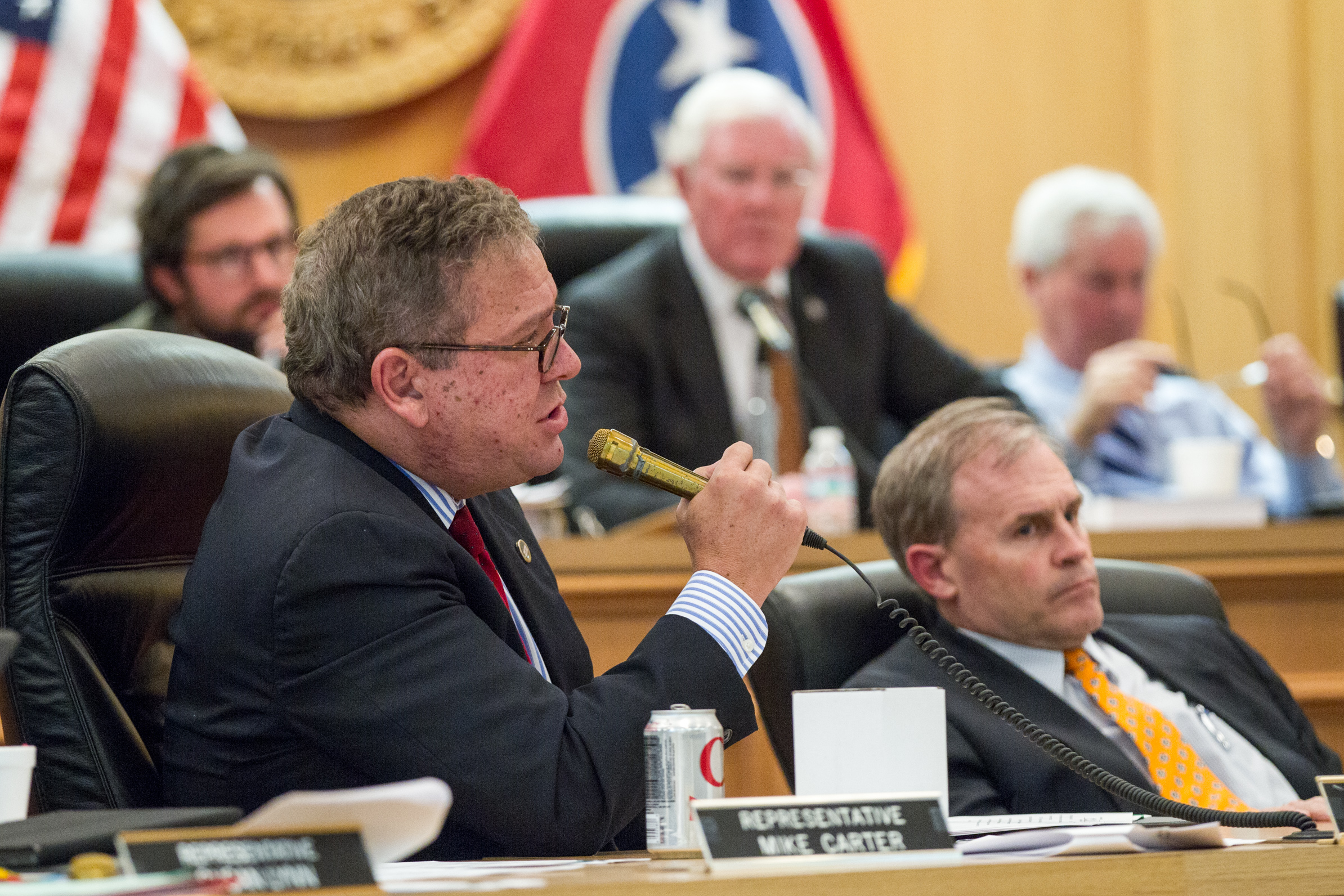

FILE - In this March 8, 2016, file photo, House Majority Leader Gerald McCormick, R-Chattanooga, speaks during a House Finance Committee hearing in Nashville, Tenn. McCormick on Tuesday, April 19, vowed retribution for companies that spoke out against a transgender bathroom bill, suggesting that lawmakers should consider limiting tax incentives and grants to them. (AP Photo/Erik Schelzig, File)

FILE - In this March 8, 2016, file photo, House Majority Leader Gerald McCormick, R-Chattanooga, speaks during a House Finance Committee hearing in Nashville, Tenn. McCormick on Tuesday, April 19, vowed retribution for companies that spoke out against a transgender bathroom bill, suggesting that lawmakers should consider limiting tax incentives and grants to them. (AP Photo/Erik Schelzig, File) NASHVILLE - Tennessee lawmakers on Friday wrapped up their annual session by passing landmark legislation that begins phasing out and eventually repeals a 1920s-era tax on investment income that generates hundreds of millions of dollars for state and local governments.

After months of wrangling, senators and representatives agreed to cut the 6 percent Hall Income Tax on stock dividends and interest earnings by 1 percent to 5 percent for the 2016 tax year. And they committed in statute to cutting it an additional 1 percent each year until it's completely gone in 2022.

Enacted in 1929, the Hall Tax generated some $303 million in 2015, of which 37.5 percent, or nearly $105 million, went to local governments where those taxpayers live.

Officials from cities and counties across the state are already groaning over the hole that will be left in their budgets as the Hall tax is completely phased out.

They also warned that covering the loss of Hall taxes paid by an estimated 205,000 people could force them to hike property taxes on far more homeowners and businesses across Tennessee to maintain essential services like fire, police, schools and streets.

"As a city, we rely on revenue from many different sources, and as revenue dollars get phased out, we have to find new avenues," Chattanooga Mayor Andy Berke told the Times Free Press after Friday's vote.

The result, Berke said, will be a "shift to everybody in the city. We were against the loss of revenue."

According to Tennessee Department of Revenue figures, the city of Chattanooga received $4.17 million in state-shared Hall tax revenue in 2015. Hamilton County received $1.58 million. Signal Mountain received $960,000.

Republicans have been whacking away at the Hall tax since they took absolute control of the General Assembly in 2010. This year's effort began as a 1 percent cut for 2016, with language saying their intent was to phase it out over five years at 1 percent per year based on an assessment of the state revenue picture annually.

But under pressure from Americans for Prosperity-Tennessee and the Nashville-based Beacon Center, automatic cuts were enshrined at the last minute.

"We'll see our economy grow stronger as companies choose Tennessee for our favorable tax structure and pro-business environment," said AFP-Tennessee state director Andrew Ogles. "I firmly believe this bill will lead to real economic growth in our state."

Signal Mountain officials say the Hall tax came to about 15 percent of their revenue in 2015. Councilman Chris Howeley said officials were anticipating this year's 1 percent drop.

But Mayor Dick Gee said despite the time the council has to make preparations, state lawmakers' decision "will certainly make a large difference in our budget. We'll have to develop a plan to replace that income to maintain the level of service we provide today."

Nothing has been planned at this point, though.

The elimination of the Hall tax's effect on the town of Walden will be similarly felt. As the tax is gradually eliminated, Walden will have to make due with less until a tax increase is necessary to offset the revenue loss, Mayor Bill Trohanis said.

"The Hall tax reduction will require municipalities to critique their budgets even more," explained Trohanis, whose town collected nearly $173,000 last year, according to the state.

In tax year 2014, 204,944 taxpayers filed Hall income tax returns, according to the state Revenue Department.

The average taxes required per return was $1,446. But based on the median liability, 50 percent of those taxes were paying $266 or less.

Carl Davis, senior policy analyst for the Washington, D.C.-based Institute on Taxation and Tax Policy, said in a statement, "The vast majority of Tennessee residents will not receive a tax cut under this bill. This is a tax cut on investment income, which mostly benefits those few families with large amounts of wealth."

But in the Tennessee Senate, Sen. Mark Green, R-Clarksville, who championed the elimination in the chamber, called Friday's vote a good thing for Tennessee.

In the House, meanwhile, Rep. G.A. Hardaway, D-Memphis, said the rich would largely benefit from the elimination while greater burdens would fall on most Tennesseans.

House Finance Chairman Charles Sargent, R-Franklin, said the first-year reductions will result in about $27 million or $28 million less revenue for the state in the new budget year taking effect July 1.

Locals would lose about $14 million statewide the first year, Sargent said.

House Majority Leader Gerald McCormick, R-Chattanooga, told reporters at the news conference with Gov. Bill Haslam that local governments have done pretty well over the last few years as Hall tax receipts went up as the economy recovered.

"We have also given them five or six years to adjust to the lost income," he said. "I think you also have to look at the idea that the state is collecting taxes on behalf of local governments and sending it to them and whether or not that's a proper role for the state to have. So we've given them plenty of time to adjust to this and I hope its going to result in more investment and more jobs for their communities."

He subsequently said lawmakers might later examine whether to give local governments more autonomy on taxation.

Haslam has traditionally been hesitant to cut the Hall tax, given the state's narrow tax base which relies heavily on sales taxes. The governor preferred lawmakers not commit to the 1 percent per year reductions in state law and just go for the 1 percent reduction this year.

"But as for me, I liked it the way we had it before," Haslam told reporters.

He declined to say whether he would veto the measure.

In other last-minute action, the Republican-dominated General Assembly voted to restore some property tax relief for disabled military veterans and seniors after struggling among themselves after Democrats put them on the spot to go even further for the veterans.

Haslam, meanwhile, avoided an attempt by a faction of fellow Republicans in the House to force the Legislature to hold a veto override session in case he shoots down a number of social conservatives' bills after they left.

It failed. Lawmakers adjourned shortly thereafter.

Haslam later thanked the 109th General Assembly for an "outstanding session" during a joint news conference with McCormick and other leaders.

Contact staff writer Andy Sher at asher@timesfreepress.com, 615-255-0550 or follow via Twitter @AndySher1.