Catoosa County residents are voting on whether to continue a 1% sales tax for county infrastructure and equipment.

The tax funds major capital projects in Catoosa County and has been renewed by voters every six years since 1994. The county's sales tax is 7%, with 4% going to the state and the other 3% going to local purposes, including the 1% up for renewal.

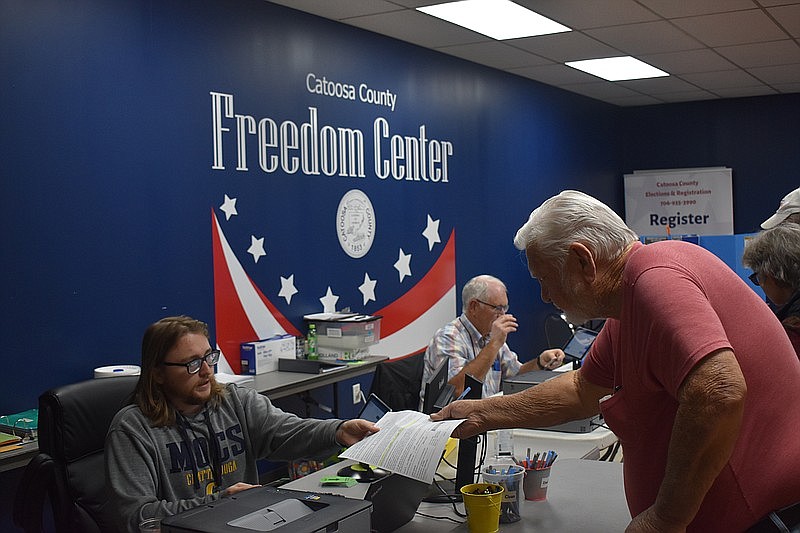

Early voting began Monday and is open through March 8 at the Freedom Center in Ringgold and Westside Precinct in Rossville. Saturday voting is Feb. 24 and March 2, while the primary election day is March 12.

Supporters of the sales tax say the money is needed for important capital projects that would otherwise be funded by increasing property taxes, while opponents argue the county government needs to rein in its budget in a time of high inflation and rising property values that make tax bills higher.

The infrastructure tax may seem like a quick fix for projects, Kenneth Cochran, a resident of the Lakeview area, said, but he said the spending eventually leads to higher property taxes in the future.

"More buildings and facilities mean more upkeep costs, and larger staffs which end up hitting taxpayers in the long run," Cochran said in a Facebook message.

He said a sales tax hits poor people hardest and incentivizes pet projects that can be traded by county leadership for campaign contributions. Also, the "sticker shock" of property taxes forces accountability by the County Commission, while the 1% sales tax makes the fiscal impact on voters seem smaller.

Rick Huggins, a resident of the Graysville area, said he supports renewing the sales tax because it's the fairest way to maintain services like sewers and roads, as well as fund emergency services.

"(The tax) ensures everyone who makes a purchase in the county, whether they're a resident or passing through the county, helps to prevent astronomical increases in our property taxes," Huggins said in a Facebook message.

A news release from the county said up to $96 million is expected to be raised over the tax's six-year cycle that would begin this year.

The majority of the money is planned for about $30 million in roads and bridges, $8.4 million for sewer projects, $10.4 million for the fire department, about $7 million for storm water projects, $5.6 million for the sheriff's office and jail, $2.7 million for parks and recreation and about $2.5 million for county vehicles and equipment.

Fort Oglethorpe is expected to receive about $14 million and Ringgold would receive about $5 million, the release said.

Funds from the current tax approved in 2019 will continue until June 30. If the sales tax is approved by voters, collections will begin July 1 and continue through June 30, 2030.

(READ MORE: School portion of Catoosa County property tax slated for increase)

Voter turnout was relatively slow in the county's two early voting locations, Tonya Moore, director of elections, said in a phone call. Early Monday afternoon, she said only 90 people had voted so far.

Both Republican and Democratic presidential primary ballots are available for voters, she said. Included on that ballot is a yes or no vote for renewing the 1% sales tax.

Mario Fernandes, a resident of the east side of the county, said county officials are trying to scare people by telling them property taxes will go up if the tax isn't approved. County government needs to focus on essential services, he said, instead of paying for recreation, land acquisition and sewer projects.

"Sewer projects serve the interest of developers in the county (who are friends of the commissioners) and create the infrastructure that permit the developers to continue to build more houses and neighborhoods (which, unfortunately, are often beyond the price threshold of the average Catoosa County citizen)," Fernandes said.

John Pless, spokesperson for the county, said that's true — if the tax is not approved, the County Commission would have to make the difficult choice of whether to forgo the slated projects or raise property taxes.

"If voters decide not to keep (the 1% tax), the sales tax would go to 6%," Pless said in a text message. "It would also mean the major capital projects like paving, stormwater and sewer, fire engines, heavy equipment for public works, etc., would not be funded. The county would have to do without or raise property taxes."

According to their Facebook pages, the Catoosa County Chamber of Commerce is supporting the tax, while the Catoosa County Republican Party is against it.

The county's GOP did not respond to an emailed request for comment.

The chamber's 20-person board voted to support the tax in December, Amy Jackson, chair of the chamber, said in an email. She said the chamber has worked to educate the public about the services the tax would support, including sending mailers to 18 subdivisions scheduled for paving over the next six years if the tax is reapproved.

Jackson said no chamber membership dues were used to advocate for the tax, and the chamber registered with the state to accept and spend designated funds collected for the advocacy campaign.

Contact Andrew Wilkins at awilkins@timesfreepress.com or 423-757-6659.