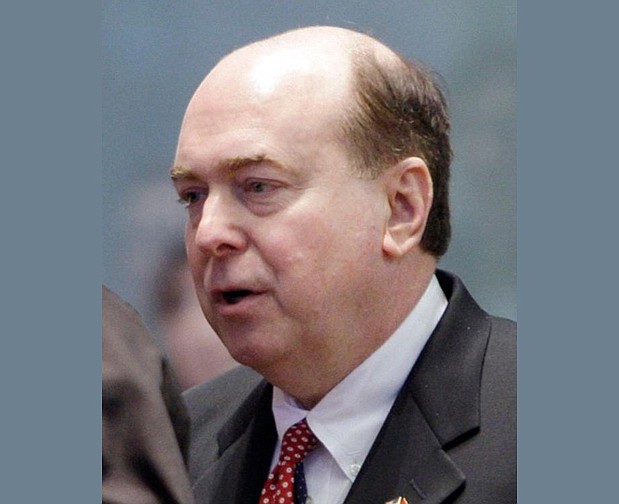

NASHVILLE -Tennessee's David Lillard is among 42 of the nation's state treasurers asking Congress not to alter the tax-exempt status of municipal bonds, saying changes could drive up borrowing costs and force state and local governments to raise taxes.

There has been talk in Washington about eliminating or capping the tax exemption to help federal officials deal with soaring debt.

Tax-exempt bonds are "the primary tool that state and local governments use to finance highways, bridges, transit systems, airports, water and wastewater systems, schools, higher education facilities, and many other projects," the National Association of State Treasurers wrote Monday to the chairmen of the U.S. House and Senate ways and means committees.

"Tax-exempt municipal bonds provide a mechanism for bringing private capital to those public projects, while saving an average of 25 to 30 percent on interest costs compared to taxable bonds," the treasurers' letter stated.

Exempting bonds from taxes means investors will accept lower interest rates, saving local governments money, the letter stated.