Astec Industries Inc. took a $90.6 million write off in the fourth quarter for abandoning an unsuccessful wood pellet manufacturing venture and exiting a German subsidiary business, but the ongoing operations of the Chattanooga-based equipment maker showed improved results in the final three months of 2019.

Astec said Friday that net income, after the impairments, rose in the fourth quarter to $14 million, or 61 cents per share, on sales of $317 million. In the same period a year earlier, Astec reported comparable earnings of $13.2 million, or 57 cents per share, on sales of $312.4 million.

Despite Astec's costly write off that resulted in a net book loss in the fourth quarter of $47 million, investors were encouraged that operating results were better than expected and the company's stock rose Friday by 4.3 percent, or $1.65 per share, to close at $39.81.

For all of 2018, Astec said it lost $60.4 million on sales of $1.172 billion, but most of those losses stem from the decision by the board to write off $65.7 million at its wood pellet plant in Georgia. Adjusted earnings for all of 2018 rose to $67.3 million, or $2.92 per share, compared with $57.7 million, or $2.49 per share, in 2017.

"We are pleased with the 17.4 percent growth in adjusted earnings for the full year," said Richard J. Dorris, who took over as interim chief executive for Astec in January following the sudden resignation of former CEO Ben Brock. "Our core businesses remain strong and we continue to gain positive momentum. While results in our Infrastructure Group for the fourth quarter and year reflect our decision to exit the wood pellet plant business and a decrease in international sales, we are optimistic about opportunities for this segment in the coming year."

Astec's results beat Wall Street estimates by 4 cents a share for the fourth quarter and revenues were about $2 million better than forecast.

So far in 2019, Astec's stock price has jumped by nearly a third but remains below the levels reached prior to its announcement last year that the company was exiting its wood pellet operations. Astec shares also are still down by more than 25 percent from the peak prices reached two decades ago by the company.

Astec shares fell dramatically last July when the company announced it was scaling back investments in its wood pellet business and re-evaluating its approach to capital investments.

"During the past year we have taken decisive steps to improve the company's financial performance and ensure capital is directed to the areas that we believe will drive the greatest value for our shareholders," Dorris told analysts during an earnings conference call. "Overall our core business remains strong and we continue to see positive momentum. With our core businesses performing well, we have continued to take steps in support of our long term goals of increasing operational efficiency, reducing costs and improving profitability."

Dorris said the wood pellet production business that Astec began in 2012 to help diversify the road building equipment maker proved "not a good fit" due to the size, complexity and time frames needed to build, install and commission such plants.

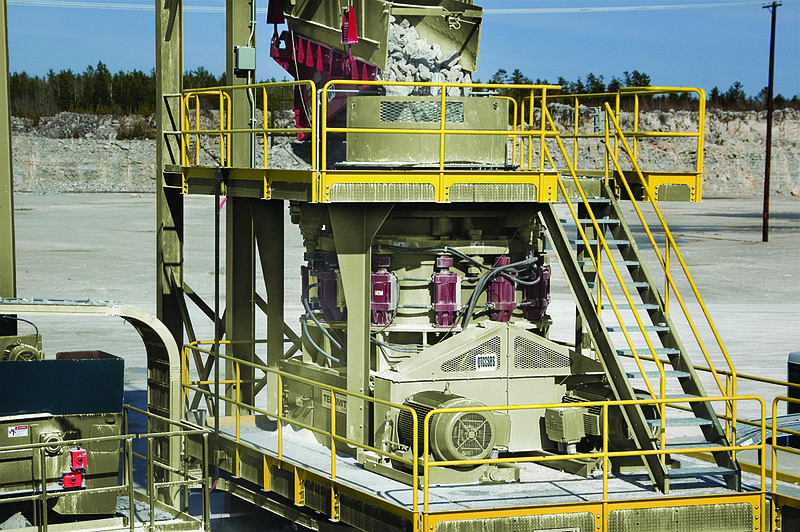

In 2019, company officials said Astec will introduce two new entry-level asphalt pants and will also add new paving equipment for both the domestic and international markets.

"Given our recent order activity, current backlog and discussions with our customers, we feel good about the first half of this year," Dorris said. "We're cautiously optimistic on the second half of 2019 as more than half of the states in the U.S. have mechanisms in place for stable infrastructure spending."

For all of 2019, Dorris projects sals will be up from 4 to 7 percent over last year and the company's earning per share should be between $3 and $3.50.

Astec's board is continuing its search for a permanent CEO to run the Chattanooga company, which was founded by J. Don Brock in 1972 and had been headed for the previous five years by Don's son, Ben Brock, who resigned in January.

Astec announced Friday that Mary Howell, CEO of the international consulting company Howell Strategy Group, and a former officer for Textron, has joined the company board of directors. She is the third new independent director to be added to the Astec board in the past year.

Contact Dave Flessner at dflessner@timesfreepress.com or at 757-6340.