Many of us know someone in retirement who struggles to pay the bills but holds significant value in an illiquid asset: their home. And while tapping into hard-won home equity loans should not be the first option, there are clearly situations in which the alternatives are less attractive.

Taking out a conventional mortgage creates another set of challenges, including the obligation of ongoing monthly payments. In 1961, a new inverted mortgage product was invented that allowed homeowners to extract equity and accrue the interest obligation over their remaining lifetime, to be settled with the lender upon sale of the property. Ultimately President Reagan signed a bill in 1988 that created the Home Equity Conversion Mortgage, an FHA-insured reverse mortgage program that created certain consumer safeguards and encouraged private lender participation.

The HECM program has been successful, but has been dogged by sensationalized reports of unfortunate borrowers who failed to fulfill their responsibilities or who did not fully understand the terms. Limited HUD statistics report a total of 41,000 foreclosures of the 971,000 loans made since 2009, a pace roughly equivalent to the rate of conventional mortgage defaults. However, HUD notes that a foreclosure event includes the situation where the last borrower dies and the home is sold by the bank to satisfy the loan, exactly as expected in the event the heirs choose not to sell the property themselves or repay the loan. HUD has been unwilling to furnish data on the breakout, but clearly the percentage of actual evictions is small.

Meanwhile, many meaningful modifications have been adopted since the program's inception. For example, until 2014, a spouse who is not a party to the loan was required to repay the note or surrender or sell the property at the death of the borrower. Today there is an exemption to allow nonborrower spouses to stay in the home and continue to defer repayment until their own demise.

Borrowers must also complete a phone counseling session, and demonstrate the financial ability to maintain the property and continue to pay the taxes and homeowner's insurance premiums.

Most recently, due to the popularity of the program, the FHA has been running a deficit on its insurance fund that backstops private HECM lenders. Effective Tuesday, costs are going up and limits on borrowing are declining.

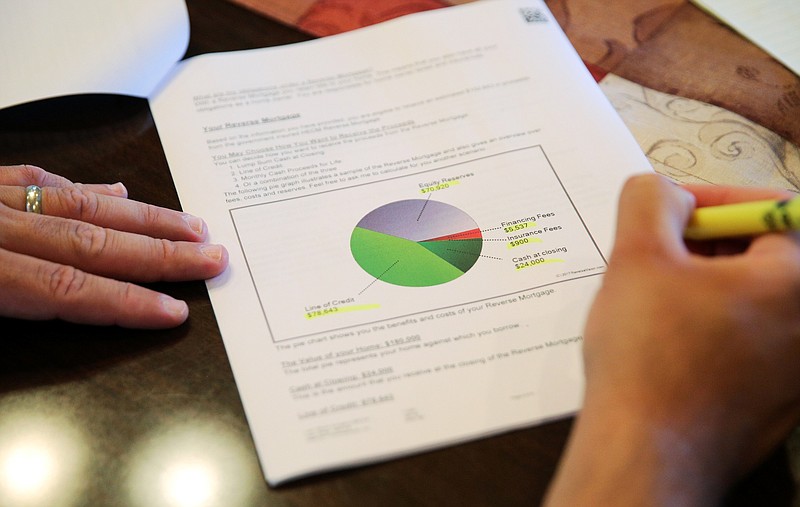

The borrowing limit is determined via a complicated formula that includes ages of the borrower, the value of the home and the amount of any existing mortgage. On average, the maximum available loan is declining by about 10 percent due to the new limits. For example, a homeowner with $150,000 in equity and no mortgage can borrow roughly $70,000 at age 70, net of origination fees.

As to the fees: naturally they, too, are going up. The FHA mortgage insurance premium is rising to 2 percent of the initial borrowing amount, with an ongoing fee of 0.5 percent of the balance.

Be aware that this product is expensive, as a reverse mortgage is riskier to lenders than a traditional home loan. Lenders are allowed to charge origination fees that can run as high as $6,000 up front, depending on the value of the home, on top of FHA premiums.

Still, the reverse mortgage can be a valuable tool for retirees with significant equity but limited cash flow. Of course, this should not be the first course of action, and borrowers must be diligent in understanding and fulfilling their obligations (as with any financial transaction). But the negative press has been largely undeserved, and the HECM should be included as an important option where appropriate.

Christopher A. Hopkins, CFA, is a vice president and portfolio manager for Barnett & Co. in Chattanooga.