Tennessee's biggest health insurer expects to avoid another double-digit rate increase for its individual plans next year after four years of rate hikes that have nearly tripled individual rates since the new Affordable Care Act plans began.

Marketplace rate hikes by BlueCross BlueShield of Tennessee

Since the individual exchange rate plans began under the Affordable Care Act in 2014, BlueCross BlueShield of Tennessee has increased rates each year to cover losses and reflect higher expenses:2015: Up 19 percent2016: Up 36 percent2017: Up 62 percent2018: Up 21 percentSource: BlueCross BlueShield of Tennessee

BlueCross BlueShield of Tennessee earned a record $427 million last year from its plans for over 3.5 million Tennesseans, including a $113 million profit earned for the first time in the individual market revamped by the Affordable Care Act implemented four years ago.

Roy Vaughn, senior vice president of strategic communications, said BlueCross expects in 2019 to moderate its rate increases for individual plans and could end up without any significant change in prices.

"We had a very strong year operationally with all of our lines earning 4-star recognition [for customer service] and all of them being profitable in 2017," Vaughn said. "It was led by our individual plan results, which for the first time since 2014 generated net income last year. After three years of consecutive losses, we knew we had to get to some level of net income and our individual policy business ended up performing better than expected."

BlueCross boosted its individual policy rates by 21 percent this year after more than doubling its initial individual rates that the Tennessee BlueCross plan introduced as one of the cheapest in the nation in 2014 when the marketplace exchange plans began under the Affordable Care Act in 2014. BlueCross racked up more than $400 million in losses from its individual plans on the exchange markets in the first three years of Obamacare. But the insurer appears to have raised its rates sufficiently to cover its costs - even with the repeal last year of the individual mandate to buy health insurance and the Trump administration's move to phase out cost-sharing payments previously provided to insurance companies for their increased risk of covering previously uninsured persons.

President Trump tweeted in December that the repeal of the mandate for all Americans to buy health insurance "essentially repeals [over time] Obamcare."

But after a rocky start, the pricing of plans may have reached more of an equilibrium even with the individual mandate repealed.

BlueCross said it priced for such uncertainty and may not have to boost rates again for 2019. BlueCross and other health insurers will file their requests for 2019 rates in the next month or so, and the Tennessee Department of Commerce and Insurance will have to approve any rate changes by this fall.

"While medical costs are always the main component of determining our premiums, we think that we can get to where we need to be with relatively stable prices as we move forward," Vaughn said, noting that the individual market is continuing to be profitable in 2018.

BlueCross in Tennessee debuted its individual plans under the Affordable Care Act in 2014 at some of the lowest prices in the country even though Tennessee ultimately ended up with some of the highest use of medical care, since the state's population tends to be more obese and exercise less than the U.S. as a whole.

"It was a market that had largely not been served, and it was a market that proved worse than we had expected," Vaughn said.

In response to heavy losses, BlueCross scaled back its statewide coverage and raised its premiums, while other insurers, including Humana, Aetna and United Healthcare, exited the individual market in Tennessee altogether.

Paula Wade, a principal analyst for the Decision Resources Group that analyzes the health insurance market, said the exchange marketplace "began to stabilize by the end of 2016 as insurers got a better picture of who was signing up and what it might cost."

"With substantial rate increases, I think a lot of insurance companies that are still in the exchanges have insulated themselves and priced for the risk involved," she said. "A lot of health insurers did much better in the individual market last year so we may not see as big of increases for 2019."

State Sen. Bo Watson, R-Chattanooga, the chairman of the Joint Pensions and Insurance Committee in the General Assembly, said BlueCross and other insurers are also benefiting by the record number of Tennesseans on the job.

"Most people still get their health insurance through their employer, and the strong economy we're seeing in Tennessee is certainly helping to stabilize the market and improve conditions for nearly all companies," Watson said.

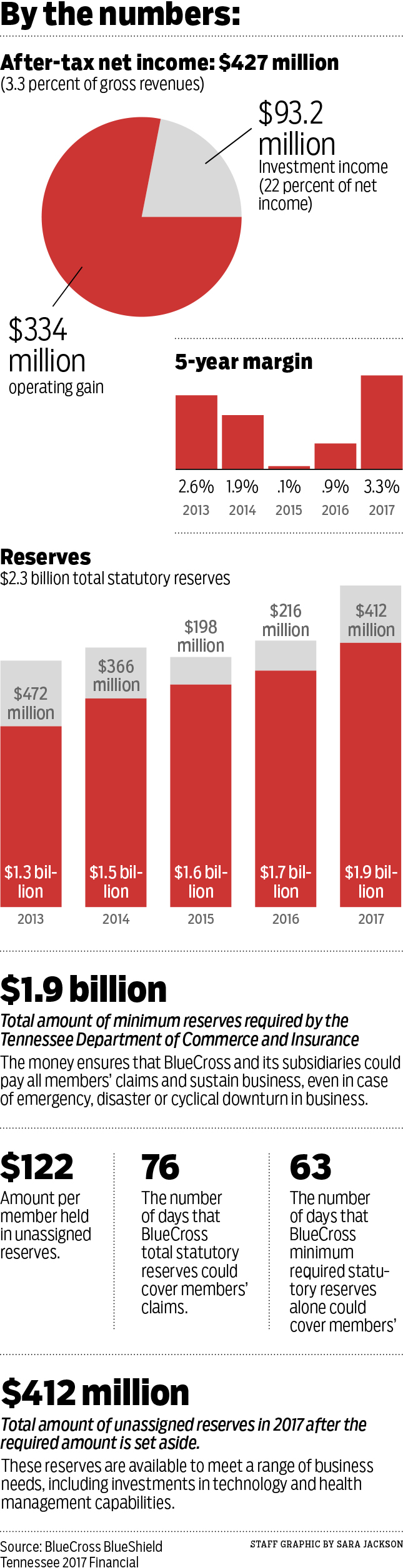

With its record profits in 2017, BlueCross swelled its reserves last year to $1.9 billion, or $412 million more than the statutory minimum required in the state. Vaughn said those reserves have been built up over 70 years and are key to helping the insurer withstand any unexpected catastrophes. The reserves would provide coverage at the current rate for only 76 days without any additional funds, Vaughn said.

Net income for BlueCross last year nearly quadrupled what the company earned in the previous year and helped to offset some of the operating loss the company had in 2015 (although investment income that year still generated a net positive for earnings).

Despite the record profits for Tennessee's BlueCross plan last year, the Chattanooga-based insurer still paid more during 2017 in federal, state and local taxes (totaling $495 million) than the net income of $427 million. The company's 3.3 percent margin last year was the highest in years, but still well below most investor-owned companies.

For the typical premium dollar paid to BlueCross, 86 cents is spent on direct medical costs, 8 cents on administrative expenses, and 3 cents each for taxes and after-tax profit from operations, the company said in its annual report on its 2017 results.

Vaughn said the effectiveness of the administration of the BlueCross plans was verified by the recognition last year by the consumer research company J.D. Power, which recognized BlueCross for "Highest Member Satisfaction among Commercial Health Plans in the East South Central Region."

Contact Dave Flessner at dflessner@timesfreepress.com or 423-757-6340.